Forecast Met After Eurozone Growth Comes Out at 0.4% in Q1

- GDP in Eurozone rises by 0.4% qoq and 2.5% yoy in Q1

- Unemployment remains at 8.5% in line with expectations

- Manufacturing PMI for region marginally revised up

© artjazz, Adobe Stock

Q1 growth data and unemployment in the Euro-area came out in line with forecasts although Manufacturing PMI rose marginally, according to GDP data released on Wednesday morning.

First quarter GDP data showed economic growth rising by 0.4% in the Euro-area compared to the previous quarter; this represented a slowdown from Q4's 0.7% but was the same as the consensus estimate, said figures released by Eurostat.

(Image courtesy of tradingeconomics.com)

The same was true of the year-on-year result which showed growth up by 2.5% in Q1 of 2018 compared to Q1 2017, also the same as expected.

The unemployment rate in the Eurozone remained unchanged at 8.5% in March, according to labour market data released at the same time, which was also as expected.

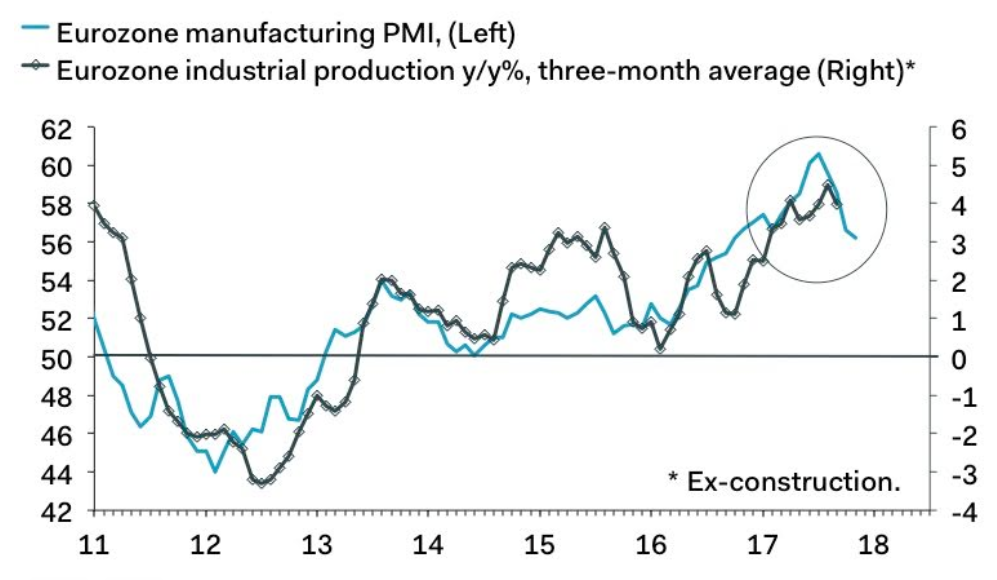

Earlier on Wednesday Euro-zone Manufacturing PMI for April unexpectedly rose two bases on final revision to 56.2 from 56.0 in the flash estimate.

The Euro was little changed versus the Dollar after the release trading at 1.9996 from a prior 1.9997.

Against the Pound, the Euro was similarly unchanged at 1.1372.

The results drew little comment from analysts as they were in line with forecasts, however, the slightly higher Manufacturing PMI did attract some responses.

"The EZ manufacturing sector is still growing, albeit more slowly than at the start of the year," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

"The Spanish PMI fell slightly less than the consensus view, to 54.4 from 54.8 in March, while the French headline was revised up slightly by 0.4 points to 53.8. By contrast, the Italian manufacturing gauge slid to a 14-month low of 53.5, from 55.1 in March, with Markit ominously referring to “clear turning point in growth since the start of the year,"" adds the economist.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.