Pound / Australian Dollar Uptrend Firmly Intact, but Beware Risk Sentiment Recovery

- Written by: Gary Howes

- GBP/AUD uptrend intact

- As AUD slumps on surging volatility

- But some markets are oversold

- Beware a GBP/AUD short-term if markets recover

Image © Adobe Images

A half-percent leap at the start of the new week for the Pound to Australian Dollar exchange rate keeps alive a trend higher that has been in place since November, but oversold stock markets could offer the Aussie help over coming days.

Sterling advanced against the Australian Dollar in a foreign exchange market that was firmly in the grip of a global equity market sell-off, linked to an ongoing liquidation of stocks in anticipation of higher U.S. interest rates.

Also creating fertile conditions for an Aussie Dollar sell-off was a ratcheting up of fears that Russia is on the cusp of invading Ukraine, posing significant geopolitical risks.

The Australian Dollar is a 'high beta' currency that tends to underperform the Pound, Euro and U.S. Dollar when markets are selling off.

"In FX, the reaction function has been typical of RORO, with the AUD and NOK suffering the most," says Daragh Maher, Head of Research, Americas, at HSBC. "Global financial markets are starting the week in classic 'Risk Off' fashion amid concerns about the Fed, Ukraine and COVID-19."

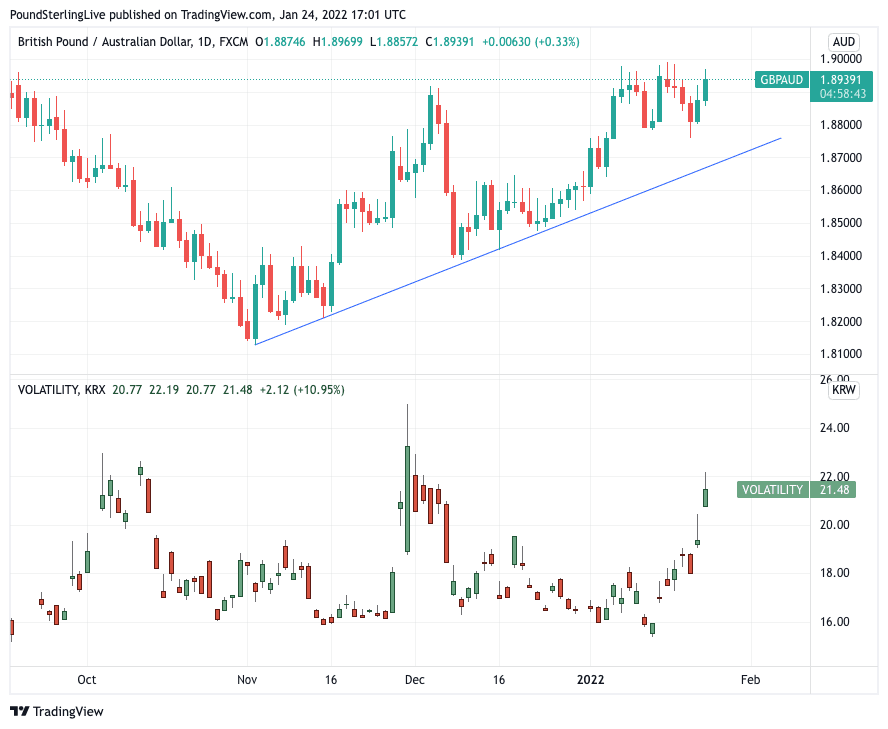

The Pound to Australian Dollar (GBP/AUD) rose to 1.8970 amidst falling stock markets and the below chart shows this is an exchange rate that is still pointed higher in the medium-term.

Above: GBP/AUD trending higher. The lower panel shows the volatility index: heightened volatility disadvantages AUD, aiding GBP/AUD.

*Buy Aussie Dollars now at market-beating exchange rates with our partners at Global Reach. *advertisement.

The lower pane in the above shows how the GBP/AUD enjoys a correlation with volatility: when volatility is high and stocks are selling off so too does the Aussie Dollar.

The current bout of Federal Reserve-inspired volatility is therefore supportive of GBP/AUD.

But, a rebound in risk sentiment would aid a recovery in the Australian Dollar and given the oversold conditions some markets are currently entering this could well transpire this week.

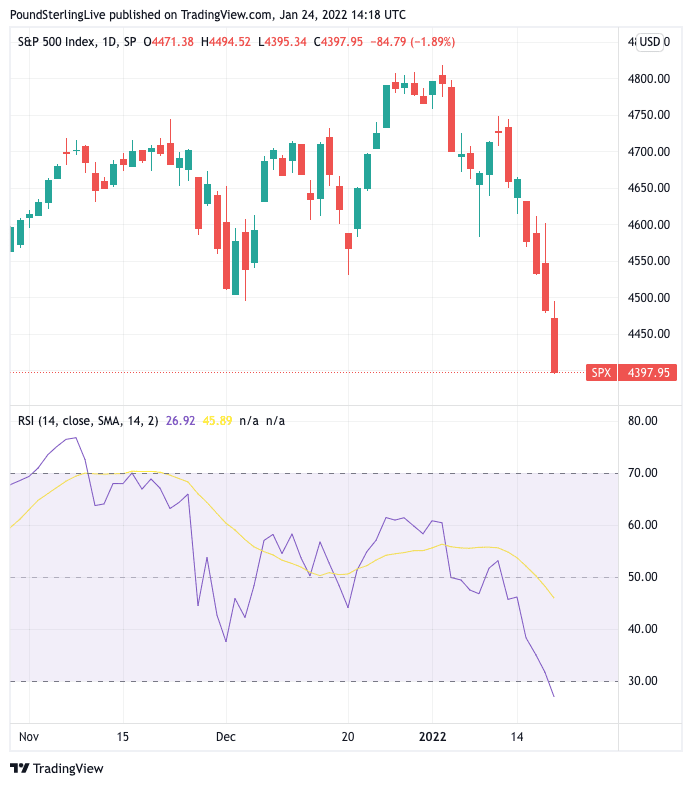

A favoured proxy for investor sentiment is the U.S. S&P 500 index which has fallen by 7.75% already in January. The decline takes the Relative Strength Index into oversold territory as it has slipped below 30.

The last time this happened was in 2020 when markets slumped amidst the spread of the Coronavirus.

For the RSI to stabilise downward pressure on stocks would be required to ease.

Above: The Relative Strength Index for the S&P 500 daily chart is now flashing oversold (lower pane).

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"With the Relative Strength Index at oversold levels of sub 30, I wouldn’t be surprised to see some “bargain hunting,” possibly as early as today or this week," says Fawad Razaqzada, Market Analyst at Markets.com.

"The sell-off in risk has been relentless, but the bulls could emerge from the ashes soon. A correction for the US technology sector and cryptocurrencies was always on the cards given the size of the rally from the initial slump in early 2020 and the fact that yields have been on the rise for months," says Renee Friedman, Senior Economist at EXANTE.

A potential trigger to a rebound in stocks could lie with the source of the current sell-off: the U.S. Federal Reserve.

As the below chart shows, it was the Fed sending a clear warning that it would have to tighten monetary conditions more rapidly than investors had been expecting that is the source of the current sell-off:

Image courtesy of @johnauthers, Bloomberg.

The above chart from analyst George Saravelos at Deutsche Bank issued the above chart, blaming Federal Reserve policy for equity declines.

How will the current rout in global markets impact the Fed's meeting this week: does it prompt just a tinge of dovishness given the scale of the sell-off?

Given the scale of the market's fear over higher interest rates in the future it appears the bar to another Fed inspired sell-off is now incredibly high.

Indeed, the balance of risks are now pointed in the Fed disappointing against these elevated expectations.

Therefore, it could be midweek when the kind of conditions emerge that allows the Aussie Dollar to find its feet again and repel the Pound's advances.