Australian Dollar Slides on RBA Minutes, But More Hikes Still Likely say Economists

- Written by: Gary Howes

Above: File image of RBA Governor Lowe. Image © Crawford Forum, Reproduced Under CC Licensing.

The release of the minutes of the Reserve Bank of Australia's latest meeting reveals the decision to raise interest rates in June was a more finely balanced decision than previously thought.

The Australian Dollar was softer across the board and market expectations for further RBA rate hikes retreated after the minutes showed policymakers had seriously considered keeping interest rates unchanged.

"AUDUSD dropped about 0.7% to 0.6800 because of lower commodity prices and the 'dovish' minutes from the Reserve Bank of Australia’s (RBA) early June meeting," says Carol Kong, a foreign exchange analyst at Commonwealth Bank of Australia.

The GBPAUD exchange rate rose by a similar margin to 1.8795.

"We didn't read the Minutes of the RBA's June Board meeting as particularly hawkish," says Adelaide Timbrell, an economist at ANZ.

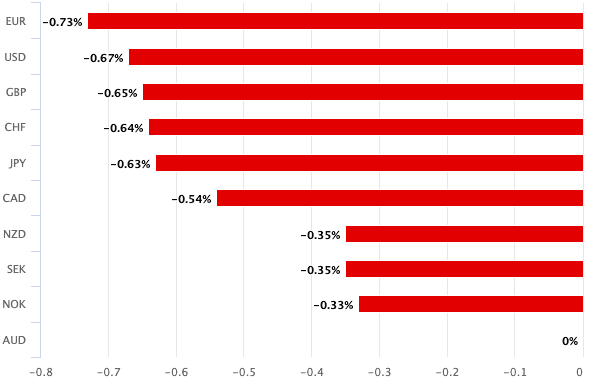

Above: AUD is the day's biggest loser as markets digest the RBA's June minutes.

The RBA raised the cash rate a further 25 basis points in June as the hiatus from hiking, announced in April, was ended.

"The case for raising the cash rate by a further 25 basis points focused on the increased risk that inflation would take longer to return to target than had been expected. Members observed that inflation was already projected to be above target for a number of years and was expected to take somewhat longer to return to target in Australia than in some other countries," read the minutes.

The decision to raise rates proved a surprise to markets that were expecting the RBA to remain on pause and the Australian Dollar rallied as a result.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The rise in the Australian Dollar brought to an end a period of underperformance and confirms that the foreign exchange market remains highly fixated on the evolution of interest rates.

But the minutes questioned the 'hawkish' AUD narrative after they revealed that "the arguments were finely balanced" in favour of raising interest rates again.

The central bank noted medium-term inflation expectations in Australia remained relatively anchored while downside risks to inflation could be observed in falling global commodity prices and falling prices in international shipping.

Following the release of the minutes the market implied probability of a 25 rate hike in July dropped from 50% to 35%, a move that explains the slide in the value of the Australian Dollar.

However, some Australian economists are of the view the RBA is not yet done hiking, which if correct could underpin the Australian Dollar further.

"After the RBA’s April pause, we flagged potential risks of inflation expectations becoming unanchored, which, if realised, would require more hikes later in the cycle. The minutes suggest that this risk may be starting to materialise," says Jameson Coombs, Economist at St. George Bank in Sydney.

St. George Bank expects an additional two 25-basis point rate hikes taking the cash rate to 4.60% and sees consecutive increases in July and August.

Commonwealth Bank meanwhile sees a 50% chance of another hike occurring in July.

"We still think another increase in July is the most likely outcome given May’s very strong labour market data, which came out after the meeting," says ANZ's Timbrell.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes