Eurozone Economy Still Set to Slow in 2019 but it's Not as Sick as Markets Thought

- Written by: James Skinner

© Christian Müller, Adobe Stock

© Christian Müller, Adobe Stock

- Eurozone to slow in 2019, but is not close to recession says Pantheon.

- After Eurostat confirms weak Q4, as inventory building weighed on GDP.

- ECB, with one eye on inflation outlook, announces fresh stimulus.

The Eurozone economy is still on course to slow even further in 2019, according to economists, although the single currency bloc's health is not nearly as precarious as markets had come to believe in recent months.

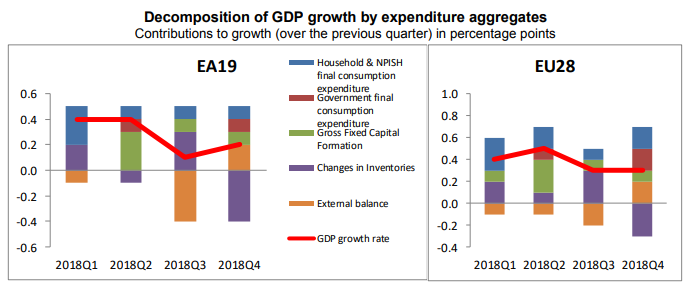

Eurozone GDP growth was just 0.2% in the final quarter of last year, Eurostat confirmed on Thursday, which means the economy expanded by only 1.8% for 2018 as a whole. That's down from the 2.4% pace of growth seen back in 2017.

Changes in inventory investment among companies was the main driver of the downturn in the second half of 2018, the first detailed breakdown of Eurostat figures for the final quarter showed on Thursday. Inventories are goods that have been produced by companies but not yet sold.

When the pace of inventory growth slows it can weigh on an economy for the relevant period. This drag coming from inventories could have its roots in declining output from the factory sector because industrial production fell steadily during the final three months of 2018 and was down -4.2% for year to the end of December.

"Inventories were the main drag on GDP growth last quarter amid decent growth in all other main sectors," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "these data are very far from signalling an imminent recession, though we are still on alert for a downward revision of the Q4 headline when Ireland reports later this month. The monthly hard data point to a horrible headline."

Above: Contributions to Eurozone GDP growth. Source: Eurostat.

New EU rules governing the process of testing automotive emissions output have hit activity in the car manufacturing sector hard during recent months, contributing to a contraction of the German economy in the third quarter and zero growth in the final quarter.

The U.S.-China trade war has also hurt demand for products made in Eurozone factories and driven confidence among companies into the ground during recent months.

However, the White House has said it is close to reaching a deal that will end China's "unfair trading practices", raising hopes of an imminent end to the tariff fight between the world's two largest economies.

"Looking ahead, we think the inventory correction, especially in Germany, has further to run, but the worst is probably over with the Q4 plunge. Growth in consumers’ spending should pick further, but government spending will mean-revert in Q1. Investment should remain supported by decent growth in construction, but capex in manufacturing will slow," says Vistesen, "Our full year growth forecast is unchanged at 1.1%."

Above: Pantheon Macroeconomics GDP and employment growth forecast.

Markets care about the GDP data because it reflects rising and falling demand within the economy, which has a direct bearing on consumer price pressures.

Inflation always dictates where interest rates will go next, and speculation about changes in rates is what drives currency prices up and down.

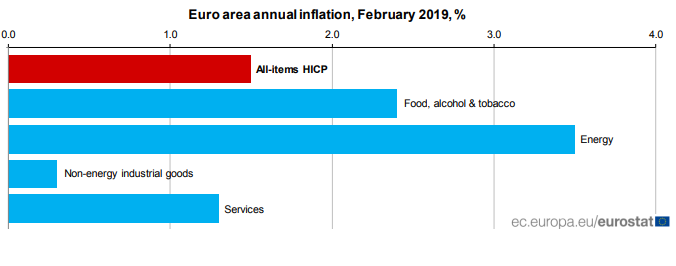

Eurozone inflation was 1.5% in February, up from 1.4% previously, but still a long way off the European Central Bank (ECB) target of "close to but below 2%". And the increase was largely the result of fluctuations in energy prices.

Core inflation, which removes volatile energy items from the goods basket in order to provide a better reflection of domestically-generated price pressures, fell 10 basis points to 1% when consensus looked for a reading of 1.1%.

That latter measure has not been any higher than 1.2% since the ECB began its record-setting stimulus programme that was intended to lift consumer price growth back to its target level by using an artificial compression of bond yields in order to encourage an economic recovery.

Above: Eurozone inflation in February 2019. Source: Eurostat.

"Policymakers still seem to expect growth to rebound in Q2. So the overall message is likely to be similar to that at the previous meeting. We think that a strong improvement later this year is unlikely, and continue to forecast growth of only 1% in 2019," says Jack Allen of Capital Economics.

The European Central Bank has already announced a new programme of cheap loans for the continent's banks in the hope that activity generated by that form of subsidised lending will be enough to prevent the economic slowdown from getting any worse.

It also told markets Thursday that its interest rate will not rise until "at least through the end of 2019" when at its previous meeting the bank had said a hiked could come by the end of summer. The ECB left is refinancing rate, marginal lending rate and deposit facility rate at at 0.00%, 0.25% and -0.40% respectively on Thursday.

The bank needs faster economic growth that is "close to potential" in order to get inflation sustainably back to its target level. ECB officials will struggle to justify raising interest rates in the absence of an outlook that underwrites a steady and sustainable return of inflation toward the 2% level.

"The latest survey evidence suggests that euro-zone growth remained at around 0.2% q/q in Q1. In December, the Bank forecast growth of 0.5% q/q in Q1," Allen writes, in a note to clients. "We think they will remain too optimistic.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement