Australian Dollar Surges on "Extraordinary" Job Growth, But Beware Payback

- Written by: Gary Howes

Image © Adobe Images

The Australian dollar was broadly higher after Australia reported what economists describe as "extraordinary" job growth in February, which could ensure that the Reserve Bank of Australia (RBA) is one of the last major central banks to cut interest rates.

The Pound to Australian Dollar exchange rate dropped by two-thirds of a per cent to 1.9314 after the ABS said a surge in job gains pushed Australia's unemployment rate down to 3.7% from 4.1% the month before.

"AUD/USD is around 1 US cent higher at 0.6620 thanks to the FOMC and an extraordinary 116,500 increase in Australian employment in February," says Joseph Capurso, Head of International Economics at Commonwealth Bank of Australia.

The Euro to Australian Dollar rate was lower by two-thirds of a per cent at 1.6522.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

For foreign exchange markets, the implications of the data hold significance as they suggest there is little chance of an imminent interest rate cut at the Reserve Bank of Australia (RBA).

The RBA will likely be one of the last major central banks to cut interest rates, which can bestow support on AUD via the interest rate channel. Illustrating how important central bank policy divergence is for currencies is the Swiss Franc which has fallen following today's SNB's decision to cut interest rates.

The SNB and RBA are the two central banks likely to bookend the cutting cycle, suggesting divergent fortunes for their respective currencies in the coming months.

"This data reinforces our view that the RBA will not be cutting rates until late 2024," says economist David Forrester at Crédit Agricole.

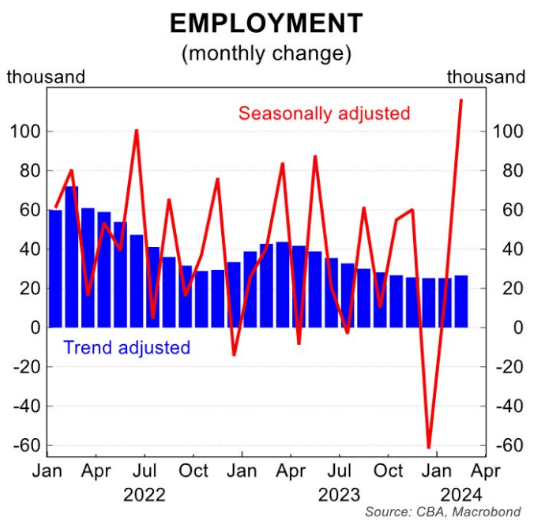

But the details of the job report are interesting, as there appears to be some payback in the most recent figures for the slump recorded in December.

The ABS had noted in the January release that more people were waiting to start or return to a job than normal.

Image courtesy of CBA.

"The large increase in employment in February followed larger-than-usual numbers of people in December and January who had a job that they were waiting to start or to return to. This translated into a larger-than-usual flow of people into employment in February and even more so than February last year," said the ABS.

The large gain in February came after a large fall in December (-62k) and a modest lift in January (+15k, was initially reported as flat).

"The volatility in the seasonally adjusted numbers has been large and has made it harder to interpret the underlying trend of the labour market," says Belinda Allen, Senior Economist at Commonwealth Bank of Australia.

Economists and the RBA will now watch the release of the March figures next month for signs of a stabilisation following the volatility of recent months.

Only when a clearer trend emerges will the RBA be more certain about the appropriateness of a rate cut.