UK Economy to Stay Resillient as Rising Exports and Investment Will Provide an Antidote to Consumer Decline say Capital Economics

The weak Pound has caused a sharp rise in inflation which is creating headwinds for the economy, particularly the consumer sector, however there are several offsetting factors coming into play which could help keep overall growth steady.

Trade and the Pound

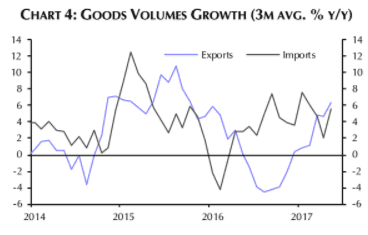

The silver-lining to the post-referendum depreciation in Sterling was supposed to be a improvement in UK export competetiveness which would lead to a renaissance in the UK's negative trade balance, however this has not yet been the case.

Whilst exports have grown due to a weaker Sterling, they have been overshadowed by a similar rise in imports which has resulted in no net rise in trade, or trade surplus.

"Annual growth in goods export volumes has risen from around minus 4% in mid-2016 to over 6% currently. So the recent weakness in net trade has mainly been due to high import growth," says Scott Bowman at Capital Economics, the independent economic research consultancy.

Imports have risen due to continued robust household spending even in the teeth of rising inflation and falling real wages, but it is not expected to last:

"We think that import volumes growth will level off in the coming months, as growth in the consumption of these products slows in the face of higher inflation," says the economist in a briefing note issued on August 8.

In addition, current survey data points to an even greater growth in exports; the survey data, which tends to be forward looking, predicts exports will pick up by 10.0% in the coming months.

The rise in global growth will help contribute to the increase.

Thus, whilst not yet in positive, trade is expected to run a surplus eventually, and contribute 1.0% to GDP over the next two years.

Beyond 2018 Bowman sees a risk of export strength fading but the main factor dictating what happens will be the end result of Brexit negotiations which are unknown.

Investment - the Hero of Brexit?

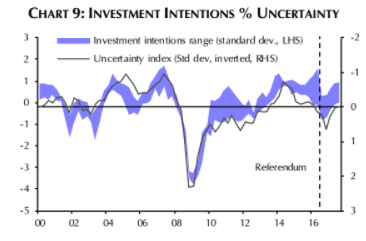

Whilst trade has arguably been the great disappointment of Brexit so far, investment may be the great 'hero' in the sense that it has out-performed even optimistic forecasts.

It was expected that investment would drop like a stone after the referendum due to the increased uncertainty of investors not knowning what the UK's eventual relationship with Europe would be.

"But business investment has held up better than even we expected. It has essentially been unchanged in the three quarters since the referendum. What’s more, dwellings andgovernment investment have both actually risen since the vote to leave," says Bowman.

Although there was an initial hit to investment after the referendum, which fell to "historically average levels", it has since bounced back to above average levels.

Part of the reason for the positive investment climate has been continued low corporate borrowing rates.

The supply of credit to firms has also remained relatively unchanged after the referendum, according to research by the Bank of England (BOE).

Although it is arguable that conditions may become even more opaque and uncertain as Brexit negotiations intensify, Bowman assesses there is just as much of a chance that uncertainty could clearify as negotiations produce more and more of the outline to a deal.

"We believe that this information will include movement towards a comprehensive free trade agreement, with a transition phase. And beyond the transition phase, we think that trade deals with non-EU countries can be negotiated to partly make up for lost trade with the EU," says the analyst.

There are also other factors which should support investment going forward, such as the high levels of company profitability currently being shown.

"The return on capital for non-oil companies has been rising since 2010 and, in annual terms, the rate in 2016 was the highest since 1998. The current rate of return is consistent with a rise in business investment as a share of GDP," notes the economist.

Companies which export a lot will gain a boost in profitability due to the weak rate of Sterling, which should encourage even more investment.

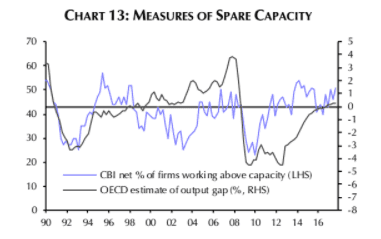

The lack of spare capacity in general will be an additional incentive to invest.

Finally, government investment, or spending should also support GDP.

"The March 2017 Budget plans already incorporated average annual growth of 8% in public sector capital spending over the next 5 years. This would result in a slight increase in government investment as a share of GDP," said Bowman.

Overall capital think investment will rise by around 2.5% in 2017, which is much higher than the 0.5% in 2016.

They argue this should help offset the slowdown in consumer spending growth.

Investment growth should further accelerate in 2018 and 2019 by 3.0%, "contributing to a pick-up in overall GDP growth."