Foreign Investors Snap up U.K. Bonds, Provides Sterling with a Fundamental Underpinning Ahead of Brexit

- Written by: James Skinner

© Pavel Ignatov, Adobe Stock

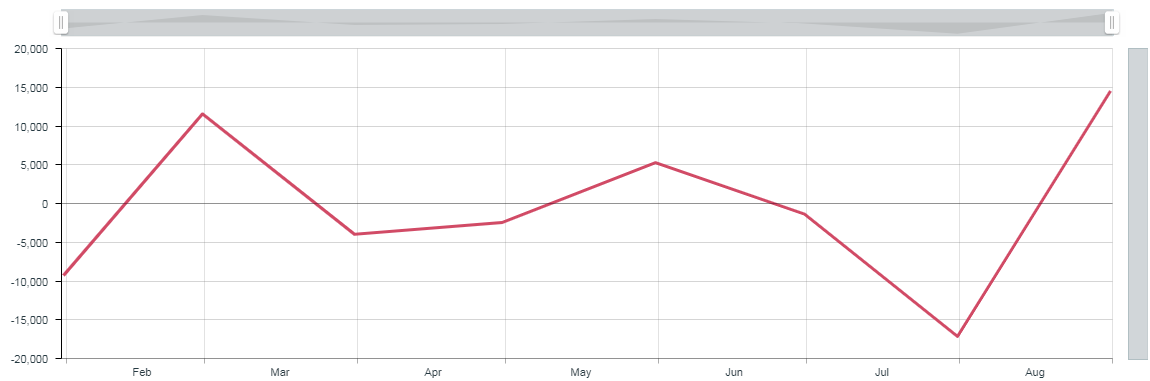

The Pound may have won a reprieve last month as the latest Bank of England (BoE) data has revealed that foreign investors returned to the U.K. government bond market in August, after going on "strike" back in July.

Foreign investors bought close to £15 billion of U.K. government bonds during August, according to Bank of England data, after having sold nearly £17 billion of them back in July.

This is the "kindness of strangers" referred to by Bank of England governor Mark Carney during the Brexit campaign when he said the U.K. government could find itself in difficulty if the electorate voted to leave the EU.

The government's still-gaping budget deficit is equal to 2% of GDP while the suffocating £1.7 trillion pile of debt carried by the tax payer now amounts to some 85.8% of economic output.

Annual interest on this debt was equal to £35.2 billion in 2017, according to the Office for Budget Responsibility, while the interest bill for all central government and public sector debt was £39.4 billion.

Above: Change in U.K. government bond holdings of foreing investors.

Carney was innacurate in describing foreigners' acquisitions of U.K. bonds as acts of kindness seeing as investors buy assets to make returns, and will do so according to their own criteria, not for reasons of benevolence.

Nonetheless, the government finances are a potential problem in a post-Brexit world because with Westminster still running a deficit, it has no choice but to roll-over maturing obligations as they fall due.

This means the Treasury must go to the market to finance not only its current expenditure, but also to refinance existing borrowings.

Fears have been, in financial circles at least, that if foreign investors perceive Brexit as something that makes lending to the U.K. government more risky, they could demand higher interest rates, or stop lending to it.

The latter is what some feared may be happening when the BoE said back in August that foreigners had sold a record amount of government bonds during the month of July.

As a result, Monday's data marks a reprieve for Sterling because if investors did really go on "strike" then the government would face a sharp rise in interest costs for any new borrowing and refinancing activity.

And that's assuming it doesn't get shut out of the market entirely. Both scenarios would mean lower Pound Sterling exchange rates and far-reaching austerity in order to minimise the need for going to the market in the first place.

"Fear not, the latest BoE monetary statistics data shows overseas investors buying U.K. gilts in August after July redemptions/selling. 12-month rolling sum precariously negative but data isn't showing a clear dump UK gilts theme on Brexit risks," says Viraj Patel a foreign exchange strategist with ING Bank N.V.

"The UK Gilt market saw a record £17.2bn of net foreign selling in July," says David Own, chief Eurozone economist at Jefferies, in a note following the publication of the BoE's July data. "If nothing else, the net foreign selling of the Gilt market in July should underline the importance of managing the UK’s exit from the EU as smoothly as possible, especially given the need to help finance the UK’s current account deficit."

July's sell-off coincided with resignations of then-foreign secretary Boris Johnson and then-Brexit Secretary David Davis from office, in protest at Prime Minister Theresa May's so-called Chequers Plan for the Brexit negotiations.

The investment data was released as officials from both sides of the English Channel push for an agreement on terms of the U.K.'s withdrawal from the EU ahead of the October European Council summit.

The deadline is important because even once a deal is done, it will still have to be signed off by the Council and approved by all parliaments in the European Union. This itself will take time but the Article 50 process governing the Brexit exit currently only provides until March 29, 2019 before the U.K. automatically leaves the EU.

However, disagreement over how to manage the Northern Irish border in the event a trade deal is not agreed at a later date is standing in the way of a deal. The EU rejected PM May's "Chequers plan" at a summit in the Austrian city of Salzburg just last week.

The EU's current Irish border proposal of customs union membership and continued "regulatory alignment" for Northern Ireland would mean either all of the U.K. remaining inside the EU customs union and single market, or a de-facto sea border being installed between the island of Ireland and Great Britain.

The latter is something PM May has said "no U.K. Prime Minister could ever agree to".

If the talks fail to deliver a viable deal before early November the odds of a so-called "no deal Brexit" will increase significantly, leading markets to fear the U.K. defaulting to trade with the EU on World Trade Organization terms.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here