Pound / Canadian Dollar Week Ahead Forecast: Could see Lows Near 1.6600

- Written by: James Skinner

- GBP/CAD risking another lurch lower this week

- Stymied by 1.69 & could see lows near 1.6600

- As GBP ailed by UK Gov & BoE holds Bank Rate

- Deeper GBP/CAD losses possible into year-end

Image © Adobe Stock

The Pound to Canadian Dollar rate was rescued from new 2021 lows by the market’s response to last week’s Bank of Canada (BoC) policy decision but risks another lurch lower over the coming days amid signs of a troublesome turn in the UK government’s approach toward the coronavirus.

GBP/CAD losses already saw Sterling come close to the round number of 1.6600 last week before the Bank of Canada appeared to disappoint the market with a simple reiteration of October’s guidance relating to its cash rate.

That guidance still suggests that Canadian interest rates could begin to rise at any point between April and September or next year although parts of the financial markets had come to expect that the BoC would open the door to an even sooner lift-off last Wednesday.

"While the BoC’s outlook was constructive for the CAD, it failed to match expectations that guidance could turn more hawkish; in reality, market pricing for early 2022 rate hikes was too aggressive," says Shaun Osborne, chief FX strategist at Scotiabank.

“We continue to forecast USDCAD falling to 1.20 through H2 2022 even if the sort of CAD strength we had been expecting into year-end is out of reach now. We think the CAD could still rally modestly but perhaps to no more than 1.25 ahead of New Year,” Osborne also said on Friday.

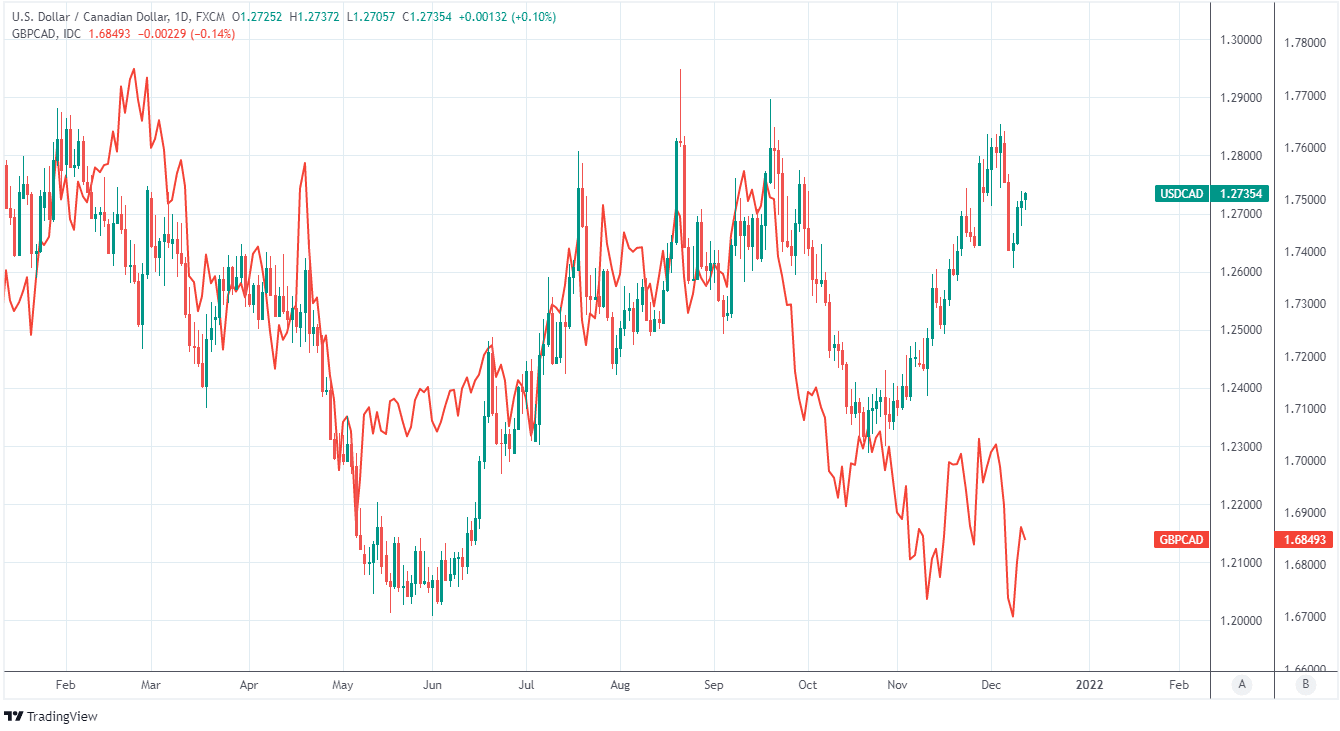

The BoC’s unchanged guidance lifted the USD/CAD rate from near 1.26 on the nose last Wednesday to above 1.27 in time for the Friday close and helped lift the Pound-Canadian Dollar rate back to almost 1.69 by the weekend.

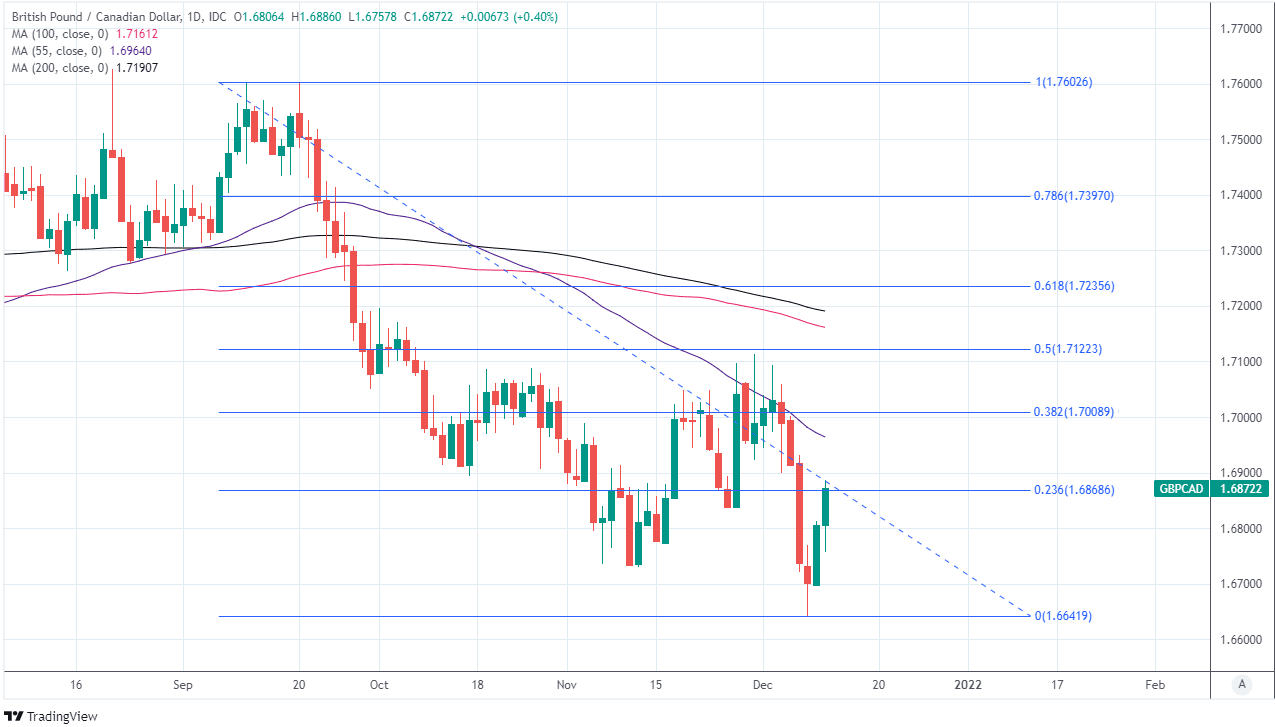

Above: GBP/CAD at daily intervals with Fibonacci retracements of late September decline indicating likely areas of technical resistance.

- Reference rates at publication:

GBP to CAD spot: 1.6850 - High street bank rates (indicative): 1.6260 - 1.6378

- Payment specialist rates (indicative: 1.6698 - 1.6766

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The rub for GBP/CAD is that making it above the 1.69 line is likely a bridge too far for Sterling, which could be much more likely to retest or potentially even overshoot last week’s lows during the coming days.

Sterling faces downside risks from the UK government’s shifting approach toward the coronavirus and may not be able to count this week on much support coming from the Bank of England (BoE), which is now widely expected to leave Bank Rate unchanged at 0.10% on Thursday.

“Get boosted now to protect our NHS, our freedoms and our way of life,” said Prime Minister Boris Johnson following Sunday’s announcement of an accelerated attempt to make a third vaccine shot available to all adults by year-end.

This followed last week’s move to ‘Plan B’ and subsequent suggestions that even a so-called 'Plan C' may soon be announced, and is a further indication that the government’s commitment to a supposedly irreversible roadmap toward a reopened economy is now falling by the wayside.

If the market hadn’t already been likely to keep pressure on the main Sterling exchange rate GBP/USD - which is an important directional influence on GBP/CAD - before this point then it may be likely to do so in the days and weeks ahead with likely bearish implications for GBP/CAD.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“In these circumstances, we continue to favour further GBP weakness in the near term especially against the USD, and expect cable to fall below the 1.3000 for the first time in just over a year. The timing of lift off for rate hikes by the BoE and Fed will appear to be narrowing considerably if the BoE delays raising rates again while the Fed speeds up tightening plans” said Lee Hardman, a currency analyst at MUFG, in a Friday note.

The renewal of restrictions on business activities and interferences in social contact has so far been modest but could yet escalate through the Christmas holiday period and so may grow further as a threat to the UK economic outlook.

Last week’s price action in the short-term interest rate space has already shown that this would likely see investors further marking down expectations for interest rates at the BoE in the months ahead, making for a potentially enduring risk to the Pound.

The Pound to Canadian Dollar exchange rate would likely slip back beneath 1.6650 this week if MUFG’s Hardman is right about GBP/USD nearing 1.30 and if at the same time the Scotiabank is correct to anticipate that any further rally in USD/CAD would be likely to run out of steam around 1.28.

“Our valuation model has reflected some of the recent slippage in the CAD but still indicates a modest CAD undervaluation relative to spot levels near 1.27. We expect USDCAD gains to the 1.27/1.28 range to continue to draw USD selling interest as a result,” Scotiabank’s Osborne said on Friday.

Above: USD/CAD shown at daily intervals alongside GBP/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

GBP/CAD would likely struggle to recover above 1.69 this week if USD/CAD holds beneath 1.28 and if at the same time the Bank of England adopts a more cautious approach toward UK interest rates in Thursday’s monetary policy decision.

“The UK government’s decision to revert to plan B and tighten restrictions in response to the threat posed by the new Omicron variant will dampen the near-term growth outlook and likely encourage a more cautious BoE to hold off from raising rates for now. But we still expect the BoE to maintain guidance that rates are likely to rise in the coming months, most likely in February,” MUFG’s Hardman says.

The BoE is widely expected to leave Bank Rate unchanged at 0.10% pending clarity on developments in the UK labour market since the government ended its furlough job support scheme in September and given the uncertainties posed by the Omicron strain of the coronavirus.

In light of this and in the absence of a surprise decision to lift Bank Rate it’s any commentary this Thursday on the outlook for borrowing costs that is likely to matter most for Sterling over the coming weeks and months.

“We believe that hawkish members will make their voices heard in the minutes, possibly with a conditional argument stating that should it quickly become clear that the Omicron variant is unlikely to be a significant threat to public health, the Bank may need to adopt a steeper hiking path than it otherwise would have done,” says Fabrice Montagne, chief UK economist at Barclays, noting what might be a potentially positive outcome for the Pound.