Australian Dollar Looking Attractive at these Levels: Bank of America

- Written by: Gary Howes

Image © Adobe Images

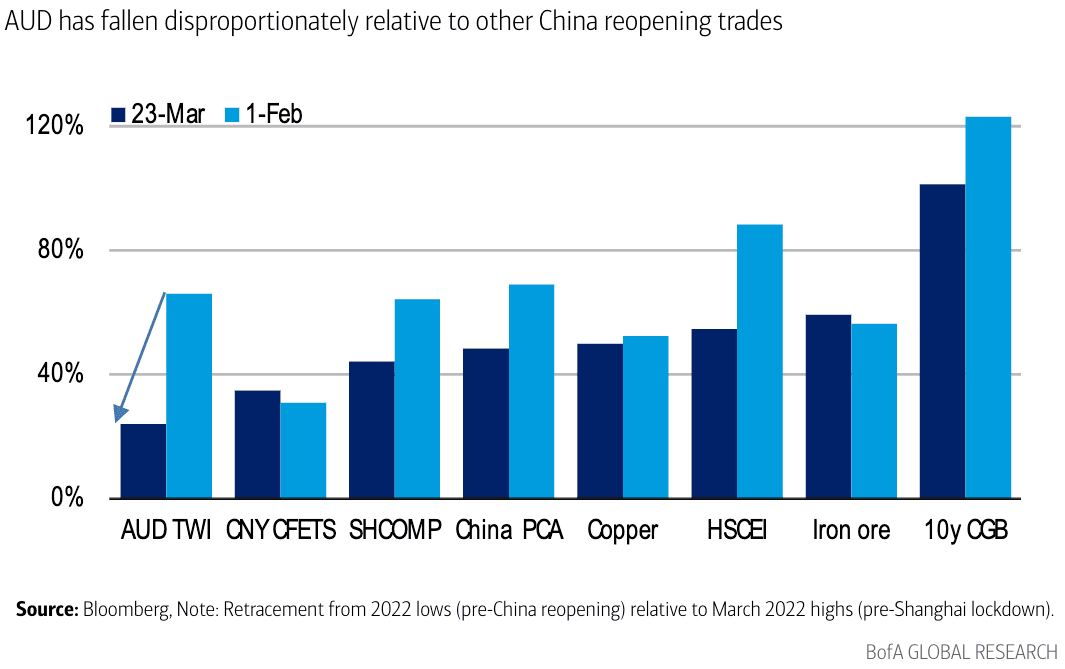

The Australian Dollar is underperforming other 'Chinese reopening' financial assets and now looks attractive as a result, according to new research from strategists at Bank of America.

"Upside risk to China growth is no longer appropriately priced," says Adarsh Sinha, co-head of Asia foreign exchange and rates strategy at Bank of America Merrill Lynch in Hong Kong.

This report comes as the Australian currency extends a losing streak against the Dollar, Pound and Euro on yet further headlines out of China that suggested the rebound in the world's second-largest economy was disappointing expectations.

It was reported by the National Bureau of Statistics that Chinese industrial profits were down 22.9% year-on-year for the months of January and February 2023, compared to 2022.

But Shah's research reveals the Chinese economy will pick up some momentum after the soft start to 2023.

His research reveals the Aussie has underperformed relative to other financial assets that are highly sensitive to the fortunes of China's economy, which is expected to see growth accelerate now that authorities have ditched the zero-Covid policy.

"Signs of green shoots in China's property sector and outbound travel bode well for Australia's export outlook," adds Sinha.

The Australian Dollar has struggled in the global FX space, having fallen 4.60% against the Dollar in February, with a loss against the Pound coming in at 2.34%, but this loss has extended by 3.30% through March.

The Aussie meanwhile fell 2.15% against the Euro in February, with a further 3.10% loss currently being printed for March.

The Australian Dollar's trend lower is notable in that it started at the same point that the euphoria associated with the Chinese reopening trade started to fade.

January was all about gains in the Australian Dollar and other China-focussed assets as investors bet on a rapid reopening in the world's second-largest economy as zero-covid was abandoned.

Australia was meanwhile tipped to receive an additional growth impetus linked to the return of high-value Chinese tourists and students.

The Pound to Australian Dollar exchange rate (GBP/AUD) has been trending higher since early February as a result of the Aussie's setback, and on Monday peaked at 1.8449 thanks to a six-day run of uninterrupted gains.

The Australian Dollar to U.S. Dollar exchange rate (AUD/USD) has been trending lower over the same period with a low of 0.6563 being recorded in March.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

China's Reopening Trade: All Bark, No Bite?

The China reopening rally looks to have experienced a short shelf-life as the hype has not been backed by hard data.

Indeed, data over the course of January, February and March revealed the Chinese rebound has been less exhilarating than the financial market moves of January might have implied.

In addition to Monday's industrial profits disappointment, Australian Dollar watchers learnt earlier this month that investment in real estate fell by 5.7% in January and February from a year ago.

That follows a 10% drop in real estate investment for all of last year

China is a key market for Australian raw product exports, namely iron ore, which underpins foreign exchange earnings, and therefore, the Australian Dollar.

An ongoing property slowdown and the decision by authorities to prioritise domestic demand over infrastructure growth could have repercussions for future raw material demand from Australia.

But, the Aussie Now Looks Attractive

Bank of America nevertheless says the Australian Dollar could be about to benefit from "external green shoots".

"While China reopening trades have generally retraced lower, the pullback in AUD has been disproportionately larger," says Sinha.

Bank of America says the Aussie Dollar has proven more sensitive to developments in the U.S. than other assets, but this should wane over the coming weeks, leaving it better placed to respond to the Chinese economy story.

Analysts say China's property sector (commodity demand) and service imports (tourism and education) are the primary channels for Australia.

"However, these are also sectors that have been slow to recover following the reopening. Nevertheless, there are signs of green shoots that bode well for China's import impulse for Australia later this year," says Sinha.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

In particular, Bank of America looks for improved performance in new home sales, which it believes have now turned a corner.

Economists meanwhile see upside risks to their 5.5% GDP growth forecast for 2023.

"Signs of sequential improvement in 10-day steel production data will be a positive sign for Australia's commodity exports," adds Sinha.

Outbound travel from China has meanwhile been constrained by flight capacity issues, leaving overall international travel at only 17% of 2019 levels in the first half of March 2023.

However, Bank of America's transportation research team uses timetabled data to show that international seats will potentially pick up sharply in 2Q 23 to 37% of 2019 levels, with Australia even higher at 44%.

"This represents attractive levels to enter AUD longs in our view," says Sinha.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)