GBP/AUD Rate Week Ahead Forecast: Supported on Iron Ore Price Drop, Aussie CPI in Focus

- Written by: Gary Howes

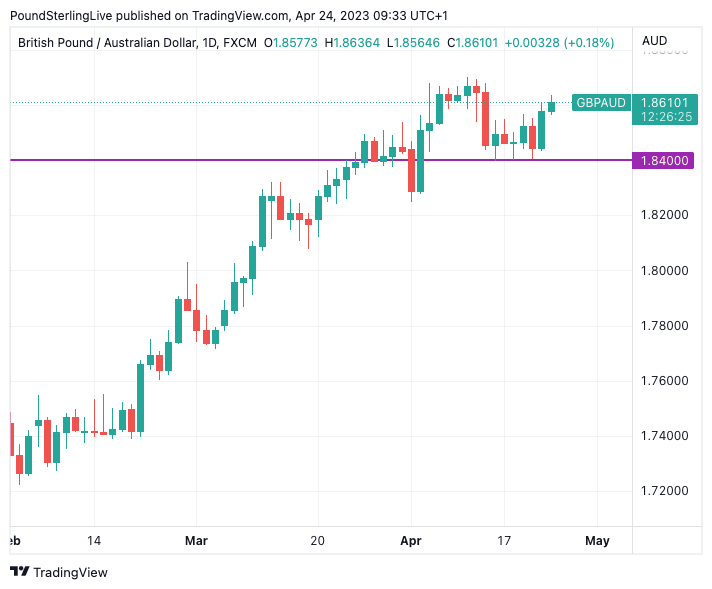

- GBP/AUD supported at 1.84-1.8450

- Iron ore decline underpins AUD weakness

- Test of 1.87 on the cards

- Particularly if Aus inflation undershoots midweek

Image © Adobe Stock

The Australian Dollar is back under pressure amidst a decline in iron ore prices, but it could find some support midweek if Australian inflation data beats analyst expectations.

The Australian Dollar was a notable underperformer ahead of the weekend with some currency analysts saying a slump in iron ore - Australia's most valuable foreign exchange earner - is a culprit.

"On Friday iron ore futures fell sharply (-6.3%) and are on track for its lowest since December," says Tapas Strickland, Head of Market Economics at NAB.

As a result, the Australian Dollar and its commodity currency peers "were notable underperformers," he says.

The Pound to Australian Dollar exchange rate (GBP/AUD) rose by 0.75% on the day with further advances being counted on Monday as the pair reclaims 1.86.

"Ample Chinese steel supplies are capping market sentiment, which is occurring despite this time of year being the peak building season. Other base metals also fell," says Strickland of the iron ore price decline.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Australian-U.S. Dollar exchange rate (AUD/USD) fell 0.75% on Friday and is lower again on Monday at 0.6688.

Further extensions lower in the iron ore price could therefore prompt further downside in the Aussie Dollar over the coming days.

"Iron ore slumped amid lukewarm demand in China. Despite the construction season underway, steel prices have continued to fall amid weak demand and rising inventories. More than 40% of steel furnaces in Tangshan have gone into maintenance this week, reducing demand for iron ore," says Brian Martin, an economist at ANZ.

But the currency could be better supported if the release of CPI inflation on Wednesday shows prices are rising faster than economists expected.

The consensus amongst economists is for headline CPI inflation to read at 1.3% quarter-on-quarter and 6.9 year-on-year.

The Reserve Bank of Australia's (RBA) closely watched Trimmed Mean is expected at 1.4 q/q and 6.7 y/y.

A beat of expectations would embolden the market to raise its expectations for further RBA interest rate hikes and ease expectations for rate cuts later in the year.

This would offer the Aussie Dollar some support near-term.

NAB economists expect the RBA to remain on hold, "but a print in line with our expectations would see an elevated risk of the RBA moving in May," says Strickland.

Ahead of CPI inflation, GBP/AUD's most recent pullback was met by a region of support around 1.84-1.8450.

Above: GBP/AUD at daily intervals. Note the strong uptrend of 2023. (Stay on top of this market by setting an alert, find out more).

The reading offered by the charts, therefore, suggests the market is not comfortable pursuing any setbacks below this support region on a lasting basis.

Any CPI-initiated setback into this zone will likely find bidding interest.

Instead, a retest of the 1.87 area is preferred and a softer-than-expected inflation reading could prompt a spike higher.

The charts suggest resistance located in this vicinity means strength could be faded.