German Inflation Undershoots High Expectations in March

- German Inflation comes out at 0.4% in March

- Shows an unexpected slowdown from February's 0.5%

- Analysts had expected a jump higher rather than a flop

© ARTENS, Adobe Stock

The first set of inflation figures are out of the Eurozone for the month of March and they appear to be painting a less buoyant picture than had been expected, according to data released on Thursday afternoon.

German CPI for the month of March slowed its rate of growth to only 0.4% from 0.5% in February, and failed to push higher by the 0.5% the consensus of analysts had expected, in part due to the dates Easter fell on this year.

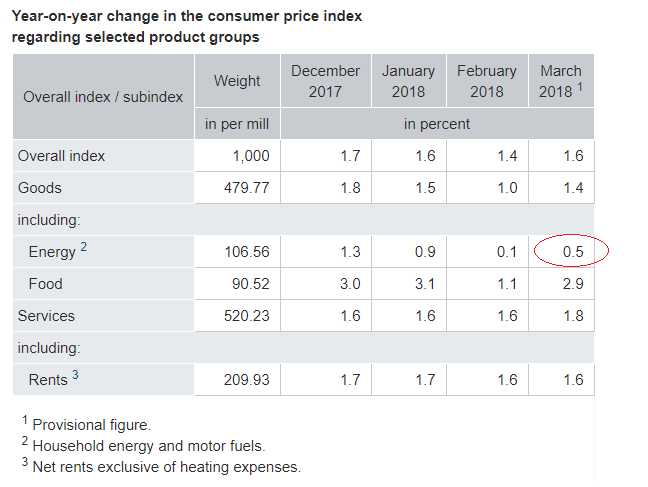

Compared to a year ago (YoY) inflation rose by a more muted 1.6% compared to the 1.7% expected, although this was higher than the 1.4% registered in March 2016, showed data released by the Federal Statistical Office (Destatis).

The German data comes out ahead of more general Eurozone wide inflation data next week.

Harmonized German inflation showed a 0.4% monthly rise but a marginally lower than headline 1.5% on a year ago. Also known as HICP, harmonised inflation uses a uniform method for assessing inflation across all Eurozone countries and is carefully watched by the European Central Bank (ECB), who use it to model their monetary policy.

The Euro was trading a few points higher after the release of the data with GBP/EUR at 1.4227 from 1.4224 and EUR/USD unchanged at 1.2317.

The result fell well short of some high expectations in the analyst community, including those of economists at Commerzbank who forecast a result nearer the ECB's goal of 2.0%.

"In March inflation in Germany is likely to have approached the central bank’s inflation target of 2% according to our economists – the data will be published today. Our economists expect a strong rise in overall inflation as well as in the core rate. So there is a good chance that the data will provide some support for the euro," said Thu Lan Nguyen, an analyst at Commerzbank.

Ultimately whether the result will be of any consequence as far as shaping ECB policy goes, is debatable since research indicates inflation data is often highly volatile in March and April.

"Thinking about the potential upward ‘surprises’ ahead, it is worth keeping in mind that March and April naturally lend themselves to volatile annual inflation readings," said Marchel Alexandrovich, senior European economist at Jefferies International.

Look at the data more closely we note that the marginal slowdown in German inflation was partly due to the stabilizing cost of fuel which only contributed 0.5% YoY in March (circled in red below) compared to 1.3% YoY in December 2017, and Goods price inflation which contributed only 1.4% versus 1.8% in December, as can be seen in the table below which shows the constituents of the overall inflation rate.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.