Australian Dollar Gets a Home-grown Boost from Retail Sales, Inflation Data

- Written by: Gary Howes

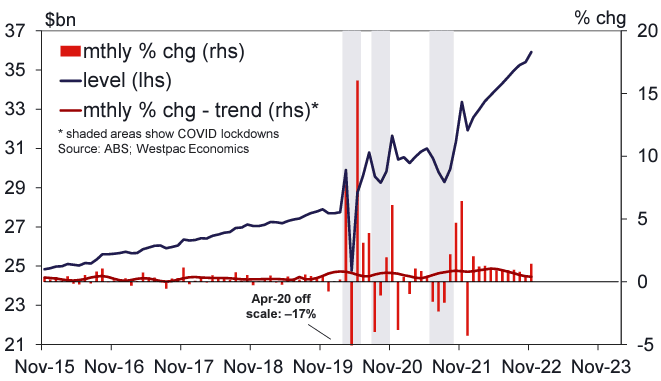

Above: Australian retail sales, image courtesy of Westpac.

The Australian Dollar cemented its 2023 outperformer status following the release of stronger-than-expected retail sales and inflation data which suggest the economy enters the year on a strong footing.

"AUD/USD shot higher above 0.6920 following stronger than expected Australian economic data," says Carol Kong, a strategist at Commonwealth Bank of Australia. "Australian government bond yields rose marginally across the curve."

Headline CPI inflation increased by 7.3% year-on-year in the final quarter of 2022, which was ahead of consensus expectations for 7.2% and up on the previous quarter's 6.9%.

Data also showed retail sales rose 1.4% month-on-month in November, far ahead of expectations for 0.6% growth while previous estimates were revised materially higher.

October's figure was revised from –0.2% to +0.4% and 0.5 percentage points were added to October's figure.

Westpac says the cumulative result meant sales were up 7.7% year-on-year compared to what had been shaping as a 5-5.5% annual gain.

There are implications for the outlook of Australian monetary policy - and therefore the Aussie Dollar - if the Reserve Bank of Australia reads the data and assesses further rate hikes might be needed than were currently planned.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"The moderating effect of interest rate rises on spending now looks to have much milder through the second half of 2022 than previously indicated. Rate rises may be starting to impact but the 'bite' looks to have been very mild so far," says Matthew Hassan, Senior Economist at Westpac.

The Australian Dollar is 2023's best-performing currency courtesy of developments in China where authorities have abandoned their zero-Covid policy, but January's data shows the domestic economy is also throwing its support behind the currency.

The Australian to U.S. Dollar exchange rate (AUD/USD) is at 0.6897 at the time of writing and the Pound to Australian Dollar exchange rate (GBP/AUD) is at 1.7614.

The RBA has signalled it is nearing the peak in its interest rate hiking cycle after raising its basic rate to 3.10% in December, saying it could be prudent to observe the impact of previous rate hikes.

At the time, the terminal rate for the RBA was seen at around 3.65%, implying a couple more 25 basis point hikes were in the pipeline.

However, this data is not consistent with an end to the hiking cycle according to Adelaide Timbrell, Senior Economist at ANZ Bank, who says there is a "very low risk of a pause by the RBA in February."

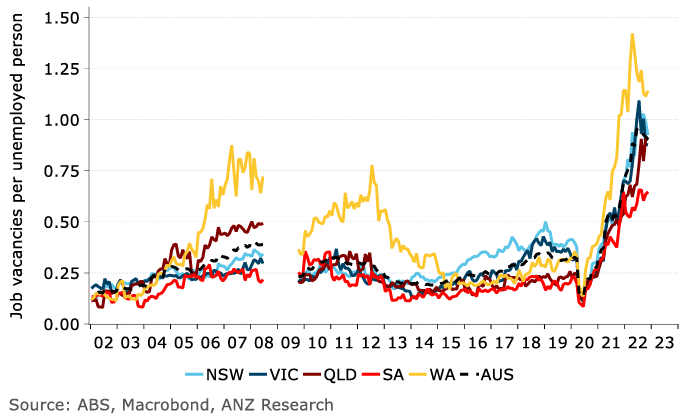

Job vacancies data were also released on January 11 and revealed vacancies stayed strong at 444,200 in November, offering further robust data for the RBA to chew over.

Above: Australian job vacancies remain at historically elevated levels.

"These data are strong enough to reduce any risk of a pause in February for the RBA and reinforce our view that the peak cash rate will be at least 3.85%. We currently forecast no cash rate cuts until late 2024," says Timbrell.

"There is still an imbalance between labour demand and supply. The proportion of businesses reporting vacancies has expanded from 26.7% in August to 27.7% in November," she adds.

The combination of a reopening China, robust economic data and the prospect of higher-than-expected domestic interest rates, therefore, offers a cocktail of positives for the Australian Dollar.

"The RBA still has more policy rate hikes in store, which suggests that FX should catch up with the developments on the rate front. Second, we think that given Australia’s exposure to the Chinese economy, its currency should be the primary beneficiary of a lifting of Chinese COVID restrictions," says Claudio Wewel, FX Strategist at Bank J. Safra Sarasin.

"Within the space of commodity FX, we prefer the Australian dollar," he adds in a year-ahead research note.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes