Is the Australian Dollar the New British Pound? Credit Suisse on RBA Credibility Issues

- Written by: Gary Howes

- AUD undermined by RBA credibility issues: Credit Suisse

- Drops bullish AUD bias

- RBA seen in same dovish camp as BoE

Above: RBA exterior. Image: RBA.

Could the Australian Dollar be the British Pound in disguise?

This is the question asked by analysts at Credit Suisse following a run of Reserve Bank of Australia (RBA) decisions that are proving to be a dovish headwind to the Australian Dollar.

None more so than Tuesday's 'dovish' 25 basis point hike.

"The RBA's decision to walk back its hawkish shift in its 7 March decision amid domestic political pressures points to renewed credibility issues, and casts AUD as the new GBP," says Alvise Marino, Macro Strategist at Credit Suisse.

The reference to the Pound rests with a now well-understood feature of global FX: the Pound is perpetually hamstrung by the Bank of England which systematically delivers 'dovish' policy updates and guidance.

The Bank of England is notoriously resistant to raising interest rates as aggressively as the market demands.

The market sees an inflationary problem becoming embedded in the UK without firm action on rates, but the Bank consistently produces forecasts that show inflation is set on a course back to 2.0% over the medium term, thus signalling it does not agree with the market.

"As far as its communication is concerned the BoE will always seem to be lagging behind developments rather than fighting high levels of inflation actively, thus creating concerns that it might drop behind the curve with its monetary policy. That means monetary policy continues to put pressure on Sterling," says You-Na Park-Heger, FX Analyst at Commerzbank.

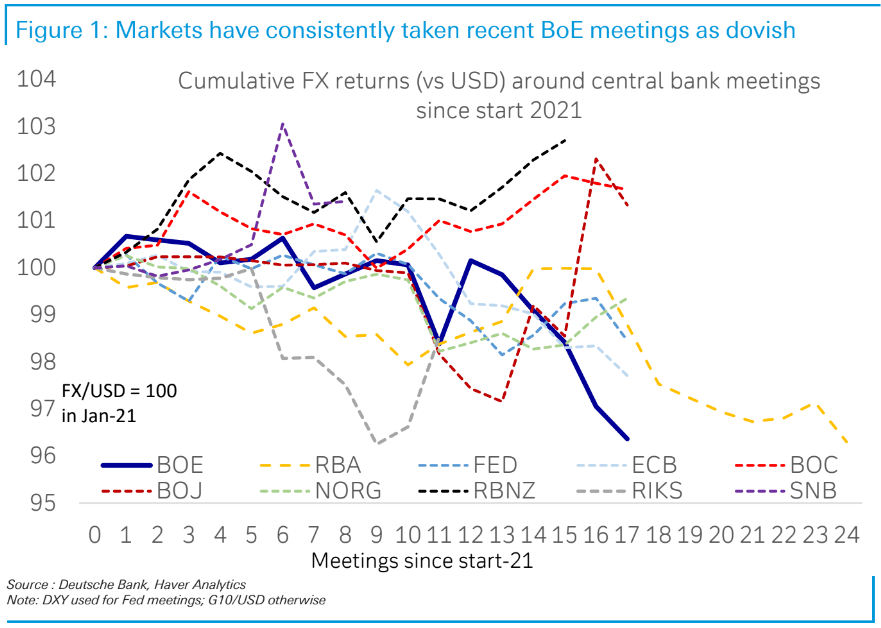

This Deutsche Bank graphic shows that the Pound is a perennial underperformer in the hours following a Bank of England decision:

But the chart also shows the Australian Dollar is not far behind in the underperformance stakes owing to an apparent 'dovish' bias at the RBA.

"We think now markets will be more reluctant to price in a more hawkish outlook, even if data warrant it," says Marino of RBA rate hike expectations.

The Australian Dollar was knocked lower on Tuesday, March 07 following the RBA's signal that it was readying to end its interest rate hiking cycle.

The RBA raised interest rates by the expected 25 basis points but changed the wording in its statement to allow it the space to consider ending its hiking cycle imminently.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Credit Suisse notes the RBA is also currently facing a challenging domestic political climate, with forceful criticism of recent rate hikes coming from both sides of the political spectrum and a looming review due by the end of the month.

"The latter is expected to address a variety of topics, potentially including the bank’s communication of its policy changes and the composition of its rate-setting board. Governor Lowe’s term is also set to end this year (on 17 Sep), which adds to the climate of institutional uncertainty," says Marino.

"This puts the RBA, and by extension AUD, in a fairly precarious situation," he adds.

In recognition of these developments, strategists are reconsidering formerly bullish stances on the Aussie Dollar for the first quarter.

"AUD/GBP dropped about 0.6% towards 0.5560 following the dovish RBA meeting. Our outlook for the RBA to soon pause its tightening cycle is one reason why we consider AUD/GBP will end the current quarter below our forecast of 0.59," says Carol Kong, currency strategist at Commonwealth Bank of Australia.

Credit Suisse says it is now dropping its bullish AUD bias and will now target AUD/USD at 0.6400 by quarter-end.

"In terms of the FX outlook, we think this puts AUD in a similar position to the uncomfortable one that GBP has occupied for most of the past year, undermined by central bank credibility issues even amid otherwise constructive circumstances," says Marino.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes