UK-Orientated Shares a Winner of Spring Budget

Image © Adobe Images

Jeremy Hunt didn’t have a lot of space to offer treats for voters, but the spread he’s laid out has pleased some investors, particularly for consumer-focused shares.

The National Insurance cut sweetener and rumours of the fuel duty freeze dangled before the Budget had already done the trick of pushing up shares in retailers.

Investors expect that the NI cut will push more pounds into the pockets of middle-income workers, pushing them to the high street and online tills.

Marks and Spencer and Next held onto earlier gains, while Greggs climbed higher amid expectations for increased demand for its value ranges.

Jeremy Hunt wanted to avoid a bond market strop by sticking to his fiscal rules, and his wish was granted, with the yield on 10-year gilts dropping back.

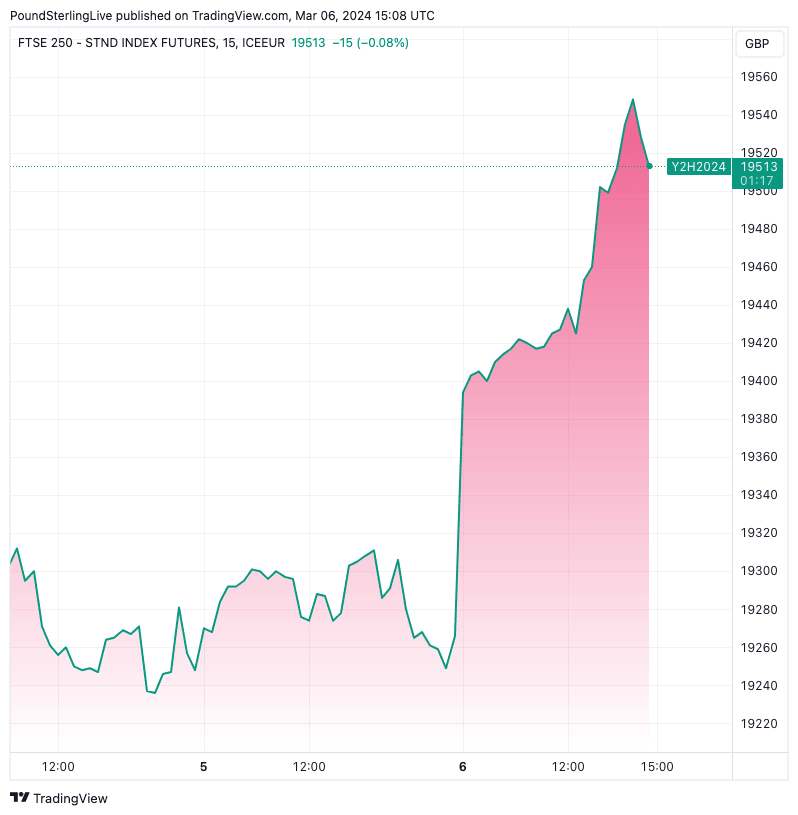

Above: The UK-focussed FTSE 250.

It’s a pretty muted response to a budgetary hat, which was notably short of surprise rabbits.

The pound dipped back a little as the Chancellor spoke with underlying worries bubbling that the plans will just lead to a sugar rush of spending, rather than laying the groundwork for more sustained growth.

This was Budget announcement was short of a big bazooka to kick start investment.

There continue to be concerns about the lack of funding for public services to improve infrastructure, particularly skills, education, and training. Given the potential obstacles ahead, the planned AI productivity boost for the NHS is unclear.

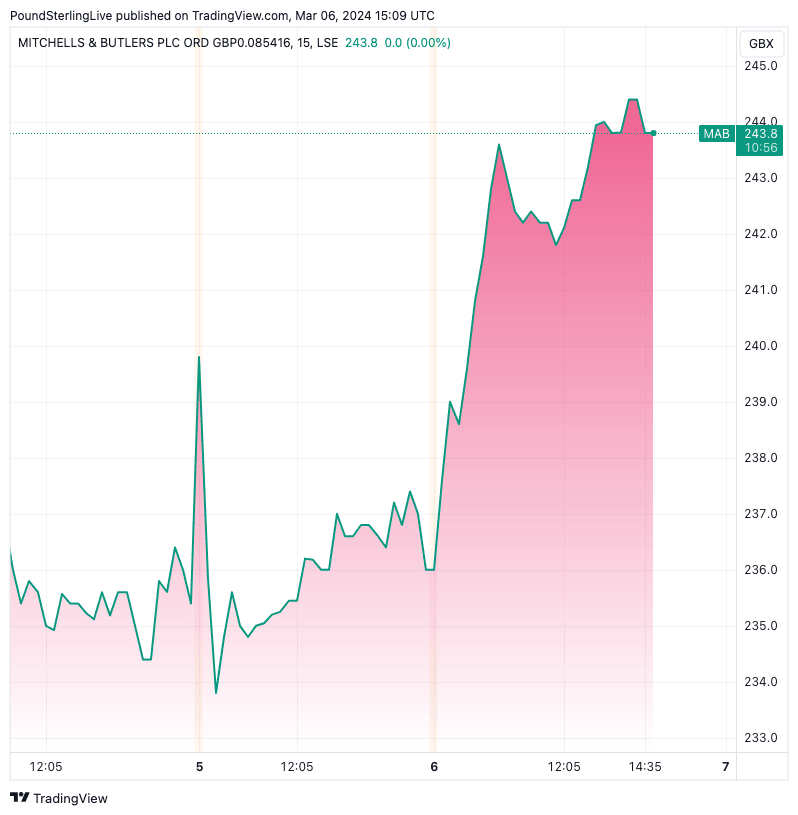

Pub chains largely hung onto earlier gains, sparked by hopes of the cut to national insurance, helped by the freezing alcohol duty.

Above: Shares in Mitchells & Butlers, the pub chain.

But hospitality businesses have been crying out for a cut in VAT amid evidence that people are simply dining in at home to save cash, as pubs, bars, and restaurants have been forced to hike prices due to rising costs. So, the freeze is unlikely to provide much respite overall.

Puffs of speculation about a vape tax and potential further duty increase on cigarettes had already led to falls in the big tobacco giants, and they lost further ground as the policy was confirmed.

The duty increase makes the price of cigarettes red-hot and prohibitive for an increasing number of smokers, who may shift to vapes, which will still be cheaper despite the new tax.

The industry is jostling for position in the vape market, given the declines in tobacco. They remain a small part of the picture, but given growth forecasts, more fiscal regulatory action worldwide looks likely.

Housebuilders have had a torrid time in this era of high interest rates, and there is fresh tinkering with landlord relief that could impact demand. While there appeared to be initial enthusiasm over the reduction in capital gains tax from 28% to 24%, it began to seep away. Investors also assess the potential sting in the tail for demand presented by abolishing holiday lettings relief.

Energy giants have largely shrugged off the sunset extension of the energy profits level to 2029.

Even Harbour Energy, the North Sea’s largest oil and gas producer, was little moved. The announcement had been rumoured, and companies have already changed some strategies to deal with the levy. What’s moving the dial more is the rise in the oil price to nudge $83 dollars a barrel after Saudia Arabia hiked some prices for buyers in Asia.

There is likely to be strong interest in the NatWest share sale, which will be the highest-profile public share offer since the Royal Mail IPO more than a decade ago.

Giving retail investors the opportunity of a slice of ownership in NatWest is a welcome move, given that they have been left out of previous sales, which have been reserved for institutional investors.

Prospects are looking up for the bank after a tumultuous year when it lost both its CEO and Chair, and the valuation has been under some pressure ever since. But with an attractive entry point, some easing headwinds and strong capital levels, the bank’s current situation is likely to spark enthusiasm.

It’s clear the economy is in need of an injection of investment, and the Government’s ambition to revitalise the market for UK listings is welcome.

With HL clients are already enthusiastic UK investors with 83% of shares held in UK listings and over 1000 UK equities available on our platform, a British ISA isn’t necessarily the right mechanism for boosting investment and runs the risk of unnecessarily concentrating portfolios and adding further complexity.

We would encourage the government to explore options such as increasing the overall ISA allowance and look forward to working with them on the detail.