Australian Dollar in the Red after RBA's Lowe Warns of Looming Interest Rate Cut and QE Expansion

- Lowe signals expansion of quantitative easing

- Rate cut to 0.1% expected in Nov.

- AUD is worst performing currency of past day, week and month

- Aussie unemployment data beats expectations

Image © Crawford Forum, Reproduced Under CC Licensing

- GBP/AUD spot rate at time of publication: 1.8304

- Bank transfer rates (indicative guide): 1.7663-1.7791

- Transfer specialist rates (indicative guide): 1.7880-1.8140

- More information on specialist rates, here

- Secure today's rate for up to 24 months, here

The Australian Dollar was sent lower in the wake of comments from Reserve Bank of Australia governor Philip Lowe that signalled further interest rate cuts and an expansion of the existing quantitative easing programme was coming.

The Australian Dollar fell against all its G10 peers after Lowe said it is "reasonable to expect that further monetary easing would get more traction" now that the economy was close to being fully opened.

Lowe told journalists after a speech given to Citi’s 12th Annual Australia and New Zealand Investment Conference the RBA was considering the possibility of cutting the cash rate to 0.10%, and is discussing whether buying longer-dated bonds would support the recovery.

Such an expansion of the quantitative easing programme - that sees the RBA buy short-dated bonds to ensure their yield sticks around the 0.25% level - would likely weigh on the Australian Dollar.

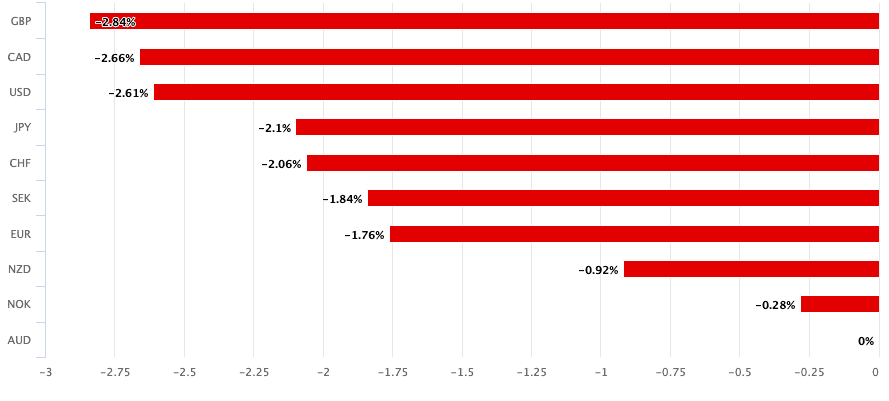

"The Aussie was the main loser among the G10s, coming under strong selling interest after RBA Governor Philip Lowe said that more stimulus is possible, with the options including bond buying and a small rate cut," says Charalambos Pissouros, Senior Market Analyst at JFD Group.

Above: AUD performance past month.

Lowe appeared to suggest the RBA would target the yield on ten-year government bonds as Australia's are now higher than "almost everywhere in the world". "The Governor complained that Australian 10-year yields are still too high. This has the market placing bets that the RBA is set for a bigger move at the November 3rd meeting, which could include a rate cut and now more likely to see a proper QE programme that includes purchases to lower Australian yields all along the curve," says John J Hardy, Head of FX Strategy at Saxo Bank.

"We think the balance of risks suggests that the RBA is more likely to ease. Therefore, we expect the RBA to cut the cash rate to 0.10%, most likely at the November board meeting, when it will also update its economics forecasts. The RBA's guidance at the October meeting that it views "addressing the high rate of unemployment as an important national priority" indicates that the bank may ultimately lean toward further easing, in our view," says economist Rahul Bajoria at Barclays.

When a central bank hints at further monetary easing, as is the case with the RBA today, the currency it issues tends to decline in value. The narrative for further easing has been building for some time now and explains why the Australian Dollar is now the worst-performing major currency of the past day, week and month.

The Pound-to-Australian Dollar rallied to fresh six-week highs on the developments, hitting 1.8312. The Australian-to-U.S. Dollar exchange rate slumped 0.60% on the day to reach 0.7097 while the Euro-to-Australian Dollar exchange rate went lower by 0.60% to reach 1.6530.

If you are holding out for better rates don't hesitate to ask your FX provider if they have they can provide the relevant stop-loss order to protect against downside and a suitable buy order to take advantage of any upside targets when they are reached, please learn more about this here.

Foreign exchange strategists at Barclays meanwhile said earlier in the week that further easing at the RBA is likely to be close to being fully priced by the market, therefore the bar to further losses is likely set quite high.

"Scope for material AUD downside appears limited, as markets have largely priced a November rate cut (in line with our current thinking) and general risk sentiment remains supportive," says Nikolaos Sgouropoulos, a foreign exchange strategist at Barclays.

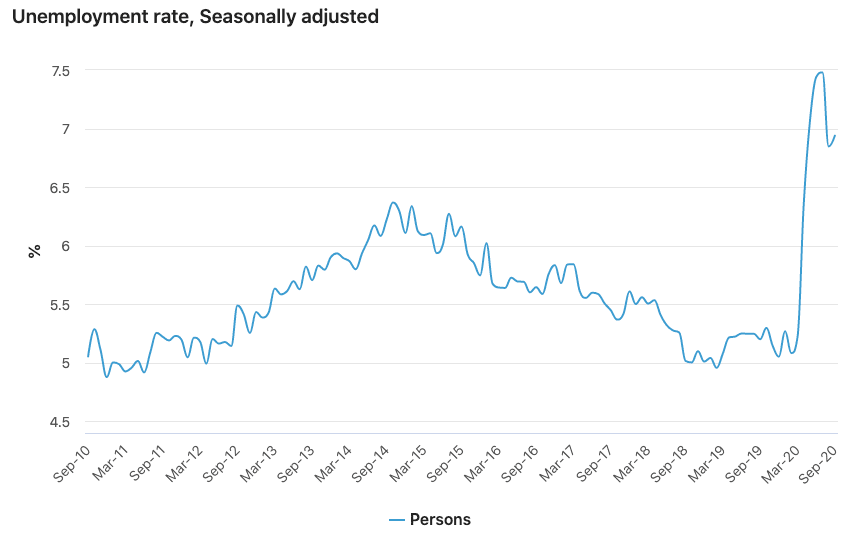

The Lowe speech comes on the same day the Australian Bureau of Statistics released data that confirmed unemployment increased by 30K people in September, ensuring the unemployment rate rose 6.9%.

"After the big rises in employment over June, July and August as the economy re-opened and consumers resumed some of their “normal” activities, jobs growth has stalled into September and this is likely to continue over the next few months," says Diana Mousina, Senior Economist at AMP Capital in Sydney.

The numbers were better than the market was expecting, with a survey of economists showing an expectation for unemployment to increase by 35K and the unemployment rate to rise to 7.1%.

The consensus-beating result will therefore likely limit some of the downside pressures weighing on the Aussie.

On a state-by-state basis, Victoria recorded the heaviest losses at −36k owing to the protracted lockdown, but the rest of the country only saw a rise of 6k jobs. Employment was flat in New South Wales (+3.3k) but rose in Queensland (+32k).

The Australian government said last week in its budget announcement that employment losses are likely to keep rising in the near-term, which will likely maintain pressure on the RBA to provide additional assistance in the form of rate cuts and quantitative easing.

"There is pressure on the Reserve Bank to also do more to reduce borrowing costs further and support lending and investment," says Mousina. "The employment data demonstrates that more needs to be done to ensure a stronger recovery."

Expectations for RBA action are ramping higher, but inevitably such trades reach saturation point, a consolation for the under-fire Aussie Dollar.

Shahab Jalinoos, a foreign exchange strategist at Credit Suisse says the RBA's ability to promote further Aussie weakness will become increasingly limited going forward:

"With the 3 November RBA decision in focus as the most likely date for policy easing, volatility markets have priced in a large amount of risk premium in AUD space around the date, well above what is priced in for the US election on the same date for other G10 currencies. This creates a potentially tricky combination of factors, and arguably a higher bar for RBA easing to meaningfully weaken AUD, especially if US elections were to yield the relatively “clean” Democrat sweep that investors associate with a weaker USD, and that markets are increasingly pricing in as the most likely outcome."