Australian Dollar: Iron Prices are Losing Ground, but is this the End of the Rally?

The price of iron ore has falling but is this the start of a deeper down-trend or merely a pull-back? The answer could be key to the Australian Dollar's outlook.

There is talk that iron ore has topped and may be on its way lower, we study the charts to ascertain whether there any substance to this view, the answer will be key for the Australian Dollar as iron ore makes up for the majority of Australian exports and is therefore the single most important foreign currency earner.

There have been signs of late that recent weakness in the Aussie Dollar can partly be laid at the door of the falling prices in iron, it is therefore a topic we will be paying close attention to over coming weeks.

Iron ore - by which we mean "Fine China Import 63.5 percent grade" - is trading at a spot price of 74.50 USD per tonne which is below its early January peak of 78.00.

Futures markets in China, moreover, have seen even deeper falls in price and traders are getting jittery about whether a top is now in place or if we should prepare for deeper discounts.

From a technical perspective, there isn't enough evidence yet to lead us to believe we are witnessing a complete reversal lower - the pair may simply be correcting back with a view to resuming its uptrend once it has completed its correction.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

In support of the latter is the fact that the pair has recently touched the September 2017 highs when it peaked at 78.00. Traders often close their positions when prices hit key historic highs and lows such as the September level.

The reason is psychology. Traders who bought in close to the September 2017 highs, thinking the price would go even higher but were wrong, will have been 'sweating it out' since then as the price went down. However, now that it has finally come back up they will be so relieved that rather than make the same mistake twice they'll be selling to get rid of their positions and that's what may be behind the current pull-back to 74.50.

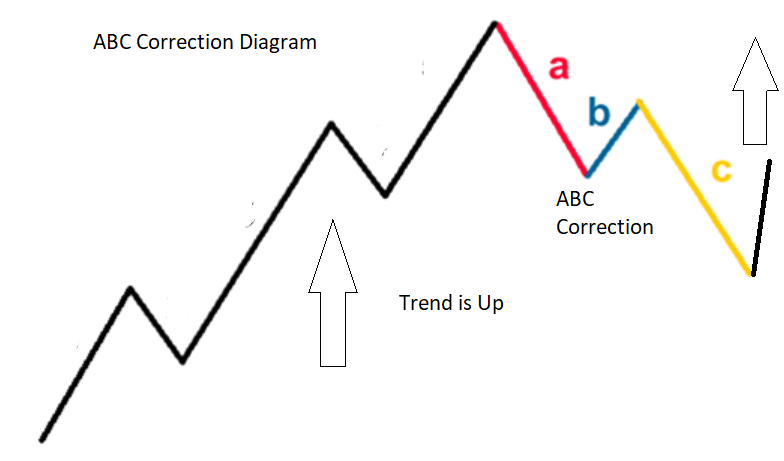

Another reason for viewing the recent decline as merely a correction is its patterning. The chart above shows the commodity has fallen in a three waveform which bears a striking resemblance to an ABC correction as shown in the diagram below.

ABC corrections do not herald the beginning of downtrends, rather they are merely corrections in the midst of longer-term uptrends and when they finish prices usually start to rise again.

Assuming the pattern persists then iron prices should start to go higher again soon.

Alternatively, if the next move higher fails and the market subsequently drops below the C-wave lows, then it would prove the move was not an ABC correction and add evidence to the idea the market might indeed be undergoing a more substantial reversal lower.

Impact on Australian Dollar Muted

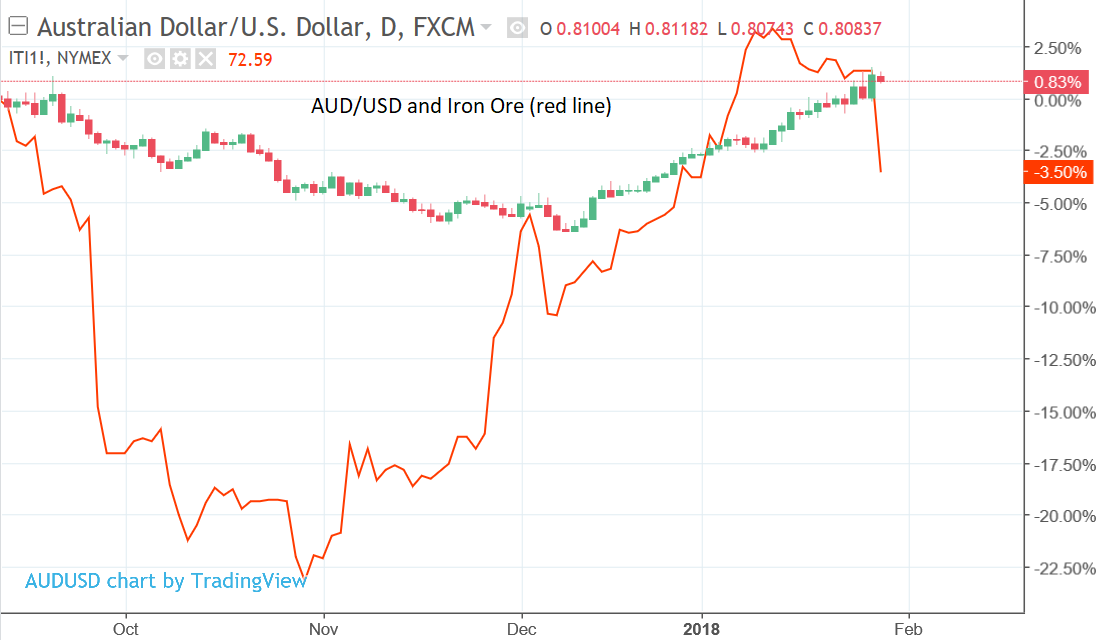

So far the correction in Iron Ore prices has only marginally impacted on the Australian Dollar.

Whilst there is evidence the Aussie weakened on the day of iron ore's largest fall - when it lost more than 4.5% of its price, the general trend in the Aussie remains much more bullish.

The chart below, for example, compares Iron Ore futures with AUD/USD and shows that the recent fall in iron has not been mirrored in the currency.

This may be partly because the Australian economy is not as dependent on iron ore as before.

There are a whole host of other commodities Australia exports and the authorities have been busy trying to diversify the economy away from being too heavily reliant on mining.

It is possible that the link between the commodity and the currency is starting to decouple as a result of these changes.

Forecasters at Swiss bank UBS are bullish about the Australian Dollar despite iron ore prices which they expect to fall.

In a recent note, they suggested that a rise in the sheer volume of iron ore exports would make up for any fall in prices.

Further, an upswing in other commodities Australia is rich in such as aluminum, silver, and nickel might make up for the lack of upside potential in iron, too.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.