Australian Dollar: NatWest are Bearish for 2023

- Written by: Gary Howes

Image © Adobe Images

Australian interest rates are unlikely to rise as high as they will in other developed nations, implying a 'carry disadvantage' that leaves analysts at NatWest Markets bearish on the Australian Dollar for 2023.

The UK-based lender and investment bank says their view on the Australian Dollar is also based on an assumption the Chinese economy will be slow to reopen and the country's external position will deteriorate as the trade surplus shrinks from a recent peak.

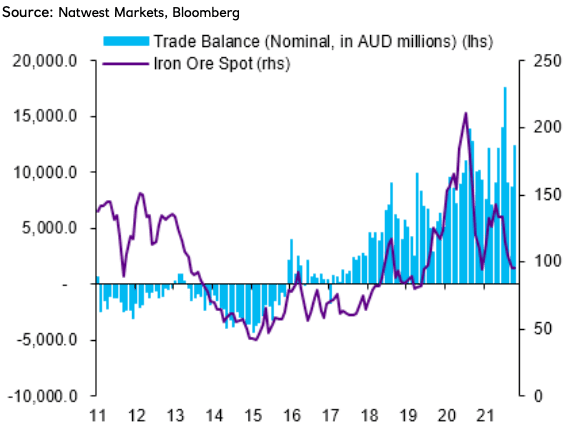

"To a large extent, AUD is correlated with the global growth cycle and is also driven by commodity/iron ore prices," says Paul Robson, Head of G10 Strategy at NatWest Markets. "A significant proportion of the country’s exports is iron ore, and recent declines in iron ore prices imply some worsening in external balances ahead, after years of steady improvement."

Above: NatWest Markets says iron ore prices imply a weakening of external balances.

Regarding the outlook for China, a still-muted outlook for growth and concerns on the property sector are risks for the Aussie Dollar.

China's property sector is important for Australia as it drives demand for key exports such as iron ore.

A sustainable recovery in the sector is therefore required to underpin the sector's growth, but such a recovery is only likely on a substantial Covid policy relaxation that stimulates demand.

"We expect the stress in China’s real estate sector to prolong, alongside risks from supply chain decoupling, and an increased risks of the trade wars of old becoming increasingly a 'tech war'," says Robson.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Reserve Bank of Australia (RBA) is unlikely to push interest rates to competitive levels to boost AUD value.

This is because inflation in Australia appears more benign than elsewhere, negating a need to aggressively pursue economy-slowing rates.

NatWest economists expect inflation to moderate from the first quarter of 2023 due to base effects and a cooling housing market.

"Mortgage rates have been increasing in the last couple of months and the majority of the mortgage stock in Australia are variable rate," says Robson.

And while further interest rate hikes are expected, the "RBA tightening expectations do look rich, given the internal and external risks."

"That likely implies that as policy rate hikes across G10 ultimately end and many central banks enter a period of stability at higher rate levels, the RBA may continue to have a carry disadvantage vs. many of its major peers," says Robson.

Carry refers to when money is borrowed in one jurisdiction at low interest rates and invested in another higher interest rate jurisdiction.

This flow of funds typically boosts the receiving currency and helped fuel a significant appreciation in the Aussie currency in the 2010s.

However, the coming years are unlikely to see this channel offer support, based on the RBA's current intentions.

"This paired with ongoing challenges in China and the implications of softening in iron ore prices for Australia’s balance of payments leave us bearish AUD," says Robson.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes