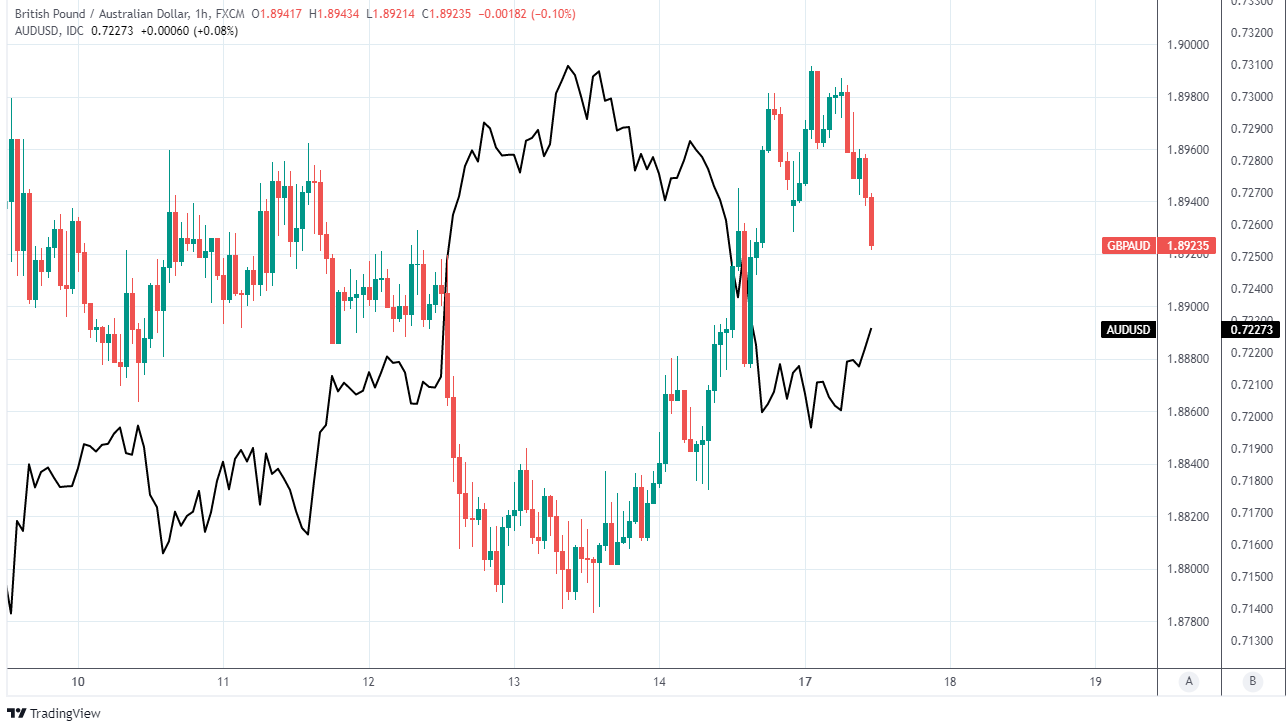

Pound / Australian Dollar Rate Could Slip to 1.8815 if AUD/USD Rebound Continues

- Written by: James Skinner

- GBP/AUD risks slippage near to 1.8815

- May struggle above 1.90 in short-term

- If AUD/USD takes another run at 0.73

- Faltering USD, PBoC policy aiding AUD

- But AU job data key for AUD this week

Image © Adobe Images

The Pound to Australian Dollar exchange rate entered the new week near to five month highs but with only limited scope to advance further amid an attempted recovery by the main antipodean exchange rate, AUD/USD, which risks pushing Sterling back to 1.8815 over the coming days.

Sterling rose to within a hair’s breadth of 1.90 against the Australian Dollar early on Monday but was quickly stifled by AUD/USD’s attempted rebound hard on the heels of the latest monetary policy decision from the Peoples’ Bank of China (PBoC).

Australia’s Dollar rose against both the U.S. Dollar and Pound after the PBoC surprised the market with a 0.10% reduction of its seven-day reverse repo rate and 1-year medium-term lending facility to open the new week in what has been described as a strong signal of its intent to stabilise GDP growth.

“Slowing growth and developers’ mounting risk of default are both drivers of the cut. Recent local flare-ups of COVID-19 have triggered factory shutdowns in some cities and supply chain interruption. At the same time, developers’ approaching debt maturities are also weighing on market sentiment,” says Zhaopeng Xing, a senior China strategist at ANZ.

The PBoC’s announcement preceded data revealing a sharp slowdown in domestic economic activity during the final quarter including in retail sales, and barely a fortnight away from the Lunar New Year national holiday period that runs for 16 days from the beginning of February.

Above: GBP/AUD rate shown at hourly intervals alongside AUD/USD.

- GBP/AUD reference rates at publication:

Spot: 1.8923 - High street bank rates (indicative band): 1.8260-1.8393

- Payment specialist rates (indicative band): 1.8753-1.8828

- Find out about specialist rates, here

- Set up an exchange rate alert, here

AUD/USD’s subsequent rebound from Friday’s lows curbed the early advance by GBP/AUD and could be likely to push Sterling back toward last week’s trough around 1.88 if it continues over the coming days.

“AUD/USD can remain supported against a backdrop of a heavy USD and optimism about the global economic recovery. We consider AUD has passed its low point for this cycle, absent any further virus shocks. As a result, we see the risk skewed towards AUD breaking above its 0.7314 resistance level rather than moving back towards 0.7000,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

Whether the Australian Dollar remains ascendant likely depends on market appetite for the U.S. Dollar, which fell widely last week in what many analysts suspect was profit-taking on speculative bets built up in 2021.

The U.S. Dollar rose strongly last year, weighing heavily on AUD/USD along the way as the Federal Reserve (Fed) prepared the market for a now underway withdrawal of the monetary policy support provided to the U.S. economy since the onset of the pandemic.

“These gains were built around the sharp increase in hawkish rhetoric from the Fed in recent months. However, the sell-off in USDs in the spot market last week suggests that long positions had become crowded. There is scope for a further reduction in long USD index positions in the next set of data,” says Jane Foley, head of FX strategy at Rabobank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

It remains to be seen if the market will continue to reduce its exposure to the U.S. Dollar, although even without further declines in the greenback the AUD/USD exchange rate could potentially benefit later this week if Thursday’s employment figures show the Australian labour market recovery continuing in December as this might fuel speculation about a possible shift in Reserve Bank of Australia (RBA) in February or soon after.

“The labour sector down under has fully recovered from the pandemic and it might not be long before the RBA is pressed to start hiking rates. We’re now expecting a 15bps hike from the RBA in Q3,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Australia’s unemployment rate fell to its lowest level since before the 2008 financial crisis in November and the economy had continued to add jobs at a blockbuster pace, and any continuation of this trend could potentially encourage wage pressures to rise sooner than the RBA has envisaged as likely.

The RBA’s research suggests that Australian wages would need to be growing by around three percent per year in order to sustain sufficient growth in economic demand for the 2.5% midpoint of its two-to-three percent inflation target to be met sustainably over the medium-term.

That target was barely seen throughout much of the last decade, hence why the RBA has repeatedly stated in recent times that its cash rate is highly unlikely to rise much before the year 2024, which is also a big part of why the Aussie Dollar was an underperformer among major currencies last year.

Above: GBP/AUD shown at daily intervals with Fibonacci retracements of November recovery indicating possible areas of technical support for Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Hiring in Australia should have cooled off in December after November’s very strong numbers. The unemployment rate may still edge lower (4.5%), but with a lot of Reserve Bank of Australia tightening already in the price, we see little room for more hawkish re-pricing. AUD/USD may edge back below 0.7200,” says Francesco Pesole, an FX strategist at ING.

While a strong job report could support the Aussie this week, and especially if it leads the market to exit some of its hefty wager against the antipodean currency, the rub for AUD/USD is that some analysts and economists expect the pace of employment growth to slow sharply in this week’s data.

Should such an outcome curtail the attempted rebound by AUD/USD, it would also be likely to offer support for the Pound to Australian Dollar rate, which tends to closely reflect the relative performance of the former exchange rate and its Sterling counterpart GBP/USD.

December’s job data is due out at 00:30 London time on Thursday and is the highlight of the week in the Australian economic calendar.

Meanwhile, in the UK jobs and inflation data are due out over the course of Tuesday and Wednesday and could potentially lead the market to assign a higher probability of an interest rate rise coming from the Bank of England (BoE) in February, which would be a favourable outcome for the Pound.

Nonetheless, and in the event of a renewed advance the Pound to Australian Dollar rate would likely struggle to sustain itself above the nearby 1.90 handle this week in the absence of marked weakness in AUD/USD.