GBP/AUD Week Ahead Forecast: Recovery Extension

- Written by: Gary Howes

- GBPAUD short-term picture stays constructive

- UK wage, inflation data dominate data risk

- Watch Chinese GDP data midweek re. AUD

- Aussie jobs figures form main domestic highlight

Image © Adobe Stock

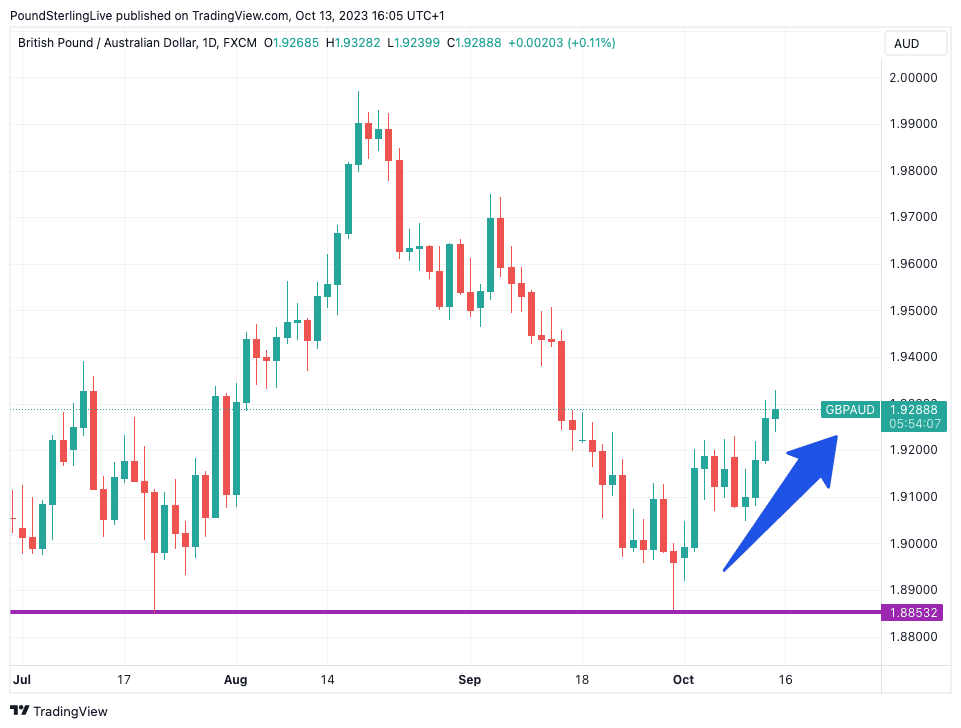

The Pound to Australian Dollar exchange rate could build on its recent rally over the coming days but a busy week of data releases in the UK, China and Australia offer hurdles that those watching this pair must take into account.

The short-term picture is positive as the unwinding of oversold conditions from the September selloff in GBPAUD continues to unwind, we are yet to observe any concrete technical evidence that would suggest the move is yet in jeopardy.

The floor at 1.8850 should offer support in the event of a selloff in Pound Sterling, while there is little upside resistance of concern until at least ~1.95 which could come into play provided the cards fall in Sterling's favour.

Above: GBPAUD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

In Australia, the week's calendar starts off with a speech by the Reserve Bank of Australia's Assistant Governor Jones, which could offer some clues as to whether or not a rate hike will be delivered over the coming months.

The prospect of a rate hike has been bolstered by signs China's economic data impulse has bottomed and Australia's domestic activity remains robust.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The rule of thumb is that any hint of further monetary policy tightening will assist Australian bond yields, which in turn can support the Australian Dollar.

Further signals on the future of interest rates will come with the release of the minutes of this month's policy decision, where interest rates were again left on hold in a move that disappointed some corners of the market and resulted in some AUD weakness.

Investors will pore over the tone of the minutes to get a feel for the mood at the central bank and how close it might be to raising rates in the future.

Above: Australian unemployment is at its lowest since 1974 and participation is at a record. Image: Westpac.

The data highlight of the week for the Aussie Dollar is the employment report due at 01:30 BST on Thursday where the market is forecasting a gain of 20k jobs.

A solid report can bolster RBA rate hike expectations and offer some support to the Aussie Dollar.

Australian employment growth has slowed gradually over the course of this year, from the frantic pace of +49k/mth (three-month average) in March to +34k/mth in June.

The unemployment rate is meanwhile forecast to read at 3.7%, unchanged on the previous release.

China has often proven the deciding factor for direction and volatility in the Australian and New Zealand Dollar in 2023 as markets attach great weight to the importance of the world's number two economy for the two antipodean economies.

"What the AUD and NZD have in common is the China syndrome. Australia and NZ still rely heavily on China as an export market and their currencies are therefore treated by investors as liquid proxies," says a weekly FX note from Crédit Agricole. "Our China strategist expects the CNY to strengthen into year-end, however, which will provide the Antipodean currencies with support."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Australia relies heavily on China as an export market for raw materials used in the industrial sector, while New Zealand relies on Chinese demand for its agriculture-orientated export economy.

Therefore, the AUD and NZD could react to Chinese GDP figures for the third quarter when released at 03:00 BST on Wednesday. The market anticipates the Chinese economy to have grown by 4.4% y/y in the third quarter, down from 6.3%, with the m/m reading expected at 1.0%, up from 0.8%.

China's lacklustre post-Covid performance has been a deciding factor in the New Zealand and Australian Dollar declines through much of 2023 and any signals of a pickup in activity could offer the two currencies a boost.

Chinese industrial production is also due Wednesday, with a headline of 4.3% y/y expected. Retail sales are meanwhile anticipated to have grown 4.5% y/y in September.

Big Week for the Pound

The coming week is busy for UK data releases and idiosyncratic volatility for Pound exchange rates can therefore be expected.

"The release of UK labour market, inflation and retail sales data could attract considerable attention. Given the reassessment of the BoE policy outlook by the markets in recent weeks and the aggressive unwinding of GBP-longs, the GBP could benefit from any positive data surprises," says a weekly FX analysis note from Crédit Agricole.

Tuesday sees the release of UK labour market statistics and the market will react to earnings and changes in employment levels as these offer a signpost as to where UK inflation trends could be headed over the coming months.

Average Weekly Earnings - excluding bonuses - are expected to have risen 7.8% annualised, unchanged on a month prior.

But economists at Pantheon Macroeconomics look for a fall to 5.0% annualised, representing a sizeable undershoot that would lower the odds of the Bank of England raising interest rates again, weighing on UK bond yields and the Pound.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the labour market report will likely show that the unemployment rate has continued to exceed the Bank of England's expectations and wage growth has started to lose some pace.

Image courtesy of Pantheon Macroeconomics.

The market expects a 4.3% headline unemployment rate in August, unchanged from July, but above May's 4.0% and the Bank of England's Q3 forecast for 4.1%.

The Bank of England, therefore, shouldn’t hesitate to keep Bank Rate at 5.25% next month, according to Tombs.

Wednesday brings with it the all-important inflation numbers for September and the market looks for headline inflation to fall to 6.5% year-on-year from 6.7% previously, but the month-on-month reading is anticipated to have risen from 0.3% to 0.4%, largely as a result of rising fuel prices.

September's release proved a decisive moment for the Pound as the unexpectedly soft reading prompted a selloff that endured through the month. Another undershoot could trigger similar price action in October, putting the 2023 lows for GBPUSD back under pressure.

Friday will see the release of GsK consumer confidence figures and retail sales, while offering some interest these releases are unlikely to have a material impact on the market, particularly given the sizeable signals that will have been provided by the wage and inflation numbers just days earlier.