Swiss Franc Falls on Second SNB Interest Rate Cut, But Weakness Could be Short-lived

- Written by: Sam Coventry

Above: File image of SNB President Thomas Jordan. Image © Pound Sterling Live, SNB.

The Swiss Franc's recent stellar run reversed after the Swiss National Bank (SNB) cut interest rates for the second time this year and reaffirmed its credentials as the most 'dovish' of the G10's central banks.

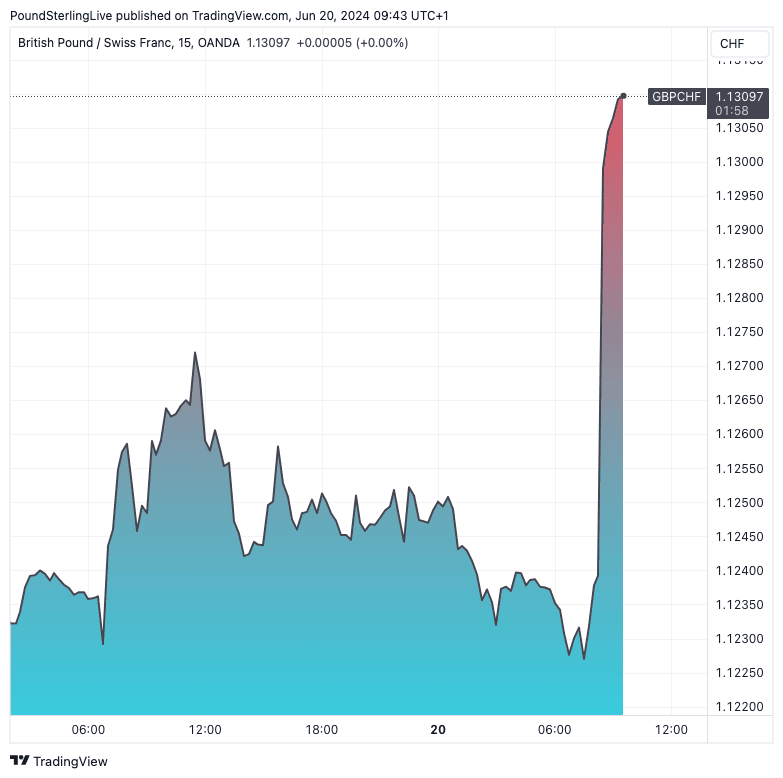

The Pound to Franc exchange rate rallied half a per cent to hit 1.1380 after the SNB lowered the base rate to 1.25% from 1.50%, saying "underlying inflationary pressure had decreased again."

The Euro to Franc rose 0.40% to hit 0.9540, and the Dollar to Franc rose 0.76% to quote at 0.8906.

The currency reaction confirms that the majority of market participants were expecting the SNB to leave interest rates unchanged, given the recent improvement in domestic data.

"The SNB is doing the right thing," says Dr. Thomas Gitzel, Chief Economist at VP Bank. "If it had remained put, as the majority of economists expected, this could have given the impression that policymakers were unsure about the last interest rate move in March."

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

The SNB might have been pushed into this interest rate cut owing to the Franc's recent rally; after all, it is the best performer when screened over the past month, a development that penalises Switzerland's exporters.

Back in May, SNB President Thomas Jordan seemed to signal unease with the Franc's decline following the March interest rate cut. The currency has ultimately strengthened since then and Jordan's previously expressed fears will have faded as a result.

Above: GBP/CHF at 15-minute intervals. Track GBP/CHF with your own alerts, find out more here.

A further 'dovish' development for the Franc came as the SNB lowered its inflation forecast profile, which means it is comfortable with the view that inflation will continue to decline, even as interest rates fall.

How far will the Franc fall? This will depend on how the market's expectation for further rate cuts evolves. If the market believes this is the final cut of the year, selling pressure might prove limited.

If upcoming developments suggest further cuts are warranted, selling pressures can extend.

"Looking ahead, we think that the SNB will not cut rates again this year as we are now no longer confident that underlying inflationary pressures are abating because labour compensation is growing at a strong rate and services inflation remains very sticky," says Adrian Prettejohn, Europe Economist at Capital Economics.

Kit Juckes, head of FX research at Société Générale, says Franc weakness might not be destinated to last and Jordan will likely "see EUR/CHF slip back down. There is too little growth and too much political uncertainty in Europe for the CHF to fall far."