GBP/AUD Week Ahead Forecast: Back Under Pressure

- Written by: Gary Howes

- RBA is key domestic event for AUD this week

- Chinese PMI releases could, however, be more influential

- GBPAUD back under pressure, 1.8950-1.90 support in focus

- Bank of England key downside risk for GBP

Image © Adobe Images

The Australian Dollar's domestic agenda is dominated by the midweek Reserve Bank of Australia (RBA) decision, where another interest rate hike is now expected, but the Bank of England and Federal Reserve are also due to deliver interest rate decisions in what will be a busy week for global markets.

Should the RBA hike interest rates and maintain a 'hawkish' bias, the Australian Dollar will be supported, according to analysts at UBS, who say the market is still not fully prepared for such an outcome.

"We like to sell the downside in AUDUSD as we expect the Reserve Bank of Australia to deliver a 25bps hike at its 7 November meeting. Money markets are underpricing this event, in our view, and it should therefore support the AUD," says a weekly note from the UBS currency strategy desk.

The odds of the RBA raising rates were lifted by the above-consensus inflation readings for the third quarter, released just last week.

"New RBA Governor Michele Bullock reminded us in a speech that the central bank will act if the outlook for inflation requires upward revisions. We believe the quarterly reading of 1.2% was sufficient," says UBS.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

CPI rose 1.2% quarter-on-quarter in Q3, which exceeds the estimate of 1.1% and represents a pickup on Q2's 0.8% increase. The trimmed mean, which the RBA pays special attention to, rose 5.2% year-on-year in Q3, which exceeds the estimate of 5.0%.

"We now expect the RBA will hike the cash rate 25bp at its next meeting as the Q3 CPI data is too inconsistent with its forecast path for the Board to tolerate," says Catherine Birch, Senior Economist at ANZ.

Expectations for another hike were boosted Monday by the release of Aussie retail sales that easily beat expectations for a reading of 0.3% month-on-month in September by printing at 0.9%.

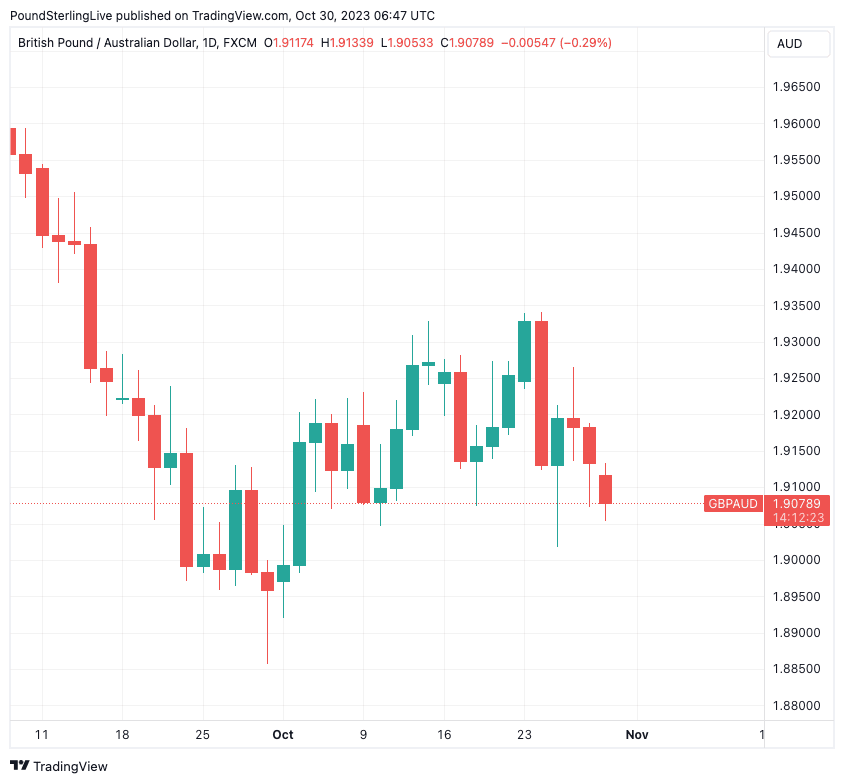

The figures have helped the Australian Dollar outperform all its major G10 peers at the start of the week, sending the Pound to Australian Dollar exchange rate down 0.30% on the day to 1.9078:

Above: GBPAUD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The chart above reveals GBPAUD to be back under pressure in the short-term with the big 1.0% down day recorded last Tuesday effectively killing the rebound. The pair now looks to record a third consecutive daily decline that would suggest some downside momentum is rebuilding.

The downside target is the 1.8950-1.90 area, given the immense support that was revealed here in the late-September to early October period. If the current selloff extends owing to a hawkish RBA we look for weakness to fade in this region.

But should this week's other key events go in a supportive direction for the Aussie - such as positive Chinese data, a benign Federal Reserve and a dovish Bank of England - GBPAUD then risks cracking through this support floor to test the September low at 1.8850.

(Please see here for the Bank of England preview and its potentially negative impact on the Pound.)

Turning to the all-important releases due from China, Tuesday sees the release of PMI figures, which will give a sense of how the economy's rebound is progressing.

The manufacturing PMI is expected at 50.4, a figure that would confirm the economy is in expansion mode.

Wednesday sees the release of China's official Caixin manufacturing PMI for October, where growth should be confirmed with an expected reading of 50.8 being announced.

Any disappointment or positive surprise in these economic surveys could well swing sentiment and impact China-linked currencies such as the Australian Dollar.

We continue to see China playing a sizeable role in moving the antipodean currencies and it could well be that it is China and global sentiment that outweighs any domestic impact coming from the RBA.

"China PMI data will also be important for the AUD and NZD in the coming week. The currencies received a brief boost this week from plans announced by China’s central government it was going to allow a rare mid-year expansion of its fiscal deficit to support the economy," says a weekly currency note from Crédit Agricole.

With this in mind, Wednesday's Federal Reserve decision and guidance are also likely to be of importance, given it will impact global risk sentiment, which is a major mover of the AUD.

"The main event for the AUD and NZD in the coming week will likely be the FOMC meeting," says Crédit Agricole.

"Our US economist expects the Fed to stay on hold next week and to remain on data watch. With the market priced a bit less than 40% for another 25bp rate hike by the Fed, the Antipodean currencies will be highly sensitive to remarks by Fed Chair Jerome Powell about the potential for further rate hikes in the face of tighter financial conditions already doing some of the Fed’s work for it," adds the note.

If the market's takeaway is that the Fed is done hiking and confident it has done enough to bring inflation lower, then the Aussie could rally alongside global equity markets.