Retail Sales in Surprise Rise, but Consumer Confidence Plummets to 50-year Low

- Written by: Gary Howes

Image © Adobe Images

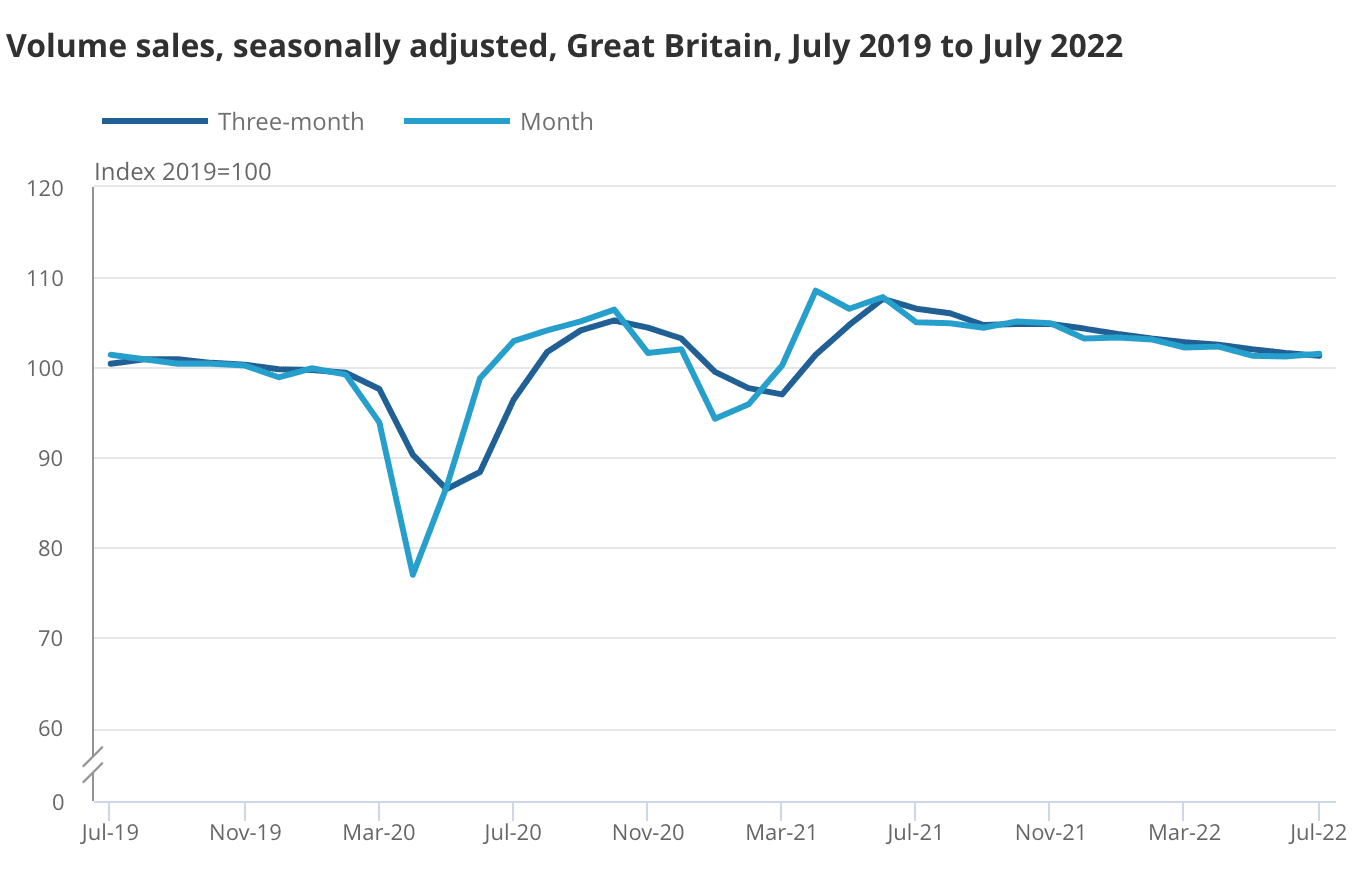

Despite surging inflation, UK retail sales surprised by growing in July, although a much-watched measure of consumer confidence plummeted to an all time low.

UK retail sales volumes rose by 0.3% in July 2022 following a fall of 0.2% in June 2022, said the ONS.

This beat expectations as the consensus was looking for another -0.2% reading.

Retail sales are now 3.4% lower year-on-year, which is slightly worse than what consensus was looking for at -3.3%, but up on June's -5.9%.

The ONS points out that despite July's better than expected result, retail sales have been trending lower since the summer of 2021.

Image courtesy of the ONS.

The data showed that for most categories that although the total value of goods sold has increased in many instances, the volumes sold have fallen.

This reflects the impact of rising prices which push up the amount of money transacted but at lower turnover.

The data comes in the same week the UK reported year-on-year inflation growth of 10.1% for July, with the Bank of England forecasting the peak will be closer to 13%.

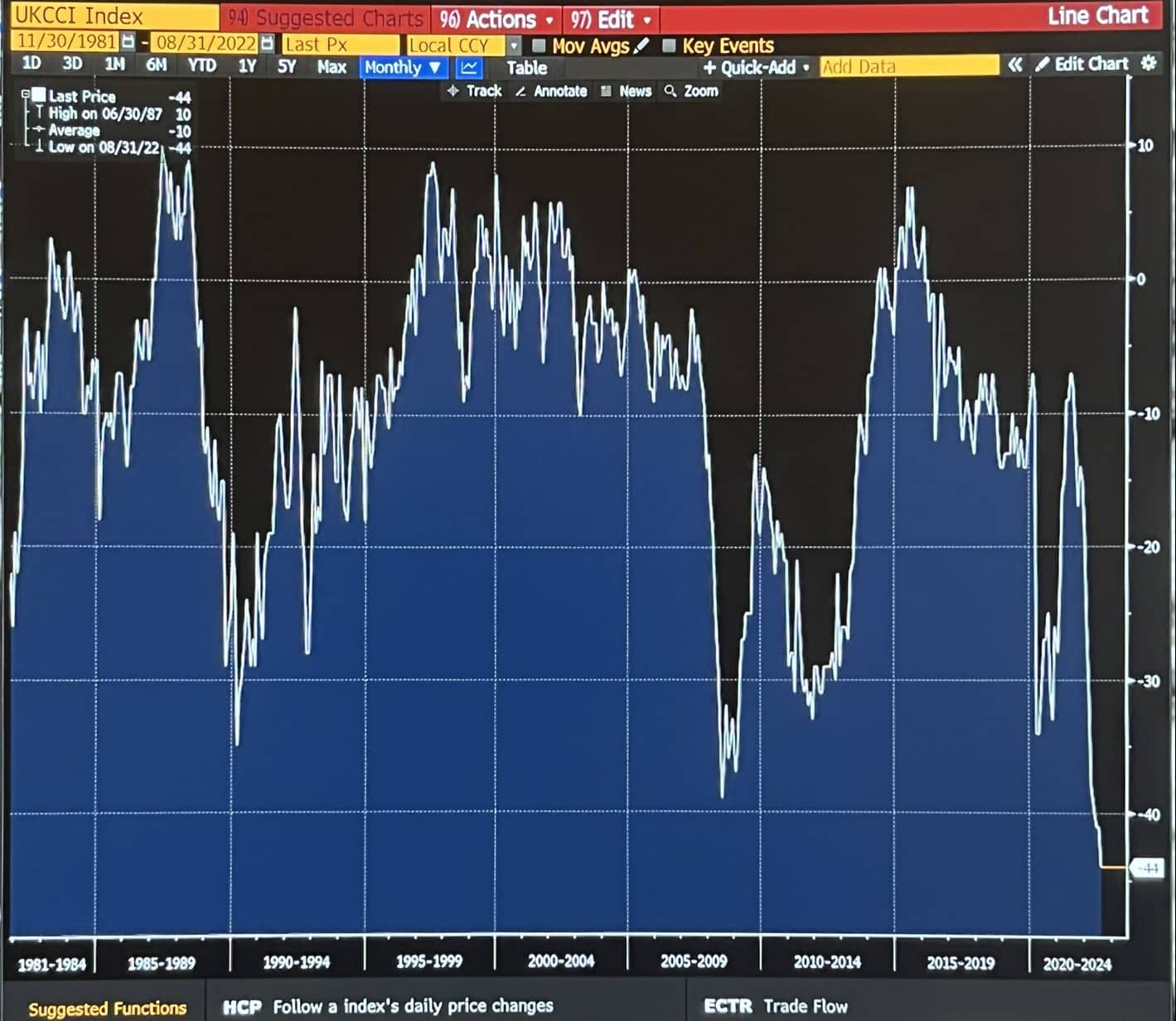

Given heightened inflation expectations, other data out Friday showed UK consumer confidence had fallen to another record low.

The GfK consumer confidence gauge fell to its lowest ever level at -44 in August, from -41 in July. At -60, a sharp decline in consumer expectations for the economy in the next 12 months is one reason for the record-breaking result.

GfK says the result was due to the ongoing surge in inflation, that is only expected to peak later in the year.

Above: The past 40 years of consumer confidence, image courtesy of @kitjuckes.

Although July's retail sales data beat expectations, the outlook remains challenging.

The upside surprise was all driven by a substantial 4.8% month-on-month increase in non-store retailing, i.e. online.

Feedback from retailers suggests this being due to a range of online promotions boosting sales.

"July's growth was more than accounted for by a jump in online sales, aided by promotional activity, while a breakdown of the data suggested cost-of-living pressures at work," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The data out Friday is clear: the UK consumer is feeling the impact of rising prices and is likely to retreat further, particularly given the UK's inflation peak is still some way off.