Gold Price is Back in Shape and Upgraded to "Constructive" at Julius Baer after 2018 Hammering

- Julius Baer upgrades Gold rating to "Constructive".

- Cites positioning flip and an inverse USD correlation.

- Recommends staggered buying over medium-term.

© kasto, Adobe Stock

Gold has been metaphorically hammered into shape, according to analysts at Swiss private bank Julius Baer, who argue in a recent report that the metal is now ripe for a rebound.

"The environment for gold remains challenging," says Carsten Menke, a commodity analyst at Julius Baer. "That said, a lot of bad news is priced in and even in the short term, there should be more upside than downside. We upgraded our view to Constructive and bought a first position."

Further downside for gold is limited by positioning in the futures market which has reached overly bearish levels and is, therefore, 'due' a rebound.

"Speculative traders are net short for the first time since the turn of the century, suggesting that prices are bombed out on current levels," says Menke. "Hence, it is very unlikely in our view that gold falls back towards the lows reached during the past year’s bear market, i.e. that it drops another 10% to 15%."

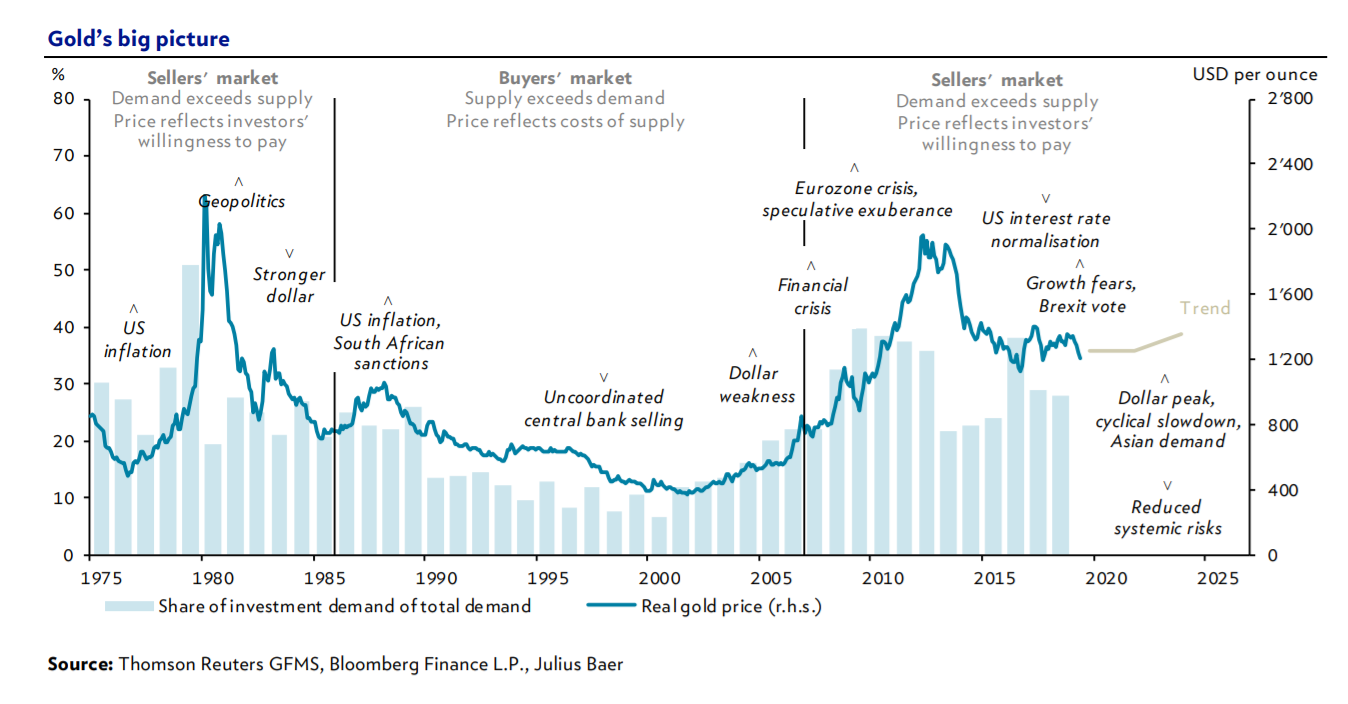

Above: Julius Baer gold price chart annotated around major price developments.

Demand should pick up in the medium-to-long term as increasing global growth concerns and rising inflation see gold reinstated in its traditional role as an inflation hedge.

"Sustainable upside to prices should materialise once growth and inflation concerns creep into financial markets, reviving the demand for gold as a safe haven," says the Julius Baer analyst.

Gold should also rally once the Dollar rolls over at the end of the year, since of all the factors driving its price at the moment, the value of the US Dollar is probably the single most important.

"Gold and the US dollar trade in a very close inverse relationship," Menke writes, in his report.

This makes perfect sense given gold is priced in US Dollars. When the Dollar rises, the yellow metal becomes more expensive for many would-be owners to buy. .

The reason behind the Dollar's rise, however, is also a key factor: interest rates. As US interest rates have risen, US investors have dumped gold for other more lucrative interest bearing assets or equities, some of which have been rising strongly in a bull market.

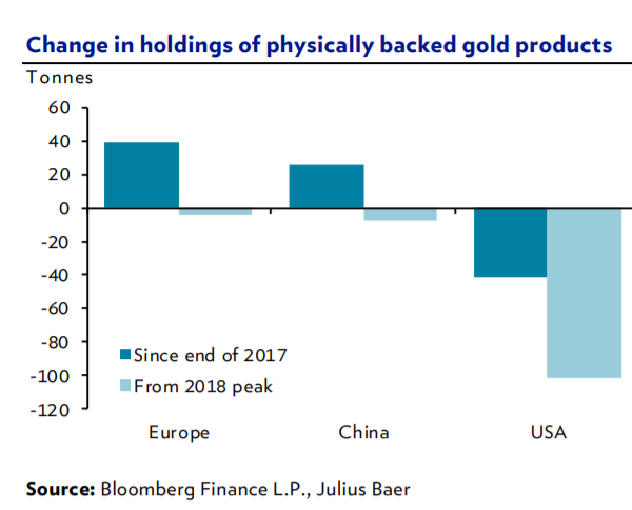

Above: Julius Baer chart showing US gold holdings relative to Chinese, European.

Another factor behind falling demand has been the investors' perceptions of President Donald Trump's "trade wars". This has not been viewed as negatively by US investors as it has been abroad, so safe-haven demand has been absent.

Menke says the future is bright for Gold after upgrading his rating of the metal to 'constructive'. He recommends buying into it gradually over the medium-term.

"We see structures that allow accumulating gold on lower-than prevailing prices, i.e. to average into the market, as a good option to build positions gradually," he writes.

Gold future were quoted 0.42% lower at $1,190 per ounce during noon trading Thursday and are down by 8.6% for 2018.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here