The Need to Invest in Infrastructure is a 21st Century Imperative, says Bank of America Merrill Lynch

- $18tr shortfall in global infrastructure spending expected by 2040

- UK Infrastructure spend is, however, relatively large at 22-23% of the total for Europe

- Growth areas for the future are transport and social sectors predominantly, in the UK

© eleonoralamio

There is a funding black hole for essential public infrastructure in both the emerging and developed world, according to Bank of America Merrill Lynch (BofA), and it is the challenge of the century to meet this shortfall so that the societies of the future can avail themselves of adequate public services.

"Stretched public finances mean that 11/20 of the world's largest economies have reduced spend on infrastructure since the Great Recession," says BofAML.

This had led to a situation in developed countries where "DM infrastructure is crumbling, with US infrastructure graded "D+". "

Left unfixed, the situation will lead to real losses in GDP for the countries in question.

At current rates the infrastructure funding shortfall is expected to reach 18tr Dollars globally by 2040, with the US short by 3.8tr and China 1.9tr Dollars.

The emerging market has been playing catch up with the 'west' and this is increasing the strain. Demographic changes mean more people are joining the global middle class, more are living in cities and the gap between rich and poor is widening.

"Emerging market global infrastructure is also struggling to meet demographic-driven demand (3bn entering the middle class by 2030E, 2.1bn aged 60Y+ by 2050E), urbanisation (2/3 living in cities by 2050E), and inequality (higher today than in 1820)," says BofAML.

The solution is likely to lie with Public Private Partnerships (PPP) which combine public and private money for infrastructure projects. This will help fill the gap and ensure efficiency.

"The model is expected to play a large role in regional initiatives such as China's "One Belt, One Road", President Trump's US$1.5tn Infrastructure Plan, and Europe's €500bn Juncker Plan," says BofAML.

Private partners contribute $337bn to PPP projects in 2017 and 90% of private investors want to increase their contribution to the sector. In other words, they are popular.

"Stakeholder support is also strong with c80% of the US public and industry professionals supporting new infrastructure investments," says BofAML.

Investment in infrastructure boosts growth - the multiplier effect is threefold, in other words for every $1 spend $3 of "economic activity" is generated.

The sectors most likely to gain as a result of an increase in infrastructure spending are "social infrastructure (US$1.25tn market); engineering and construction; affordable housing (US$1tn+ opportunity); materials & equipment (combined US$2tn market by 2025) and roads and rail.

The Picture in the UK

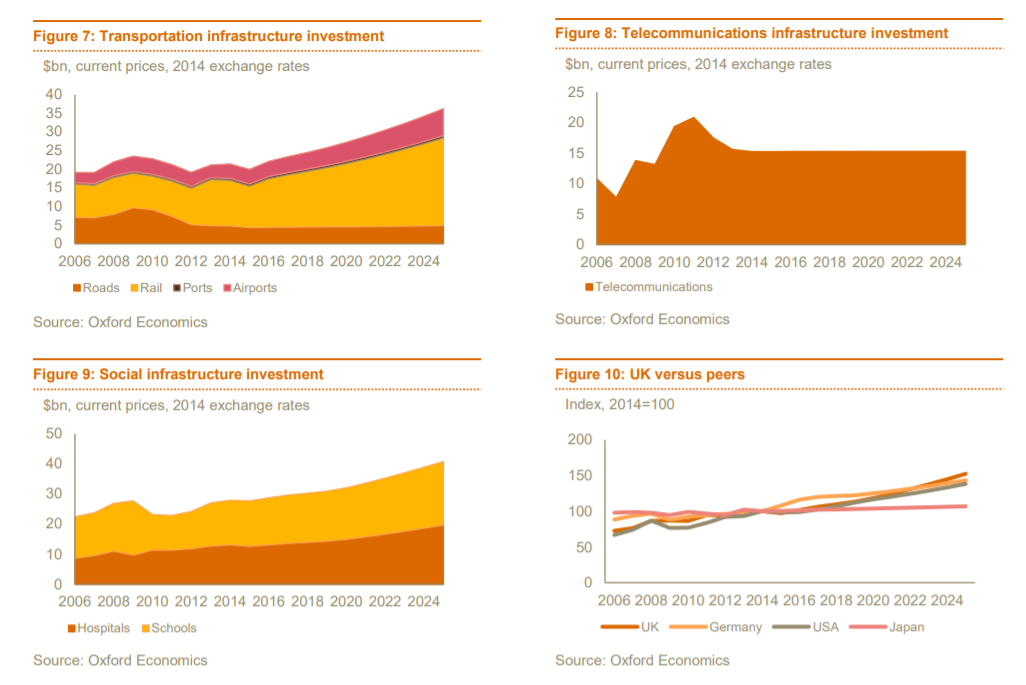

Infrastructure spend in the UK is actually very high by European standards, with total UK spend accounting for between 22% and 23% of European spend, according to Richard Abadie, global leader at PriceWaterhouseCoopers (PWC).

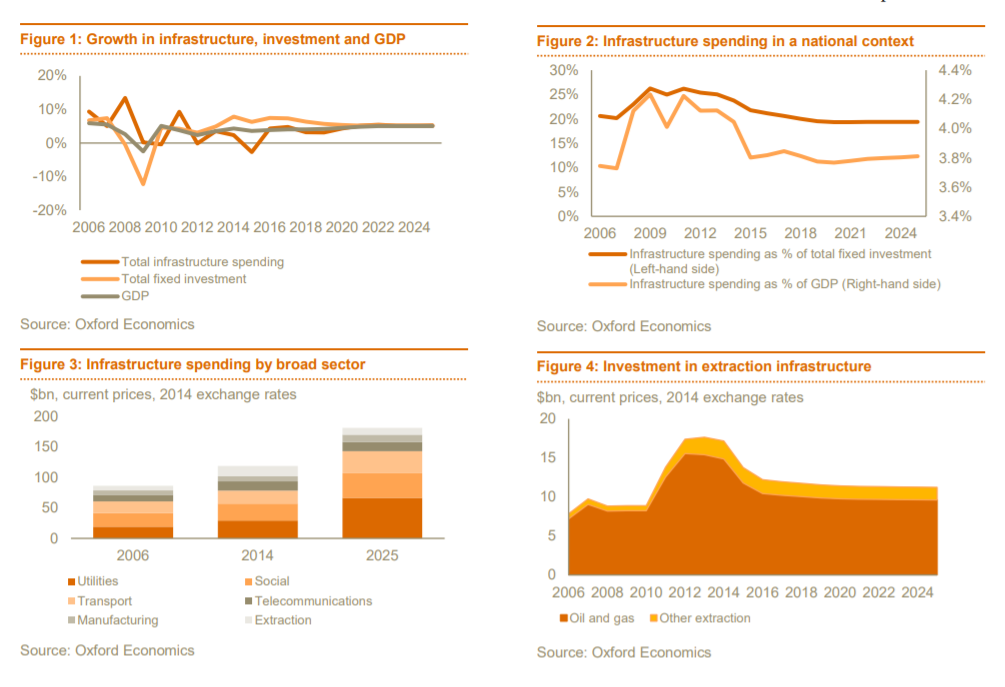

The composition of the spend in the UK is likely to change, moving away from 'extractive' (North Sea Oil) and heavy industry projects to more transport and social projects.

Total spend in the UK reached $119bn in 2014 and is likely to rise to $182bn by 2025.

All areas of infrastructure spend suffered after the financial crisis but power generation was less impacted and is expected to increase by an average 8.0% a year to 2025 as the UK replaces several ageing power stations.

Rail connectivity and airport expansion infrastructure projects are forecast to be the major growth areas of the future in the UK.

One of several major rail connectivity projects currently in the pipeline, for example, is the "Southern Rail Access scheme, a proposal currently the subject of a feasibility study for a rail link between Heathrow Airport and London Waterloo, Guildford or Basingstoke," says Antonio Fabrizio, a reporter at Inframation, part of the Acuris Group.

A £1bn rail link between Oxford and Cambridge is also currently in the pipeline.

A new Thames River crossing, a tunnel under the Thames and a road expansion at Stonehenge which will involve the construction of a 1.8mile tunnel under the heritage site itself.

UK social infrastructure projects currently in the pipeline include "Project Pheonix, a GBP 3bn CapEx programme for the development of healthcare centres similar to the existing Local Investment Finance Trust programme," says Fabrizio; a plan to build four prisons by the Ministry of Justice and the GBP 210m Velindre Cancer Centre in Cardiff.

One of the key debates surrounding Brexit is whether a UK-based infrastructure bank will be set up to replace the EU's European Investment Bank (EIB).

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.