Eurozone Growth Unchanged, ZEW Marginally Optimistic; German Slide Insufficient to Raise Concerns

- The German GDP growth rate slowed down more-than-expected in Q1 but not enough to concern experts

- Eurozone GDP revisions for Q1 left preliminary estimates unaltered.

- The ZEW business survey showed green shoots of optimism in May

© Stefan Yang, Adobe Stock

Official data confirmed a marginal slow down in the pace of economic growth in the Eurozone economy in the first quarter on Tuesday.

New figures reaffirmed preliminary estimates that the Euro-area grew by 0.4% in Q1, down from 0.7% in Q4, and 2.5% compared to Q1 a year ago (in 2017), compared to 2.8% in Q4 for the same period, statistics produced by the European Union statistics agency, Eurostat, showed.

Further, important sentiment data measuring business people's outlook in Germany and the Eurozone in May, released from the ZEW economic centre for research, showed a rise overall, supporting a more optimistic outlook for Germany and the region.

Eurozone 'economic sentiment' rose to a balance of 2.4 from 1.9 previously when an increase to 2.0 was forecast.

German 'economic sentiment' stayed at -8.2 as expected and the same as previously, and 'current conditions' remained high at 87.4, if slightly down from the previous 87.8, and managed to beat expectations of a dip in the 87s.

The data is unlikely to alter the European Central Bank's (ECB's) plan to wind down its QE programme, which provides the region with emergency liquidity.

Recent commentary from ECB official and chief of the Banque de France Francois Villeroy supported the notion that the ECB might even remove QE and start raiisng interest rates sooner than previously expected.

Higher interest rates would be supportive of the Euro but the ECB has to remove QE first before it can start raising them and it has said it does not plan to do so until September 2018.

German Growth Falters But From a High Starting Point

The fourth largest economy in the world, Germany registered a slight slow down in the first quarter of 2018 according to new data out on Tuesday, but the slide was not deep enough to upset experts.

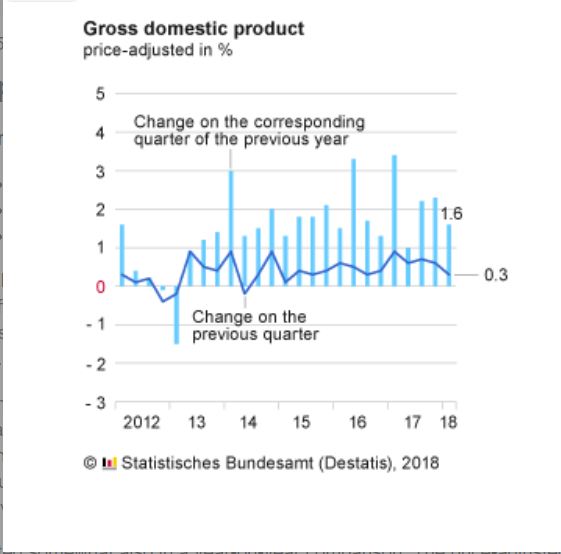

Germany's rate of economic growth fell to 0.3% in the first quarter of 2018 from 0.6% in Q4, according to data from Destatis, the German statistics bureau, released on Tuesday morning.

GDP rose by 1.6% in the first quarter compared to Q1 in 2017 (a year ago), which compared with 2.3% in Q4.

Both results missed analysts' expectations of 0.4% and 1.8% respectively, signaling a deeper than expected slowdown, however, the data was not poor enough to spark major concern.

"Such as it is, the German economy is slowing, but not collapsing," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

The slowdown in Q1 could easily be remedied by the German government spending more of its relatively generous budget surplus and abandoning what French president Emmanuel Macron has called the German 'fetish with budget surpluses'.

"Germany’s newly-appointed finance minister, Olaf Scholz, proudly announced earlier this month that his country would be running a budget surplus of €63B over the next four years—about 1.9% of GDP between now and 2022—some €14B more than initially estimated," says the economist in a note yesterday.

This probably explains why the Euro did not fall very far after the release and then recovered surprisingly quickly even though the actual result was below-forecast.

The Euro has probably also gained underpinning support from recent commentary from Francois Villeroy, a high-ranking European finance official, who said that the European Central Bank (ECB) should get itself in a position where it could start raising interest rates more quickly than previously expected.

Higher interest rates support a currency by attracting greater inflows of foreign capital drawn by the promise of higher returns - and by reducing outflows.

"ECB Governing Council member Francois Villeroy de Galhau, head of the French central bank, considers an earlier than currently generally anticipated an increase in the ECB's key interest rate likely," says Swiss lender LGT.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.