Cryptocurrencies Break Downtrend on Reports of Easing Regulatory Stances

- Cryptos rise as Indian regulators change their tone

- Greater chance of incorporation of Bitcoin into ETF also supports

- Report suggests use to become more widespread as technology advances

Image © Rawpixel.com, Adobe Images

Cryptocurrencies are rebounding off the back of several reports which suggest a more positive future in store for digital money

One such story is that India will probably not go through with its proposed ban, a further report suggests in the US they are one step closer to creating a Bitcoin ETF, a recent report commissioned by broker Etoro also suggests Cryptos could find widespread use as methods of mainstream payment in years to come.

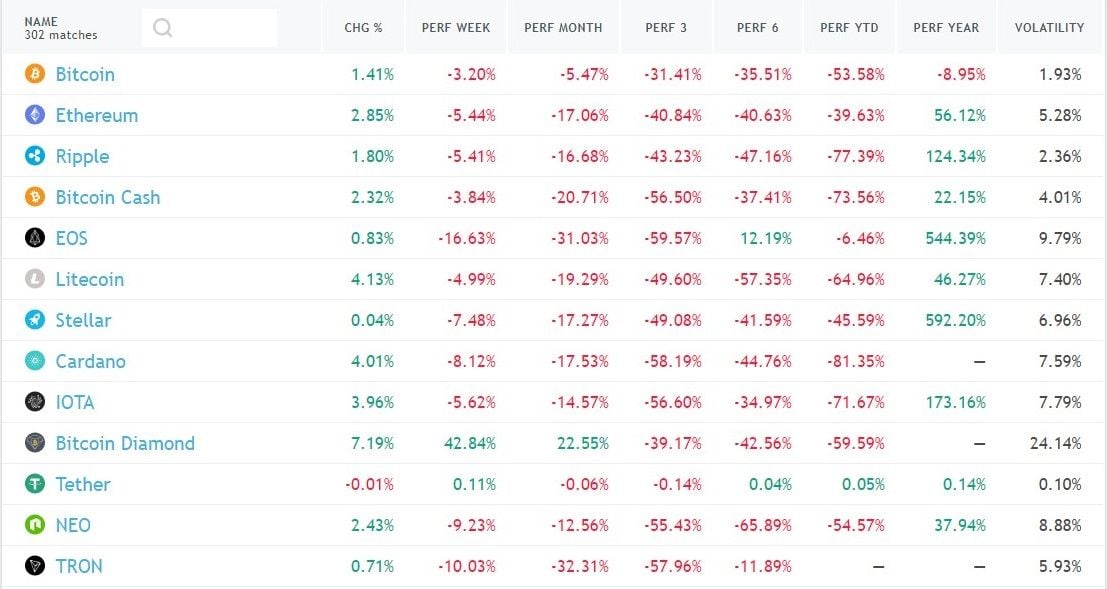

The largest cryptocurrencies were trading up well over 1.0% on Wednesday following the reports, with Bitcoin, the largest, up 1.38% and Etherium up 2.66%. The gains snapped a losing streak lasting several months or longer for some cryptos.

Investors probably liked the news that the Indian government may back-track on its decision to ban cryptocurrencies because they encourage money-laundering and are dangerously volatile.

"After months of uncertainty, there are indications that India may not, after all, opt for a blanket ban on virtual currencies. A finance ministry panel set up to study them may even suggest that they be treated as commodities," say Kamalika Ghosh and Nupur Anand in a joint report carried on Quartz.

They based their report on comments from an unnamed source in the finance ministry that has been privy to the discussions of panel members.

"I don’t think anyone is really thinking of banning it (cryptocurrencies) altogether," said the source, "The issue here is about regulating the trade and we need to know where the money is coming from. Allowing it as (a) commodity may let us better regulate trade and so that is being looked at," the source added.

The reformulation of cryptocurrencies as commodities may become the preferred method of dealing with the new currencies. The method could be a useful compromise for dealing with what are essentially hard-to-categorise anomalies of the financial system. It may provide a way of allowing their use by other countries which are also concerned about their links to organised crime. A redefinition as commodities requires less regulation than real 'money'.

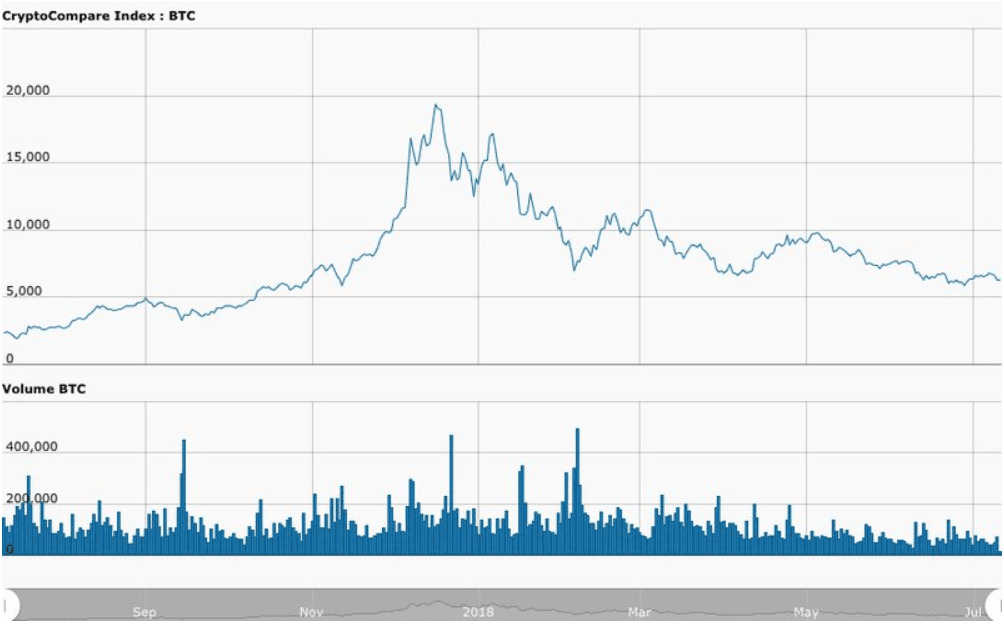

Cryptocurrencies have had a terrible year in 2018 on the back of fears that more and more countries could ban them, after China led the way by banning Bitcoin in January.

As a result of bans and concerns about its ability to compete with existing payment methods like credit cards on transaction speed, Bitcoin is currently trading at a third of its peak value of $20,000.

Yet Cryptos could rebound and reach new highs of $60k on the back of a major game-changing event, says Julian Hosp, co-founder of cryptocurrency TenX.

Such an event might be confirmation of a Bitcoin Exchange Traded Fund (ETF) or if an influential country were to make an announcement that was "very, very positive," for the currency, Hosp tells crytpoglobe.com.

Indeed, it appears that Bitcoin is one step nearer to being incorporated into an ETF after the news that "CBOE Global Markets recently filed an application for a Bitcoin ETF, and it now seems likely that this request will be approved because decentralised cryptocurrencies aren’t securities," according to Omar Faridi, a reporter at cryptoglobe.com.

The application comes after several other attempts failed due to regulatory concerns.

Yet this time is is different, says Faridi, since cryptocurrencies have been redefined by the Securities and Exchange Commission (SEC) as not being securities, which means an ETF has more chance of being approved.

"CBOE’s application comes after the US Securities and Exchange Commission (SEC) announced that Bitcoin (BTC) and Ethereum (ETH) will not be classified as securities. This means it may have a better chance of being approved, thus potentially drawing more institutional investors to the digital currency ecosystem," says Faridi.

A recent report commissioned by Etoro and written by two lecturers from the prestigious Imperial College London, suggested cryptos would slowly but surely enter the mainstream of payment methods and compete with fiat money.

"Cryptocurrencies have the potential to upend everything we thought we knew about the nature of financial systems and financial assets... In this research we show that cryptocurrencies have already made significant headway towards fulfilling the criteria for becoming a widely accepted method of payment," says William Knottenbelt, professor of applied quantitative analysis at Imperial College.

Developers are already creating solutions to help bring cryptos into the mainstream of payment methods, potentially further boosting their fundamental value.

Creators of a revolutionary new crypto called Puma tokens, for example, have developed a blockchain payment processing solution called the Puma Pay Protocol which allows two-way transactions in what was previously a one-way market in which crypto-holders had to actively send funds to merchants if they wished to pay for something, but using the Puma Pay Protocol software they will now be charged like a normal credit card.

These sorts of systems are expected to open the way to cryptos being used in day-to-day shopping.

"Any cryptocurrency today allows only one type of transaction which is a primitive 'push-transaction' which means that customer needs to go to his wallet and actively send the tokens or the currency's to the merchant," says Yoav Dror, CEO of Decentralised Vision, the company developing Puma Pay.

The more widespread adoption of cryptos could well be another catalyst for a recovery in prices.