Recession Worries? The Worst is Over for the Economy, Says Berenberg

- Written by: Gary Howes

Image © Adobe Stock

Is news of a UK recession a cause for worry? No, not really, says a leading economist who says the economy was let down by drooping exports, and the worst has now passed.

The UK economy contracted 0.3% quarter-on-quarter in the final quarter of 2023, which makes for two consecutive quarters of contraction owing to Q3's 0.1% shrinkage.

The word 'recession' carries negative connotations and understandably dominates the day's news and political agenda, while on the financial markets, the Pound fell in response.

But, one analyst tells us this is not a typical recession and all indicators point to an economy that is in better shape than the inevitable headlines suggest.

"Are the data a cause for worry? No, not really," says Kallum Pickering, Senior Economist at Berenberg Bank.

There are three factors to consider, argues Pickering:

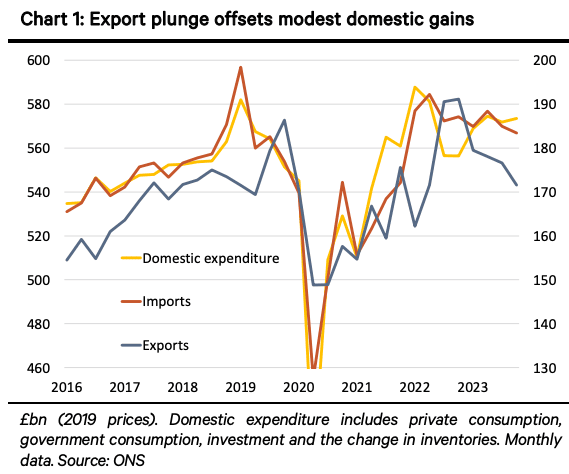

First, the key reason for weakness is an outsized drop in exports rather than soft domestic activity.

Second, a healthy labour market at the end of the year, resilient domestic activity and the continued improvement in confidence and PMIs in January show that, although the UK suffered a technical recession in H2 according to the narrow definition of two quarters or more of declining real GDP, the broader economic picture is not consistent with a typical recession.

Third, preliminary data are often revised. In its own analysis of the data, the ONS notes that “historically, the absolute average revision between the initial quarterly GDP estimate and the estimate three years later is 0.2 percentage points”.

According to Berenberg's analysis, the overall disappointment was not due to a surprise weakness in domestic demand, which may have signalled a risk that the Bank of England (BoE) had hiked too much, but external weakness.

"Exports sank by 2.9% qoq while imports declined by 0.8%. Net trade subtracted 0.6ppt from the quarterly change in GDP. As trade numbers are among the most erratic data in the GDP statistics, we would not be surprised if the Q4 export plunge is reversed in Q1," says Pickering.

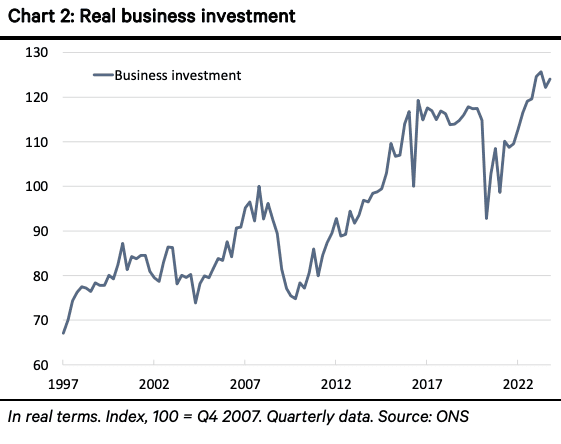

Some optimism can be found in the figures, with Berenberg picking up on the upswing in business investment which continued to rise at a solid pace last year.

"After strong gains from 2010 onwards, investment stalled after the Brexit vote amid paralysing political uncertainty. It then suffered another big hit during the COVID-19 pandemic. But the situation is improving," says Pickering.

According to the ONS, business investment rose by 6.1% y/y in 2023, with a 1.5% q/q gain in Q4. Pickering points out that annual growth has averaged c4% y/y since 1998 (excluding the global financial crisis (GFC) years of 2008/09 and the first year of COVID-19 in 2020.)

"The worst is over," says Pickering. "In all likelihood, the late-2023 softness should mark the bottom of the cycle for the UK."

Berenberg looks for growth to rebound to 0.3% q/q in Q2 and to 0.4% q/q in Q3.