UK Manufacturing Data Beats Expectations but Offers no Support to the Pound

Image © Adobe Stock

Pound Sterling is seen struggling at the start of the week with the release of manufacturing PMI for June offering no discernible boost, despite it comfortably beating analyst expectations.

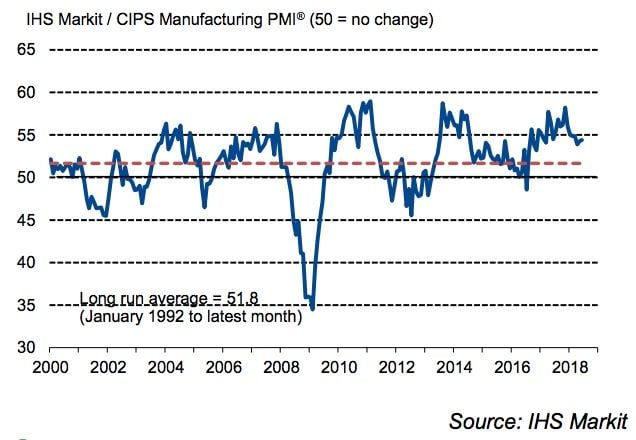

The IHS Markit / CIPS manufacturing PMI report for June read at 54.4, ahead of expectations for 54.1.

Any reading above 50.0 is indicative of growth in the sector, even if that growth is moderating with the report stating:

"Sector data indicated that the upturn remained broad-based during June. Output and new orders rose across the consumer, intermediate and investment goods industries. However, the overall rate of expansion in manufacturing output slowed, as growth of new order inflows improved only mildly."

Furthermore:

"Although the rate of increase in new business edged up to a three-month high, it remained among the weakest registered over the past year and-a-half.

Following the release, the Pound-to-Euro exchanger rate was quoted flat at 1.1307, the Pound-to-Dollar exchange rate was 0.3% down at 1.3165. Sterling was the third-worst performing name in the G10 currency complex with only South Africa's Rand and New Zealand's Dollar putting in a worse performance.

"While the the output balance, which has the best relationship with the official measure of manufacturing output, slipped back from 56.9 in May to 55.5, that left the balance’s average over Q2 consistent with a rebound in quarterly manufacturing growth to a little under 1%, far stronger than the 0.1% contraction in manufacturing output in Q1. This would provide a boost of about 0.1pps to quarterly GDP growth in Q2, increasing the chance of the MPC raising rates at its next meeting in August," says Andrew Wishart, UK Economist with Capital Economics.

Markets are currently watching UK data within the context of what it means for a Bank of England interest rate rise at some point in 2018.

Of late, expectations for an August rate rise have firmed, and should they firm further we would expect the Pound to gather support.

However, the Pound's lacklustre performance, despite expectations for an interest rate rise, confirm the baggage of Brexit uncertainty remains an heavy burden to bear for the currency.

Again, markets are waiting for further clarity on the way forward, and hopes are building that the cabinet's outing to Chequers - the Prime Minister's country residence - at the end of the week to thrash out differences in opinion and finally settle the matter will yield some guidance.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.