Eurozone Growth Slowdown Probably Temporary as GDP Data 'Face-Saving' For Some Members

- Q1 GDP results for Austria, France and Spain suggest slowdown not acute

- European Central Bank (ECB) likely to remain in wait-and-see mode

- Commerzbank's in depth analysis indicates elements of full-blown recession lacking

© European Central Bank, reproduced under CC licensing

Preliminary GDP results for the first three months of 2018 have been announced for a handfull of Eurozone countries and the takeaway is the recovery in the region is made of sterner stuff than some market commentators had feared.

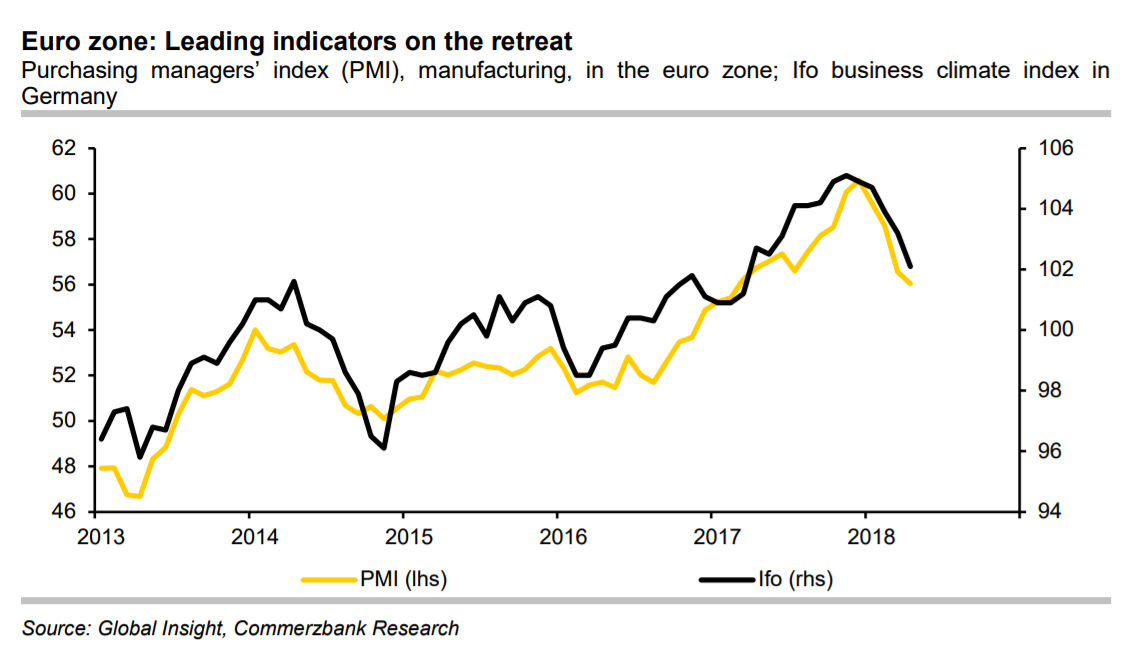

The fall in Eurozone sentiment indicators and expectations of a corresponding drawdown in growth has become something of a fetish for markets over recent weeks as one poor survey release followed on from another.

Is this the start of a recession, as some commentators are asserting, or just a temporary blip?

Up until today most of the data for Q1 has been survey-based, with the main two being the PMI's for the region (Purchasing Manager Indices) and the Ifo Business survey. PMI's are surveys of key procurement managers and the Ifo is a survey of German business managers. Both have declined steeply in recent months.

Today's Q1 GDP results from France, Spain, and Austria should help clarify the issue with the aid of some real, hard data for the period.

And as it turns out the data was not as bad as some had perhaps feared, suggesting president Draghi's exhortation to "caution" justified.

In France, quarterly growth for Q1 came out at 0.3%, just below the 0.4% predicted; in Spain growth registered a robust 0.7% rate in Q1, in line with expectations and the same as Q4's 0.7%; in Austria growth was 0.8%, seemingly in line with forecasts and only slightly below the 0.9% registered in Q4.

All in all the data from these first three member states seems to indicate the slowdown does not warrant an 'action-stations' scramble quite yet.

Concerns about the dip in growth reached a peak during the European Central Bank (ECB) press conference on Thursday, April 27.

Particularly telling was the president Draghi's admission that most of the meeting had been discussing the slowdown in Eurozone growth.

Draghi's eyewitness report of the proceedings jarred somewhat with his more upbeat rhetoric expressed in the press conference in which he quietly dismissed the slowdown as temporary and focused instead on the bigger picture of continued improvement.

Yet it may be that after focusing on the details of the data the governing council came to the right decision, as the hard evidence out today suggests that in three of the larger member states, anyway, growth held up reasonably well in Q1.

Not just raw data, but analysis of past periods of underperformance also suggests the watchword should be "caution", especially before jumping to lugubrious conclusions.

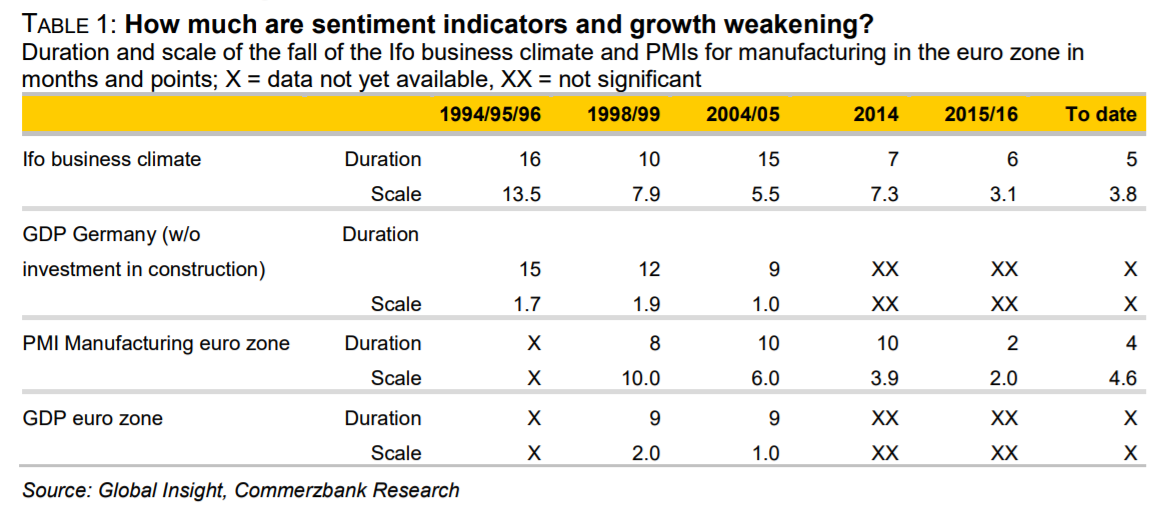

Historical back-testing of comparable periods of decline in leading sentiment indicators conducted by Commerzbank argue that in only about half of cases does the region go on to experience a recession.

"Such a turnaround in leading indicators does not necessarily mark the end of the upswing. Since the beginning of the 1990s, about half of these occurrences were actually followed by "only" a dip in growth, and this should also be the case this time," says Dr. Ralph Solveen, an analyst at Commerzbank.

Normally several other ingredients are required to induce a full-blown recession including either the 'bursting of a bubble' or a period of central bank "tightening". Neither of these are present in current conditions.

Homing in on the smaller more representative sample of five periods where these two added ingredients were not present indicates that most of the time the culprit was a combination of a much stronger Euro and a global economic 'shock' in a major economy.

Solveen notes that in comparable periods of declining sentiment in 1994/96, 1998/99, 2004 and 2014 the D-mark first and then the Euro appreciated by between 12% and 35% in all the cases before sentiment dampened.

Other factors were as follows: in 1994/96 the US Federal Reserve hiked interest rates steeply and interest rates globally surged, leading to a bond market collapse.

In 1998/99 the Russian and Asian crises triggered a slowdown in the Eurozone.

In 2004 the main reason appeared to be the 25% rise in the Euro.

In 2014 the Euro's 12% rise in the preceding 18-months was the main reason.

In 2016 the main cause appeared to be dampening business sentiment in China.

In the current 2018 period one arguable cause, following the pattern of earlier instances, could be the 9.0% sudden appreciation in the Euro in late 2017/18, whilst another may be the slowdown in the Chinese housing market, according to Commerzbank's Solveen.

The bottom-line is that the slowdown is not likely to lead to a major root-and-branch reappraisal of ECB policy.

This suggests the Euro may also be protected from a sudden revaluation lower.

The smaller sample of slowdowns which have the most in common with the current dip do not suggest a long period of recession is on the cards.

At the most, there might be a small delay in the ECB raising interest rates; Commerzbank thinks the first rise will come in Autumn 2019 when the market expects a rise in the Summer.

"We, therefore, assume in our baseline scenario that the ECB will decide in September to end its bond purchase programme towards the end of the year but we do not expect the first interest rate hike before the autumn of next year," says Solveen.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.