Swiss Franc: Manipulation Badge of Little Consequence says Swiss Private Bank

Image © Adobe Images

- Pound-to-Franc spot rate at publication: 1.2033

- Bank transfer rates (indicative guide): 1.1612-1.1670

- Specialist transfer rates (indicative guide): 1.1650-1.1760

- Get a quote from a FX specialist here

The U.S. Treasury's latest report to Congress on market manipulation by major trading partners has labelled Vietnam and Switzerland as currency manipulators, a move that could have significant implications if they invite some form of sanction by U.S. authorities.

But the report could amount to nothing more than hot air and there will be little significant impact of the designation for the Swiss franc and Swiss assets, says J. Safra Sarasin.

The Bassel-based private bank and asset manager says the decision by the U.S. Treasury is largely a political one and represents the dying kicks of the outgoing Trump administration.

"We expect little practical consequences," says Dr. Karsten Junius, Chief Economist at J. Safra Sarasin, in response to the report issued by the U.S. Treasury.

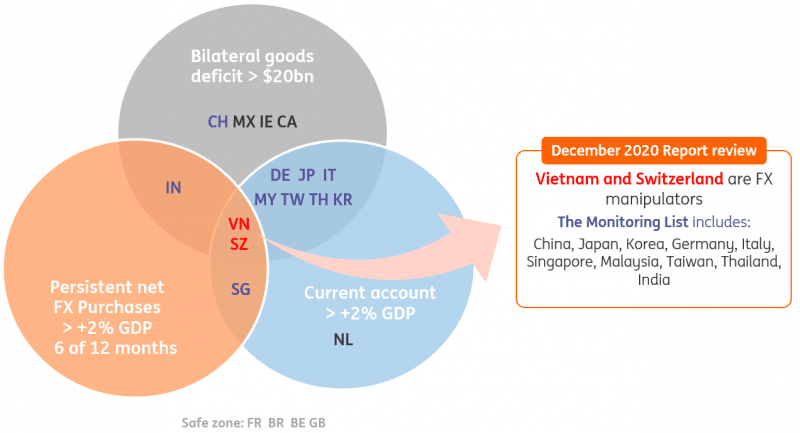

The U.S. Treasury on Wednesday ruled Switzerland and Vietnam had exceeded the three criteria to be labelled a currency manipulator:

1) FX-interventions of at least 2% of GDP

2) a bilateral trade surplus of at least $20BN

3) a current-account surplus with the US of at least 2% of GDP.

Image courtesy of ING.

"We see this to be a last step of the outgoing US-administration to appear tough on trade-related matters. It should have virtually no practical consequences," says Junius.

The Swiss National Bank (SNB) has never attempted to make it a secret that it is a significant player in the country's foreign exchange market, intervening in an attempt to try and keep the value of the Swiss Franc from flying too high.

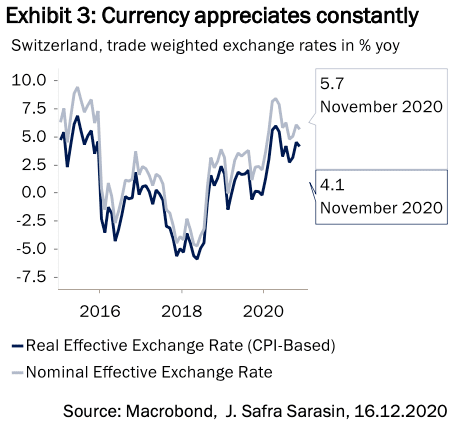

Switzerland's substantial current account surplus and safe-haven deposit box credentials mean the currency is highly valued, which can pose significant headwinds to Swiss economic growth while threatening the SNB's mandate to keep prices stable.

Analysts at ING Bank N.V. say that a period of bilateral talks will now start, giving a chance to gauge the Biden administration's early trade policy stance.

"In the case of Switzerland, this is unlikely to curtail the central bank's intervention," says Francesco Pesole, FX Strategist at iNG.

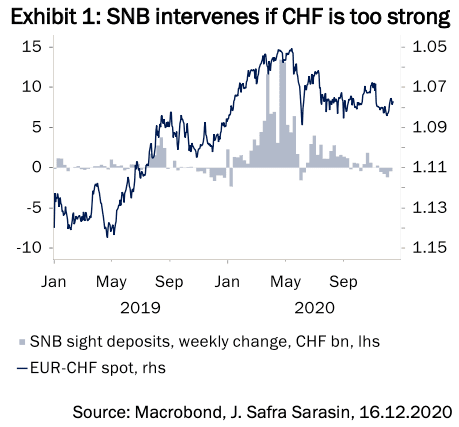

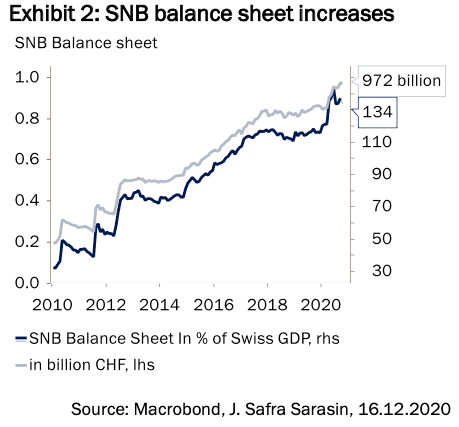

The SNB intervened when the Swiss Franc was approaching EUR/CHF levels of 1.05 in the second half of 2020 and the balance sheet of the SNB is increasing constantly, a typical sign of intervention.

"But for monetary policy purposes there is no alternative. With a trade weighted exchange rate that is appreciating strongly and consumer, producer and import prices that are all falling the central bank has no alternative if it wants to deliver on its mandate," says Junius.

The Treasury's report is however incomplete, given ongoing negotiations with China and the covid-19 crisis.

The Treasury opted to skip the 2019 period and has moved on to publishing one covering the July 2019-June 2020 period.

For this latest period, the Treasury found Vietnam and Switzerland exceeded all three criteria and labelled them as currency manipulators, but “spared” Taiwan and Thailand.

"We must remember that the FX report has had strong political overtones in the last few years and the Treasury staff has a great deal of discretion when deciding how much of the increase in reserves should be seen as FX intervention," says Pesole.

Pesole says they believe there will be little chance of the SNB stepping back from its current policy of intervention.

"We suspect this is the start of a long, drawn out process where the two sides in theory will start a dialogue on how to address this issue. And from the looks of today’s price action in both EUR/CHF and USD/CHF, the SNB has no immediate plans to step away from intervention," says Pesole.

Indeed the central bank announced soon after the designation that it would not refrain from conducting policy in its current manner.

Nevertheless, Pesole adds "Switzerland’s cards have certainly been marked and the SNB may have to add Washington scrutiny to a long list of factors pressing the CHF higher".