Consumer Sentiment Survey in January Probably Not Endearing to the Pound

UK consumers shook off the winter blues at the start of the new year a recent survey has shown, although in its details the data raises concerns about the outlook for the Pound.

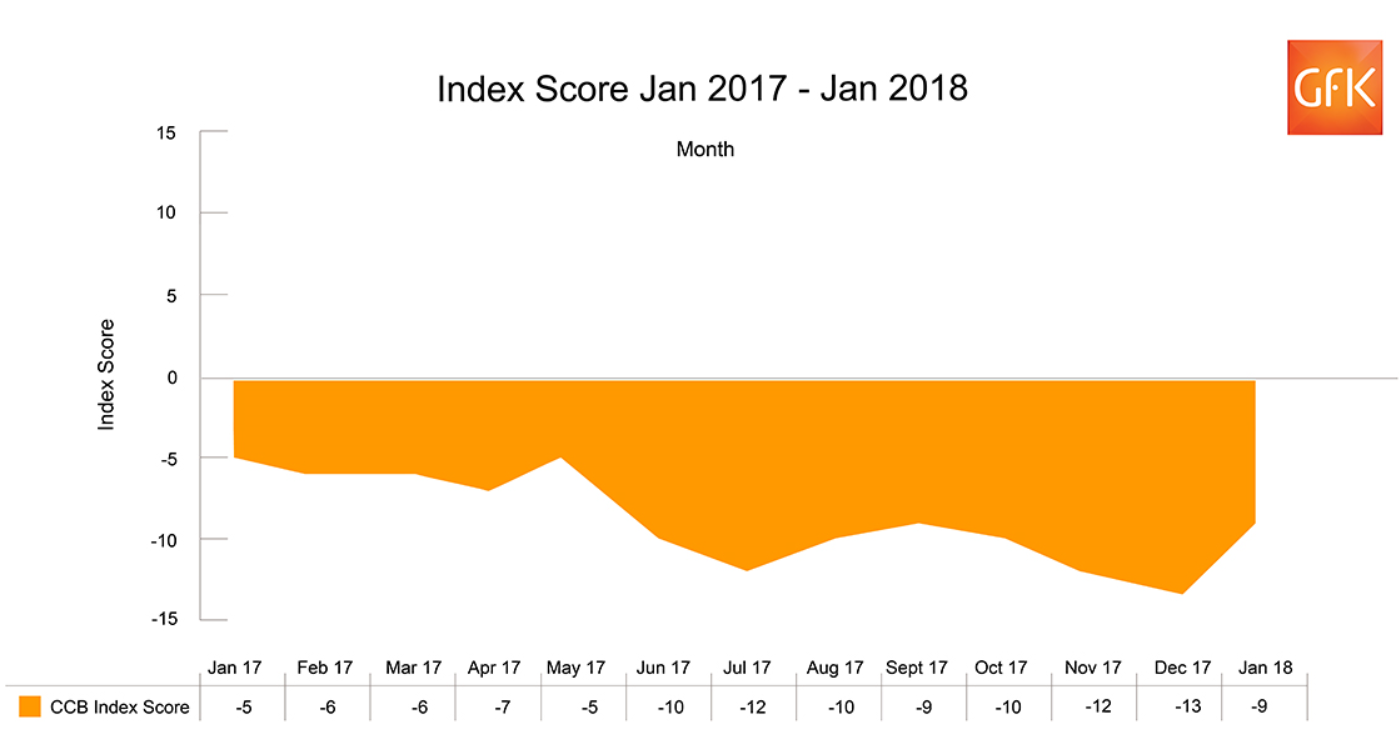

Consumer confidence in the UK rose for the first time in four months in January but it did so from a low base of only -13, and it remains in negative territory at -9; in addition, it is also still below confidence levels registered in January 2017 of -5.

The results - from the GfK Consumer Confidence Survey - infer that, broadly-speaking, British consumers are still operating defensively.

"Standing at -9, the Index is still lower than this time last year (-5), and still in negative territory, and in the absence of good news about rising wages and declining inflationary pressures, this off-trend number could be a temporary blip rather than a strong sign of recovery," says Joe Staton, Head of Market Dynamics at GfK.

Within the broad index are various sub-categories, and these showed that the two areas in which consumers felt the most confident were in the 'savings index', which was the only sub-category to show improvement from last year, after rising to +10 - a full 12 points above January 2017's result - and 'personal finance', which rose +6 and was only one point lower than Jan 2017.

The 'major purchase index' showed the biggest rise, up 5 points from December to +1 but remained below the previous year's score of +10.

Views about the 'general economic situation' remained deep in negative territory at -29 for the last 12 months, and -24 for the next 12 months - both lower than Jan 2017.

Given the uncertainty surrounding Brexit, it is not surprising that people's views of the next 12 months are relatively pessimistic, and shows Brexit remains a concern.

The improvement in the savings index does not bode well for growth because part of the resilience the UK economy since the referendum has been as a result of consumers drawing on savings to cover the increase in costs from higher inflation since real wages have been falling.

If people are now saving more, however, there is a risk that they may be doing so by tightening their belts not earning more, and this could limit spending and weigh on growth.

From a currency perspective, the mixture of uncertainty and prudence which the data reveals does not bode well for the Pound, even if it is only survey-based evidence, not 'hard' data.

Business Confidence

Another major sentiment gauge released in the last 24 hours is the Lloyds Business Barometer, which is a business sentiment survey which asks businesses whether they are more or less optimistic about the economy than they were 3-months ago.

The barometer showed that overall confidence rose by 7 points from 28% to 35% in January, which was the highest result for 9-months.

(Image courtesy of Bloomberg)

Investor Confidence

A rise in global confidence, especially in the Eurozone, was shown by a third sentiment survey - this time of investors - conducted by global financial services giant State Street.

Their 'global investor confidence index' jumped to 102.1 in January, up from 95.7 in December, whilst in the Euro area alone it rose by 16 points to 113.4.

The survey is conducted purely by analyzing the types of assets investors favour and assigning a risk score to each one to develop a quantitative scale of investor risk appetite.

Equities, for example, would have a higher risk score than 'safer' investments like bonds etc.

The results appear to contradict concerns being raised about global investor sentiment in a recent research from Dutch lender ABN Amro, who suggested the Dollar's recent recovery was spurred by safe-haven flows as a result of falling global risk appetite.

ABN Amro's thesis is based on the idea that the Dollar will fall weaken as the rest of the world goes through a growth spurt and 'catches up' with it, however, if this doesn't happen then the Dollar will rise instead.

The strong Eurozone investor sentiment revealed by the State Street 'survey' is likely to be supportive of the Euro.

This contrasts with ABN Amro's concerns that falling global risk appetite will particularly weigh on the EUR, as it will prick the speculative bubble of Euro longs which has been behind the recent rally, bringing EUR/USD back down to 1.15 in the process.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.