GBP/AUD Rate Week Ahead Forecast: Downtrend Called

- Written by: Gary Howes

Image © Adobe Stock

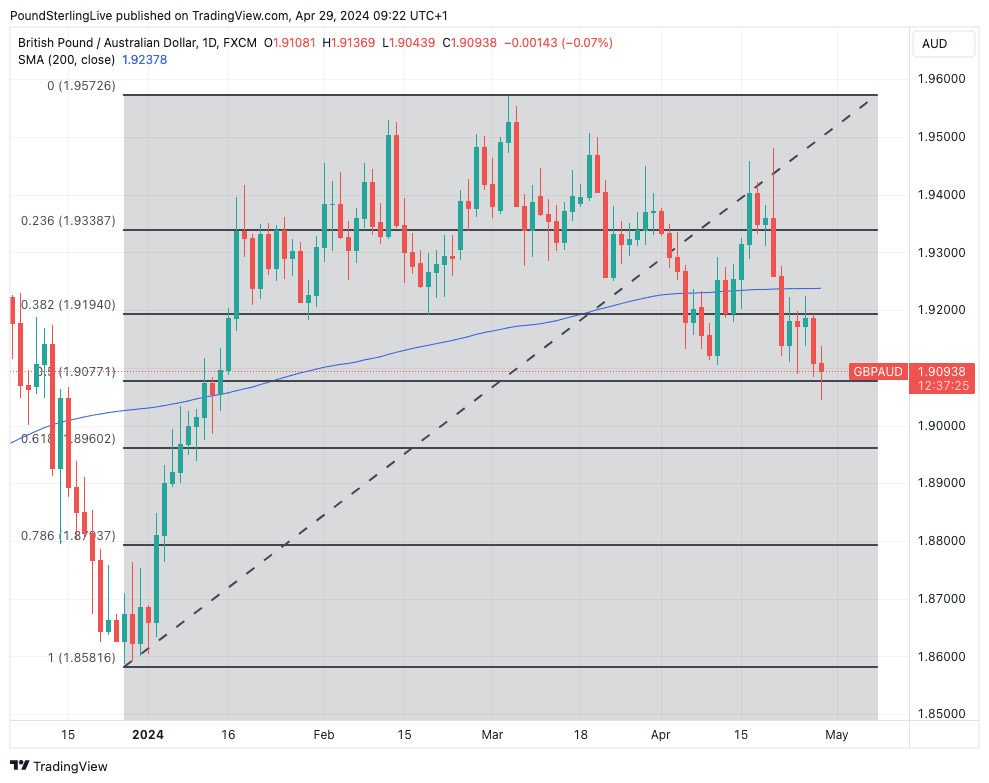

The Pound to Australian Dollar exchange rate is breaking down and technical studies show a higher likelihood of further losses in the coming days.

The Aussie has turned into one of the best performers in the G10 currency family when screened over the past week and month, which speaks of idiosyncratic outperformance.

Last week's bumper inflation print kicked the prospect of an interest rate cut at the Reserve Bank of Australia (RBA) further into the distance. In fact, some economists now reckon that the next move at the RBA will be an interest rate hike.

This means higher-for-longer interest rates in Australia, which will be attractive to investors who can borrow in lower interest rate currencies and ship the capital to Australia, boosting demand for AUD.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The AUD's post-inflation rally pushed the Pound to Australian Dollar exchange rate (GBP/AUD) below the 200-day moving average, which indicates to us that the trend has turned from the upside to the downside. Until the exchange rate recovers the 200 DMA we will consider any strength to be a countertrend relief rally that will ultimately deteriorate and give way to further losses.

In the coming week, technical support will likely be around 1.9070, which is the 50% Fibonacci retracement of the 2024 rally, but we don't see any strong evidence that it can offer significant support. Resistance is clearer to identify, first at 1.9194, which forms the 38.2% Fib retracement line. We saw this level frustrate recovery attempts last week and note as a level worth watching.

Above: GBP/AUD at daily intervals. Track GBP/AUD with your own custom rate alerts. Set Up Here

The second resistance is the 200-day MA itself, at 1.9237. "It is important to note that support and resistance levels are not exact price points, but rather zones where demand and supply can change. These levels are closely monitored by market participants, who are all keen to take advantage of opportunities that may arise when supply or demand changes," according to AvaTrade, the MetaTrader 5 trading provider.

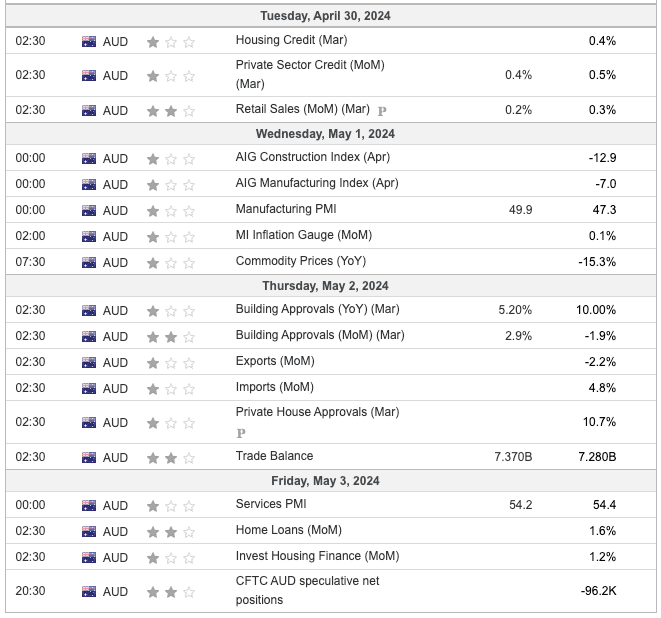

Looking at the Aussie calendar, we only see second-tier data on tap in the coming days:

Image courtesy of Investing.com.

The low event risk in both the UK and Australia means the Aussie can potentially carry recent momentum forward, but we will also be conscious of important items on the U.S. calendar.

The high-beta Aussie Dollar is highly sensitive to global investor sentiment, which is in turn driven by expectations for the U.S. interest rate outlook.

With market expectations for the first rate cut at the Federal Reserve having receded to December following last week's hot consumer spending figures, the coming week's figures will determine whether a 2024 rate cut is even on the cards or whether we will have to wait until 2025.

Wednesday's Federal Reserve policy update will be the first key test for the Dollar as investors will be interested to know whether the Fed is ready to validate market expectations for the first rate hike to come in December.

Recall, the Fed's most recent dot plot forecasts showed policymakers expect three rate cuts in 2023. The Fed will have to concede this is a tad ambitious in the face of the incoming data which shows the economy is starting to generate heat again.

The Australian Dollar will weaken if the Fed cautions its previous forecasts for interest rates look too generous.

The big data event of the week will be Friday's job report: weakness here will signal that, finally, a turning point is coming. We would expect a sizeable stock market rally and a rally in the Australian Dollar if the headline non-farm payroll figure undershoots the 210K the market expects.

But, this is an economy that seems to perpetually surprise to the upside, so we wouldn't hold our breath. Another beat could send the Pound-Australian Dollar higher.