UK Trade Deficit Widens after Brexit Stock-building Bites, Holds Back Economy

- Written by: James Skinner

© Winterbilder, Adobe Stock

- Trade deficit widens in Q4 as stock-building bites ahead of Brexit.

- Companies imported more cars, machinery and chemicals in quarter.

- Economists say stock-building likely detracted from GDP growth.

The trade deficit widened in the final quarter of 2018 after stockpiling ahead of the UK's exit from the European Union led to a pick up in imports, which one economist says is part-responsible for Monday's poor GDP growth number.

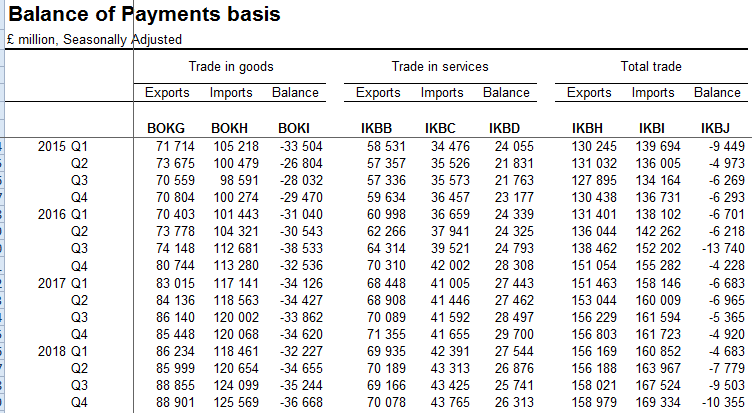

The UK's goods and services trade deficit widened to -£10.35 bn during the final quarter of 2018, from -£9.5 bn previously, after the nation's import bill rose at a faster pace than its export trade.

Exports rose to £158.97 bn, from £158.02 bn previously. But imports increased much faster, from £167.52 bn to £169.33 bn, after companies stepped up their purchases of cars, manufacturing materials and chemicals.

Car imports were up by £1.2 billion in the final quarter, while machinery imports rose £300 mn while imports of other machinery and chemical items rose by £700 mn respectively, the Office for National Statistics (ONS) says.

"Stockbuilding probably contributed to the 1.3% q/q rise in imports. (Exports rose by 0.9% q/q.)," says Paul Dales, chief UK economist at Capital Economics. "If it wasn’t for stock building, then net exports would have added to growth rather than subtracting 0.1 ppts."

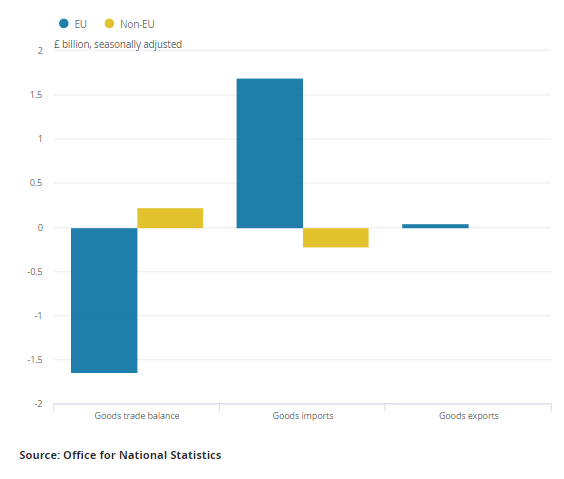

Above: Growth in the UK's imports and exports. EU vs Non-EU countries.

The terms of the UK's departure from the EU, as well as its future trading relationship, are yet to be agreed and markets are concerned the country could leave without any such terms having been agreed.

That could see the UK and EU impose tariffs on imports of goods from eachother. It might also mean delays at ports if customs staff have trouble adapting to the new relationship.

The government has said in recent weeks that customs authorities have plans in place that will ensure trade is not disrupted at the ports even in the event of a so-called no deal Brexit but this has not prevented companies from taking precautionary measures.

"There were some signs that Brexit is boosting stockbuilding. After excluding the alignment adjustment and valuables, inventories added 0.3 ppts to growth after 0.0 ppts in Q3. Some may say that GDP growth would have been negative without that, but that’s not quite right," says Dales.

Trade balance data measures the difference in value between a nation's imports and its exports. Currency markets care about it because the data provides insight into supply and demand of a currency in the "real economy", while also giving a steer on the likely pace of GDP growth in a given period.

A narrowing deficit suggests either that exports and their associated demand for a currency are rising, or that imports and their associated supply of a currency are falling. Both are typically good for a currency while a steadily narrowing trade surplus, or a widening deficit, is a negative influence.

The size and trajectory of a trade surplus or deficit is important for economic growth because imports are a subtraction in the calculation of GDP, while exports represent a credit to the value of economic output. As a result, rising exports and, or, falling imports can help boost the economy.

Above: Quarterly trade balance data. Source: Office for National Statistics.

Monday's trade data was released alongside growth figures for the final quarter, which showed the economy slowing sharply into year-end. GDP growth was just 0.2% during the final quarter, down from 0.6% in the third quarter, which means the economy grew just 1.4% in 2018.

That makes 2018 the UK's worst year for growth since 2012 when the economy was held back by an economic slowdown and debt crisis in Europe.

Eurozone economic growth also tumbled in the third and final quarters, although the UK's economic woes are thought to be as much the result of uncertainty over the Brexit process as they are external factors.

"Net trade dragged modestly on GDP growth, but government spending jumped, easily reversing declines over the previous two quarters," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Today’s data bring clear signs that Brexit uncertainty is depressing the economy, but we would not rush to conclude yet that GDP is on track to fall outright in Q1. Solid growth in households’ spending, thanks to low inflation and robust labour income growth, should keep GDP on a slightly rising path."

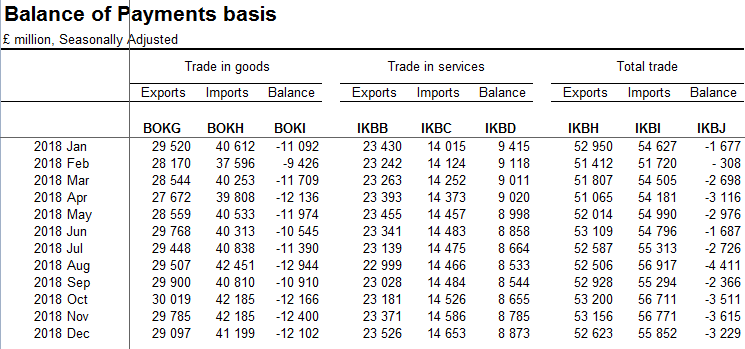

International trade was a clear weight around the ankles of the economy in the final quarter but if figures for the December month, as well as trajectory of the trade balance during each month of the quarter, are anything to go by then the worst of the trade drag may now be over.

This is because the deterioration in the trade balance took place in October and November, while the deficit narrowed sharply in December. The combined goods and services deficit fell to -££3.22 bn in December, down from -£3.61 bn in November.

That being said, if the UK were to leave the EU without an agreement governing the departure, then the quantity as well as value of imports and exports from the country could be impact significantly.

Currency devaluation could mean the value of spending on imports increases significantly, while tariffs could easily see goods exports fall if they are effective in making UK-made goods less competitive or non-tariff barriers are effective in stymying overseas demand for British goods.

"With a growing risk that we may not know whether 'no deal' has been averted until much closer to the 29 March deadline, the UK economy faces a challenging few weeks. The chances of a rate hike from the Bank of England this year are receding," says James Smith, an economist at ING Group.

Above: Monthly trade balance data. Source: Office for National Statistics.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement