Misplaced Australian Dollar Strength Follows Labour Market Survey

- Written by: Gary Howes

Image © Adobe Images

AUD outperforms after the Australian Labour Force Survey revealed a solid increase in jobs. But Australia's biggest banks don't think this is enough to prompt a rate hike at the Reserve Bank of Australia.

The Pound to Australian Dollar exchange rate is down a third of a per cent on the day at 1.9280 after the ABS said employment rose 50.2k in June, well above consensus at +20k. The Australian to U.S. Dollar rate looks set to snap a three-day run of losses as it rises to 0.6732 as markets moved to price in higher odds of an RBA hike next month.

The Aussie Dollar is the day's best-performing G10 currency.

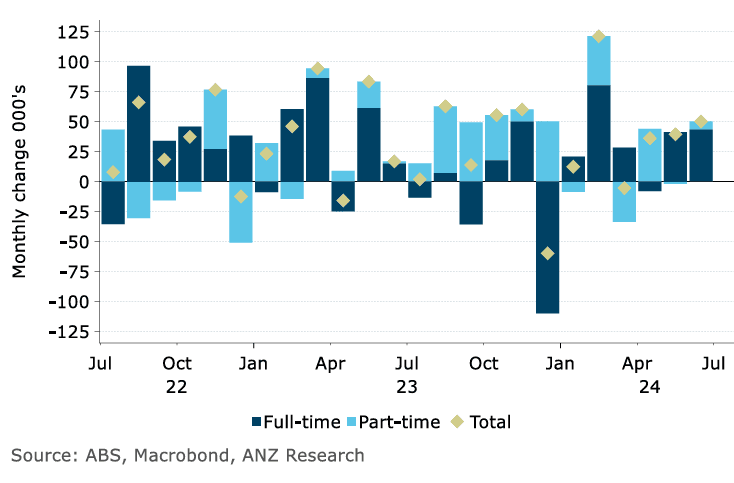

Gains follow ample evidence that the next move at the RBA will be another hike: the bulk of the jobs added were full-time, +43.3k, with part-time 6.8k, which economists consider a sign of a healthy labour market as businesses are confident enough to commit to long-term contracts. In fact, of the 250k jobs added so far this year, +200k have been full-time.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Hours worked grew by 0.8%. These data raise the odds of the Reserve Bank of Australia (RBA) raising interest rates again next month, given a strong jobs market churns out solid wage increases, which bolster inflationary trends.

"The market is underpricing the odds of an RBA hike," says a note from TD Securities. The rise in the Aussie Dollar suggests the market has raised expectations that a rate hike is now more likely.

But, the unemployment rate ticked up to 4.1% and analysts at some of Australia's biggest banks still think the RBA's next move will be a cut, interpreting the labour market report from the soft side.

"Monthly employment growth. Employment has increased by 254.1k over the year to date" - ANZ.

ANZ says the labour market is loosening, as evidenced by the unemployment rate drifting up since late 2022 and employment and hours worked growth slowing.

"The labour market is now exerting less upwards pressure on wages, with wages growth appearing to have peaked last year and newly agreed enterprise bargaining agreements incorporating lower future wages growth than those agreed last year," says Blair Chapman, an economist at ANZ Bank.

ANZ thinks the labour market will likely continue slowing and predicts a rate cut as the next RBA move.

Westpac cuts the data on a three-month average basis, showing that "employment growth has clearly slowed" from an annual pace of 3.6% y/y in June 2023, to 3.1% y/y in December 2023, to 2.7% y/y in June 2024.

"Businesses’ appetite for labour has clearly cooled, from being well in excess of supply to now tracking broadly in line with population growth," says Ryan Wells, an economist at Westpac.

"Today’s update is unlikely to materially alter the sentiment of the RBA," he adds.

Commonwealth Bank of Australia (CBA) points out that the most important metric in the labour force survey from a monetary policy perspective is the unemployment rate.

On this count, the increase to 4.1% shows "the labour market loosened modestly in June, despite a solid lift in jobs."

Gareth Aird, Head of Australian Economics at CBA says Australia has witnessed an increase in the unemployment rate, despite solid jobs growth, because the participation rate has risen noticeably.

This means more workers are entering the jobs market, which means businesses will have a bigger pool to choose from, easing pressure on wages.

Given wages are a key driver of domestic inflation, signs of slowing wages will give the RBA confidence that it doesn't need to hike again.

CBA thinks the employment report does not support an increase in the cash rate next month.

If these bank analysts are right, the market might be getting ahead of itself in bidding up the Aussie Dollar.