September Services PMI Misses the Mark

- Written by: James Skinner

© IRStone, Adobe Stock

The latest IHS Markit services PMI marks a duo of disappointments for the U.K. this week, although markets were largely unmoved by the result as the Brexit negotiations and ongoing Conservative Party conference continue to dominate the agenda for economists.

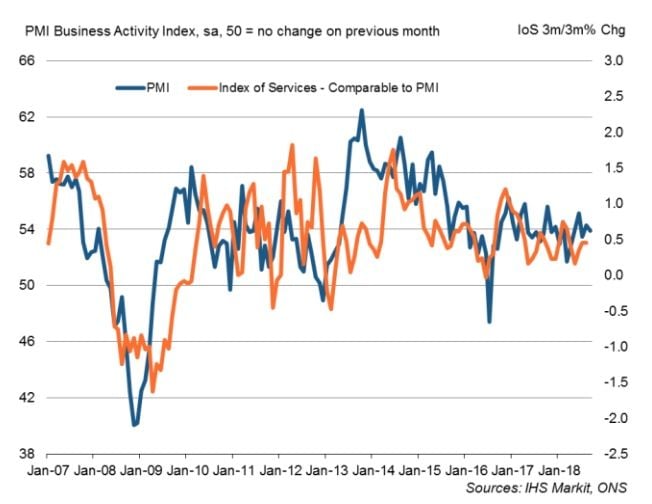

September's Markit services PMI came in at 53.9, down from 54.3 back in August and a fraction beneath the consensus for an index reading of 54.0.

This came after both current activity levels and new orders grew at a slightly lesser pace in September than they had during the previous month.

However, new orders that did roll in have simply added to a preexisting backlog of uncompleted work, which will support the sector in the months ahead.

Meanwhile, hiring continued apace as companies sought to alleviate manpower shortages and secure staff to support future projects.

"The falls in the construction and services PMIs offset the large rise in the manufacturing survey, dragging the all-sector PMI down marginally from 54.2 to 54.1. This is consistent with quarterly GDP growth of around 0.5% or so in the third quarter – slightly up from 0.4% in Q2. Note too that if anything the surveys might be understating growth since the service sector PMI does not account for activity on the high street, which has been growing strongly in Q3 so far," says Thomas Pugh, a U.K. economist at Capital Economics.

PMI surveys measure changes in industry activity by asking respondents to rate conditions for employment, production, new orders, prices, deliveries and inventories. A number above the 50.0 level indicates industry expansion while a number below is consistent with contraction.

Markets care about the PMI data because, covering the UK's three largest commercial sectors, they are an important indicator of momentum within the economy. And economic growth has direct bearing on the rate of inflation and it is consumer price pressures that dictate where interest rates will go next.

"The subdued level of the PMIs places little pressure on the MPC to raise interest rates again before the March 2019 Brexit deadline. A weighted average of the output balances of the manufacturing, construction and services surveys in Q3 is slightly lower than in Q2 and consistent with quarter-on-quarter GDP growth of about 0.3%," says Samuel Tombs, chief U.K. economist at Pantheon Macroeconomics.

Wednesday's services number marks the third and final PMI survey to be released from the U.K. for September, with two having surprised on the downside this week. Capital Economics' Pugh is upbeat about the outlook for the economy despite the data, while Pantheon's Tombs is anticipating a slowdown in growth for the three months to the end of September.

Tombs' assessment is closer to the consensus view, which envisages U.K. GDP growth of just 1.3% in 2018, down from 1.7% back in 2017.

Growth already slowed from 0.4% at the end of 2017 to just 0.1% in the first quarter and the economy grew by just 0.4% in the second quarter too.

Much of the anticipated slowdown is the result of expectations that uncertainty over the outcome of the Brexit negotiations, which many see coming to a head during the final quarter, will weigh on the economy during coming months.

On that note, members of the governing Conservative Party are gathered in the English city of Birmingham for their annual conference, which also draws to a close Wednesday with a speech from Prime Minister Theresa May.

2017's conference proved to be a disastrous affair for the Prime Minister and with the Conservative parliamentary party now in a state of civil war over her plans for Brexit, markets are attuned to the possibility that resentment among the grass roots could further nurture the leadership ambitions of May's rivals.

The conference takes place as officials from both sides of the English Channel push for an agreement on terms of the U.K.'s withdrawal from the EU ahead of the October European Council summit.

The deadline is important because even once a deal is done, it will still have to be signed off by the Council and approved by all parliaments in the European Union. This itself will take time but the Article 50 process governing the Brexit exit currently only provides until March 29, 2019 before the U.K. automatically leaves the EU.

However, disagreement over how to manage the Northern Irish border in the event a trade deal is not agreed at a later date is standing in the way of a deal. The EU rejected PM May's "Chequers plan" at a summit in the Austrian city of Salzburg in September.

The EU's current Irish border proposal of customs union membership and continued "regulatory alignment" for Northern Ireland would mean either all of the U.K. remaining inside the EU customs union and single market, or a de-facto sea border being installed between the island of Ireland and Great Britain.

The latter is something PM May has said "no U.K. Prime Minister could ever agree to". The Times reported this week that PM May is preparing to offer continued customs union membership for all of the U.K. in the event a solution that is palatable to Brussels cannot be found.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here