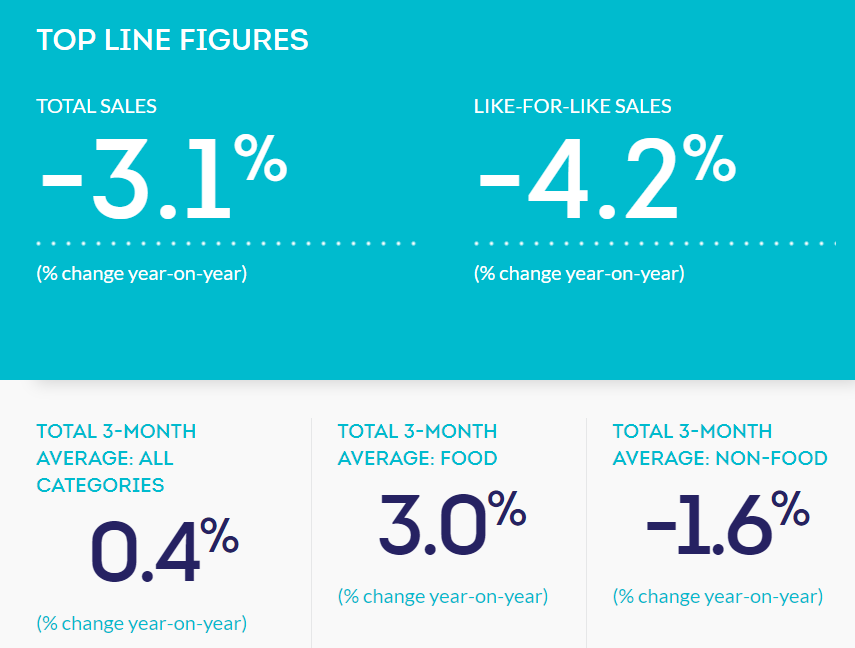

Retail Sales Drop "Off a Cliff" in April After -4.2% Decline

- Retail sales survey declines in April due to absence of Easter which fell in March

- Three-month average also low, however, suggesting possible deeper malaise

- Sterling insensitive to news perhaps due to already negative outlook

© Alice Photo, Adobe Stock

Retail sales in the UK fell “off a cliff” in April after recording a -4.2% decline, according to the British Retail Consortium's (BRC) Retail Sales Monitor report, released overnight.

The decline was partly due to the timing of Easter which was in March and normally sees sales accelerate, according to the joint BRC-KPMG report, although this was not the whole explanation as the 3-month trend was also subdued, showing an average rise of only 0.4% in sales in all categories but -1.4% in non-food.

"The first glimpse of summer may have temporarily lifted clothing and footwear, but non-food sales overall continue to be weak," says Helen Dickinson OBE, chief executive, at the BRC.

"Consumers’ discretionary spending power remains under pressure and the reality is, that with only a gradual return to solid growth in real incomes expected, the market environment is likely to remain extremely challenging for most retailers," she adds.

Total sales for the whole year declined - 3.1% in April – the sharpest decline recorded since the monthly sales monitor started in January 1995.

"The BRC’s survey adds to evidence that consumers have tightened their purse strings this year and are prioritising repairing their balance sheets over spending more," says Samuel Tombs, chief Uk economist at Pantheon Macroeconomics.

Although the absence of Easter would have had an estimated -3.0% impact the fall in total sales of -3.1% from a year ago was highly unusual and negative, according to the analyst.

"It is extremely rare for total sales to fall outright; December 2008 was the last time our calendar-adjusted measure of total sales fell for two consecutive months. Continued weakness in sales in April can’t be pinned on the weather—average temperatures actually were 1.1 degrees Celsius above their 1970-2017 April average—or any other one-offs," says Tombs.

The data had little impact on the Pound, which traded at 1.1426 GBP/EUR, 0.8752 EUR/GBP, and 1.3554 GBP/USD, however, perhaps due to so much negativity from poor data for Q1 already being baked into the exchange rate, at least according to one analyst.

"Awful UK BRC sales data haven't done any real damage to GBP, which probably tells us bearish sentiment is at a peak again," says Kit Juckes, strategist at Société Générale (SocGen).

One bright spot in the data was the fashion sector.

“Fashion sales received a much-needed boost, but otherwise the sales were disappointing for the rest of the high street," says Paul Martin, head of retail at KPMG.

Separate data from Barclaycard found consumer spending increased by 3.4% year-on-year in April.

Recent UK borrowing data from the Bank of England (BOE), however, paints a picture of sharp decline in consumer credit, which may be partly responsible for the slowdown in retail sales.

The data showed a sharp fall in lending in March as well as a reduction in mortgage approvals.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.