U.K. Trade Deficit Widens in August but Strong Summer Performance Means Exporters Likely Supported Economy in Third-quarter

- Written by: James Skinner

© Winterbilder, Adobe Stock

The U.K.'s trade deficit widened during August although a strong performance over the last three months likely means international trade made a positive contribution to growth during the third-quarter, according to economists.

Imports into the United Kingdom grew faster than exports from it during the August month, taking the goods trade deficit to -£11.2 billion, from -£10.4 billion the previous month.

Meanwhile, the trade in services surplus grew by a fraction from £9.8 billion to £9.9 billion but this was not enough to prevent the combined trade in goods and services deficit from widening again.

The total trade deficit was -£1.2 billion in August, a deterioration from the -£572 million deficit seen back in July, which takes some of the shine off of what was a strong performance for the three months to the end of August.

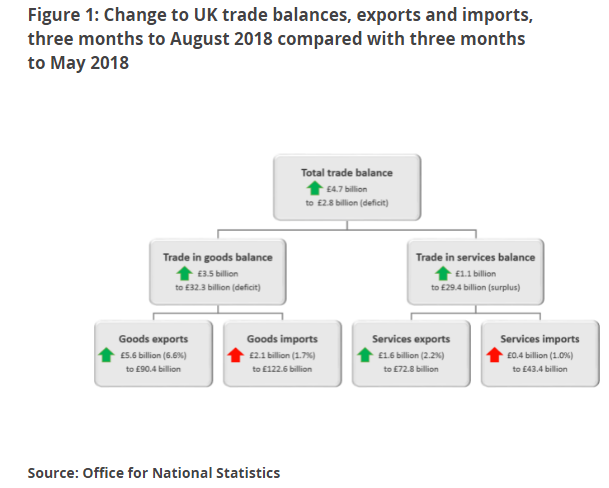

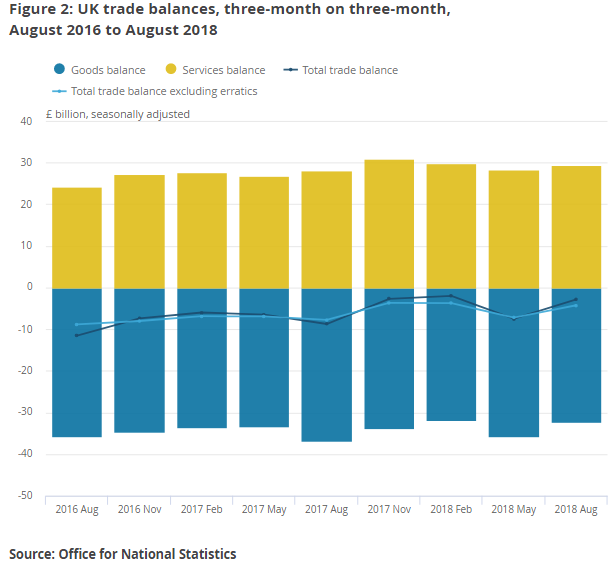

Britain's goods trade deficit narrowed from -£35.8 billion to -£32.2 billion for the three months to the end of August while the total deficit, which includes the services surplus, shrank from £-7.4 billion to -£2.8 billion.

For the year ending in August, the total trade deficit almost halved from -£28.6 billion in 2017 to -£15.1 billion this year, but some economists say the data presents a misleading picture of the U.K.'s trade performance.

"The narrowing of the trade deficit over the last year largely reflects the underperformance of the U.K. economy vis-a-vis its trading partners, rather than a delayed boost from sterling’s 2016 depreciation. Exporters kept their foreign-currency prices steady immediately after the depreciation and have maintained them since then, so the competitiveness of U.K. goods in global markets hasn’t improved," says Samuel Tombs, chief U.K. economist at Pantheon Macroeconomics.

Above: Changes U.K. goods and services balances for three months to end of August.

Trade balance data measures the difference in value between a nation's imports and its exports. Currency markets care about it because the data provides insight into supply and demand of a currency in the "real economy", while also giving a steer on the likely pace of GDP growth in a given period.

A narrowing deficit suggests either that exports and their associated demand for a currency are rising, or that imports and their associated supply of a currency on global markets are falling. Both are typically positive while a steadily narrowing trade surplus, or a widening deficit, is a negative influence.

The size and trajectory of a trade surplus or deficit is important for economic growth because imports are a subtraction in the calculation of GDP, while exports represent a credit to the value of economic output. As a result, rising exports and, or, falling imports can help boost the economy.

"So while net trade likely boosted quarter-on-quarter GDP growth by about 1.0pp in Q3—more than reversing the 0.6pp drag in Q2—we doubt that it will provide sustained support over the coming quarters," Tombs warns.

Changes U.K. goods and services balances for three months to end of August.

Wednesday's trade balance data was released alongside Office for National Statistics figures that highlighted strong momentum in the economy during the summer months but revealed a slowdown in growth during August.

GDP growth came in at 0.7% for the three months to the end of August, unchanged from an upwardly-revised pace of expansion for the quarter to the end of July, and ahead of the consensus for a 0.6% expansion.

However, U.K. economic growth came in at 0% for the month of August, down from an upwardly-revised 0.4% back in July and beneath the consensus for a 0.1% expansion.

This suggests momentum ebbed from the economy toward the end of the third-quarter, taking some of the shine off of the three-month number.

"While the strength of GDP growth does reflect some underlying improvement, it has been flattered by a rebound in construction as the sector made up for time lost to poor weather at the start of the year. And even if the economy did record a 0.6% quarterly expansion in Q3 as we expect, it would still be on course for a weak performance in 2018 as a whole," says Andrew Wishart, an economist at Capital Economics.

U.K. growth already slowed from 0.4% at the end of 2017 to just 0.1% in the first quarter. It rebounded in the second quarter, with GDP rising 0.4%, but consensus is that output will increase by only a paltry 1.3% for 2018.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here