What's Up With Oil, and How Will it Impact Foreign Exchange Rates?

Oil.. petroleum.. black gold - by whatever name it is known, the commodity has been surging of late due to political upheaval in Saudi Arabia - but what is the likely impact on foreign exchange?

Oil has risen to the highest it has been since 2015 with the two most widely sourced varieties Brent and West Texas Crude (WTI) trading at $64.08 and $57.33 per barrel respectively - a rise of about 6.0% in only a month.

The reason for the rise has been the political events in the Middle East, more specifically in Saudi Arabia where there has been a purge of the ruling elite on charges of corruption.

As a result of the 'delicate political and economic context' in Saudi Arabia experts now believe that the ruling regime will want to see substantially higher oil prices of above $70 a barrel.

The Saudi's have had to endure unaccustomed hardships since oil prices fell last year and it is expected they will now want to escape this enforced austerity, and the only way of doing that is to make sure oil prices rise.

Ironically, part of the reason oil prices have remained so low is because the Saudi's have wanted them that way - due to waging a war against the increasing threat of fracking operators in the US who were taking over more of their global market share.

The vulnerability of frackers, however, was their high-cost base which requires oil to stay above $50 a barrel for their operations to remain profitable, so the Saudi's decided to tactically weaken the price of oil hoping to thereby put the frackers out of business.

It almost worked - oil prices fell to lows of $27.58 a barrel in 2016 after the Saudi's allowed supply to swell - and many frackers went bust, but the advent of new technology and more efficient methods allowed frackers to reduce their overheads and the industry rose from the ashes.

Fracking has now become more efficient and can extract oil for less than the previous $50 tipping point level, enabling operators to be more resilient to a price war, this combined with 'austerity fatigue' and the desire to privatise the Saudi state oil producer Saudi Aramco has led them to give up their price war.

The Saudi's influence the price of oil through OPEC (Organization of the Petroleum Exporting Countries) which is the name of a cartel formed of most major global exporters to influence oil prices - normally to keep them high.

OPEC can influence prices by changing supply - either limiting it or increasing it.

At the next meeting of OPEC analysts believe the Saudi's could try to encourage the rest of OPEC to agree to cuts in supply to help increase oil prices back above $70 per barrel, thus the outlook for the commodity remains relatively bullish in the short-term.

Impact on Currencies

Historically, changes in the price of oil have impacted most heavily on the currencies of major oil-producing nations such as Canada, Russia, and Norway.

Of the leading G10 currencies the one most impacted by changes in the price of oil is the Canadian Dollar (CAD) due to the country's heavy reliance on oil exports.

The reason the price of oil impacts on CAD is that when it rises, the aggregate cost of Canadian oil correspondingly goes up, which thereby increases the demand for the currency.

The strange thing about the current rally in oil is that it does not seem to be having much impact on currencies.

"So far there has been little spill-over impact on the foreign exchange market. The correlation between the performance of the price of oil and oil-related currencies has weakened over the last year," says Bank of Tokyo-Mitsubishi UFJ (MUFG) Currency Analyst Lee Hardman.

The reason currencies do not appear to be reacting very much to oil prices is due to market skepticism that the strength will be sustainable after a long period of sideways activity in the $50-60 barrel range.

"The correlation between the performance of the price of oil and oil-related currencies could re-strengthen if the market becomes more convinced that the period of consolidation for the price of oil has ended," continues Hardman, adding:

"If upward price momentum is maintained, it will increase upside risks to our forecasts for oil-related currencies. The Colombian peso and Norwegian krone appear particularly cheap relative the current price of oil thereby creating more scope for potential catch up strength," he says.

Of the Canadian dollar and Russian rouble, Hardman says these are, "more modestly undervalued in comparison."

The analyst, however, finished his note by saying that he is skeptical higher oil prices, "can be sustained much beyond current levels."

Crude Rise Shortlived

Also skeptical about whether high crude prices can be sustained, is Gartman Letter Author Dennis Gartman, who thinks that the rise in crude due to Saudi politics will be shortlived, and once King Salman and his son consolidate their grip on power the opposite will start to happen and crude will fall.

"Eventually the consolidation of power in the hands of King Salman and his son, the Crown Prince Mohammed bin Salman, shall be a positive force, not a detrimental one, and eventually this shall be manifestly bearish of crude oil," said Gartman.

The analyst differs from MUFG's Hardman in seeing more impact on the Canadian and US Dollars from the rise in oil, which he thinks have retained a "bid tone" as a result.

He includes the US Dollar, which is not a natural beneficiary of higher oil prices, because, higher prices support the fracking industry which is predominantly located in the US.

Brent Less Linked to FX

The rally in oil will not impact much on foreign exchange even those currencies traditionally sensitive to changes in the price of oil, such as the Canadian Dollar, the Rouble, and the Norwegian Krone, according to CityIndex Analyst Kathleen Brooks

This is because the rally is mainly in Brent crude oil, not West Texas (WTI) which is languishing over $6 behind, and Brent crude is a variety which is much less correlated to currencies than WTI.

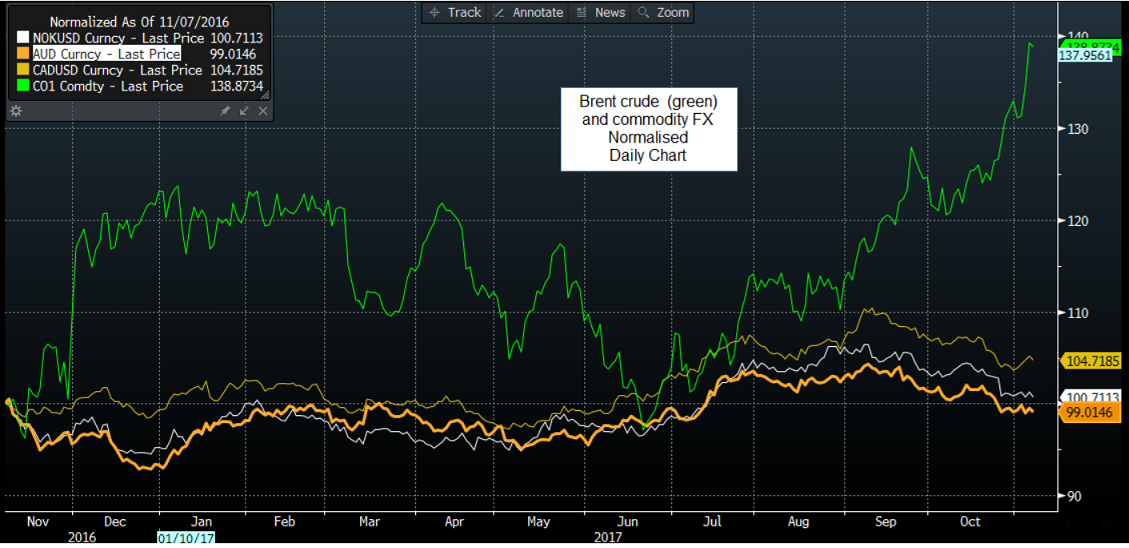

Brooks illustrates the lack of similarity between FX and Brent in the chart below.

Even the normally highly correlated Canadian Dollar is unlikely to be supported by the upswing in oil.

"The most significant correlation is the Canadian dollar, which has a 64% positive correlation so far this month.

However, correlations can be deceiving, as the correlation in October was negligible. The uptrend in the CAD and

Brent in recent days is most likely coincidence, we believe that the CAD’s resurgence was more a function of good

payrolls data in Canada and thus could be short-lived," says Brooks.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.