UK Trade Deficit Widens in Second-quarter as Currency-induced Export Boost Remains Elusive

- Written by: James Skinner

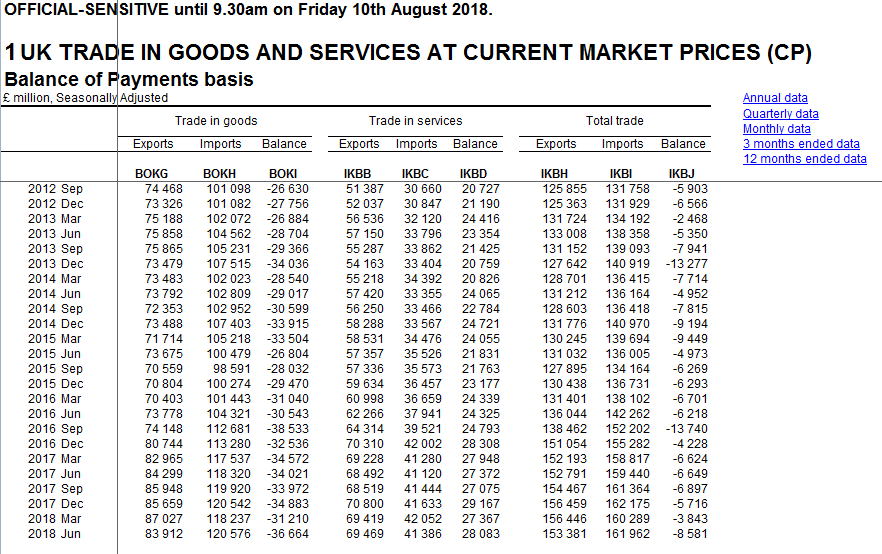

-UK trade deficit widens sharply in second-quarter.

-Exports fall, imports rise as trade boost remains elusive.

-"Net trade" drags on GDP growth during second-quarter.

© Winterbilder, Adobe Stock

The UK trade deficit widened during the second-quarter as exports fell while imports ticked higher, according to Office for National Statistics data released Friday, which saw "net trade" weigh on the pace of quarterly GDP growth.

The total UK trade deficit widened to -£8.6 bn during the recent quarter which, marking a sharp deterioration from the -£3.8 bn during the previous period, came against a backdrop of an escalating US-China "trade war" and as the Eurozone economy slowed for a second straight quarter. Almost all the UK's international trade is with the EU, China and US.

Although the total trade balance includes services sector activity, it was the goods trade deficit that weighed on the total result after widening from -£31.2 bn at the beginning of the year to -£36.6 bn for the three months to the end of June.

"The poor performance partly reflects the fact that supply chains have become ever more global. But Brexit also has made exporters reluctant to invest in extra capacity or to seek to increase their market share abroad by cutting their foreign-currency prices," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Above: Office for National Statistics quarterly trade balances.

Trade balance data measures the difference in value between a nation's imports and its exports. Currency markets care about it as the data provides insight into supply and demand of a currency in the "real economy", while also giving a steer on the likely pace of GDP growth at the start of the second quarter.

A narrowing trade deficit suggests either that exports and their associated demand for a currency are rising, or that imports and their associated supply of a currency on global markets are falling. Both are typically good for a currency while a steadily narrowing trade surplus, or a widening deficit, is a negative influence.

The size and trajectory of a trade surplus or deficit is important for economic growth because imports are a subtraction in the calculation of GDP, while exports represent a credit to the value of economic output. As a result, rising exports and, or, falling imports can help boost the economy.

"Net trade exerted a large 0.8pp drag on growth, as export volumes dropped by 3.6% on the quarter – primarily driven by a fall in car and plane exports to non-EU countries – while import volumes fell by a smaller 0.8%. Even excluding the volatile valuables component (mostly non-monetary gold), net trade still subtracted 0.5pp from GDP," says Ruth Gregory, a senior UK economist at Capital Economics.

UK GDP grew by 0.4% for the second quarter overall, up from 0.2% at the start of the year and in line with expectations, although it has done little to boost confidence in the UK's economic prospects for the current quarter.

The result came after a contraction in the index of production which, covering the industrial sectors, offset a stellar month for the services and construction industries.

GDP data matters for markets because it reflects rising and falling demand within the UK economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates.

Interest rates are the raison d'être for most moves in exchange rates and can also have a bearing on future levels of GDP growth.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Export Boost Remains Elusive

The trade figures are a disappointment for economy-watchers as they call into question the idea that the UK might receive a currency-induced boost to growth from the export sector.

UK manufacturing and export goods sectors have been a relative bright spot for the economy ever since the referendum of 2016, thanks largely to a cheaper currency, which has made British goods cheaper for international customers to buy.

"The data are volatile, but it’s now more than two years since sterling started to depreciate and a trade boost still has not materialised. At the same stage after all other double-digit percentage depreciations of sterling in the post-war period, net trade had lifted GDP, by around 1.0% on average," adds Pantheon's Tombs.

Survey measures of manufacturing activity have been running high ever since and the cheaper currency helped drive a surge in ONS-reported activity last year that saw the sector enjoy its longest run of growth since 1988.

However, imports have continued to increase during this time, eliminating what might otherwise have been a sustained source of support for the economy.

"We wouldn’t necessarily read too much into the trade figures, since they are extremely volatile from quarter to quarter," Gregory adds. "Meanwhile, at least business investment rose by a solid 0.5% on the quarter, suggesting that while fears of a “no-deal” Brexit have grown, Brexit-related uncertainty is not weighing too heavily on firms’ spending plans. Note too that looking ahead, the surveys suggest that the economy has maintained this pace of growth at the start of Q3."

Friday's data left the annualised pace of UK GDP growth at 1.3%, which is in line with a downwardly-revised consensus, although the Capital Economics team forecast that growth will be 1.5% for the year overall. Both of these numbers are below the 1.7% seen in 2017 and beneath the 1.8% seen in 2016.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here