Swiss Franc Appreciation Not Done says Wall Street Investment Bank

- EUR/CHF could fall to 1.02

- Eurozone summit mid-week could catalyse EUR losses

- Franc best poised to benefit

- SNB intervention unlikely to halt CHF appreciation

Image © Adobe Images

- GBP/CHF market rate: 1.2043

- Bank transfer rates (indicative): 1.1630-1.1700

- FX specialist transfer rates (indicative): 1.1670-1.1930 >> More information

The Swiss Franc is being tipped to advance against the Euro over the course of the week commencing April 20 according to strategists at Goldman Sachs who eye a key meeting of Eurozone leaders as a potential catalyst for fresh upside in the Swiss currency.

The Wall Street bank says the Euro is likely to decline against the Swiss Franc - which is one of 2020's best performing currencies - owing to concerns over political unity in the Eurozone, which could be exposed at a mid-week meeting of European leaders.

"Go short on rising fiscal tensions," says strategist Zach Pandl, Co-Head of Global FX, Rates and EM Strategy at Goldman Sachs of the EUR/CHF rate.

"Several EMU member states lack the fiscal space to fully respond to the coronacrisis. And while the ECB has stepped in forcefully, we expect that markets will remain concerned further EU-level support will only arrive with sovereign bond markets under more severe stress," says Pandl.

The Euro has underperformed against the Greenback, Franc and even the British Pound, over the course of the past three weeks with analysts saying a degree of political uncertainty has crept back into the currency's valuation as leaders fail to agree a joined-up approach to funding a financial response to the economic ravages wrought by the coronacrisis.

The issuing of a pan-Eurozone bond - a coronabond - has been promoted by those Eurozone economies that require substantial funding to stave off the economic effects of the coronavirus, but whose debt levels suggest they cannot afford to issue a fresh funding drive. Countries such as Italy and Spain are in favour but the idea also has the support of northern nations such as France.

But resistance from countries such as Germany and the Netherlands believe that by underwriting this new borrowing they are effectively asking their citizens to directly fund other Eurozone nations that might be regarded as being profligate in their spending habits.

EU leaders are set to convene via video link on Wednesday to discuss the impact of the Covid-19 pandemic, where the issue of financing the Eurozone and EU recovery will once again be on the table.

Eurozone finance ministers last week agreed on a package of stimulus measures to in lieu of an actual coronabond, and leaders are likely to be asked to sign off on these next week.

"However, that agreement left out a lot of the detail including how the so called “recovery fund” will be paid for, so this still has the potential to cause issues between leaders. Discussions about the stimulus package may be complicated by it being tied into the negotiations on the EU’s upcoming seven-year Budget," says Rhys Herbert, an economist at Lloyds Bank.

The Euro is the obvious focus for any currency reaction to any inability by the Eurozone to negotiate a route forward. However, Goldman Sachs see the Franc as being a currency that would be poised to outperform on the Euro's woes.

"These tensions should continue to put significant appreciation pressure on the Franc," says Pandl.

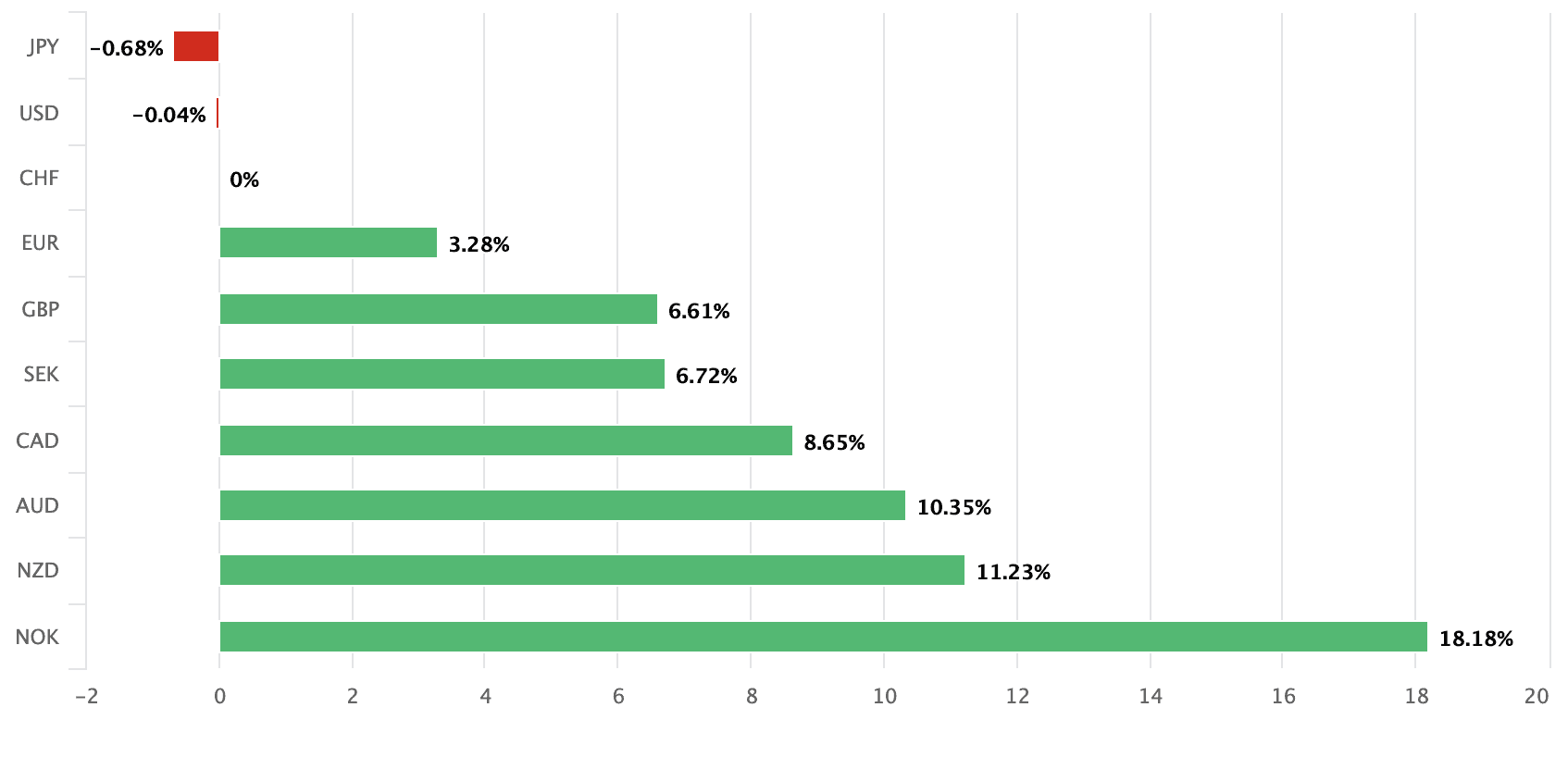

Above: Franc performance in 2020

We would expect any depreciation in the value of the EUR/CHF exchange rate to be reflected in other CHF crosses, such as the GBP/CHF exchange rate.

The Swiss Franc is the second-best performing major currency of 2020, rising against the majority of its G10 rivals save for the Japanese Yen.

That the Yen and Franc are topping the leaderboard for 2020 suggests this is a year that has favoured those currencies deemed to be safe harbours during times of financial stresses; a dynamic that has been encouraged by the coronavirus pandemic.

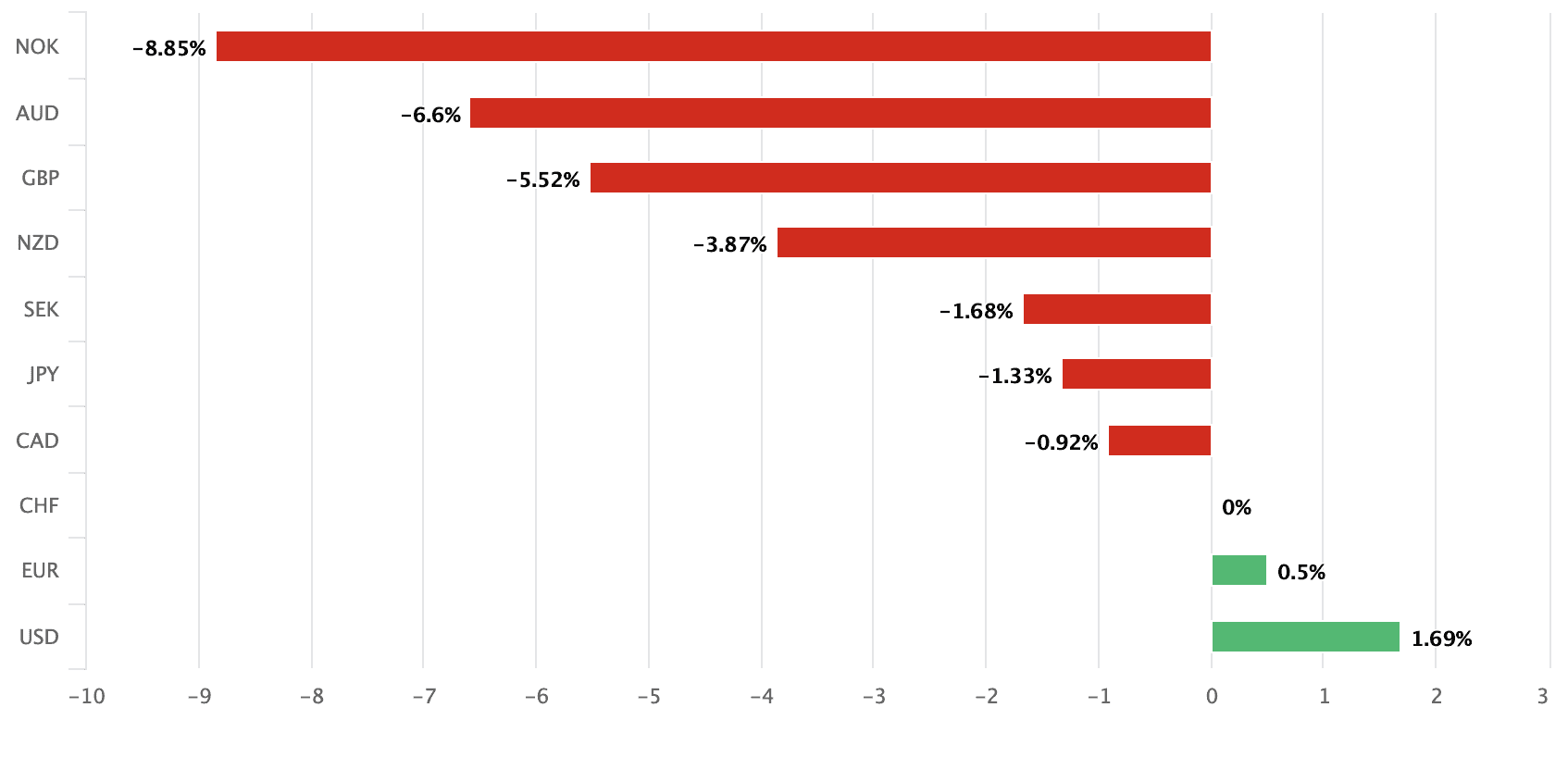

However, of late, the Franc has given back some ground due a stabilisation in financial conditions and improved investor sentiment that tends to see 'havens' such as the Franc decline.

Above: Franc performance over the past month

The Euro-to-Franc exchange rate is quoted at 1.0518, meaning it is effectively trading at its lowest levels since 2015.

The Pound-to-Franc exchange rate is quoted at 1.2042 and appears to be moving sideways after the multi-day recovery from March lows at 1.1175 stalls.

The appreciation of the Franc over the course of 2020 appears to have invited interventions by the Swiss National Bank (SNB), who see the stronger Franc as a significant headwind to the economy.

The SNB does actively involve itself in the currency market to try and stem the appreciation of the Franc, and their actions could therefore be seen as a hinderance to any further appreciation.

Above: EUR/CHF since 2015

However, analysts don't appear overly concerned that the SNB will effectively contain any major appreciation impulses in the Swiss currency.

"CHF total sight deposits continue to rise and suggest the Swiss National Bank may have bought CHF30bn+ of FX since March. The central bank probably doesn’t want to be backed into a corner with a new line in the sand at 1.0500, meaning that a EUR/CHF print sub 1.0500 won’t necessarily trigger a waterfall of follow-through, but this topic will certainly be a story for the week ahead," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING.

Goldman Sachs' Pandle says so far that has only slowed the speed of CHF appreciation, rather than reversed its course.

"In the past, the SNB has been wary of prolonged intervention against persistent pressures. We therefore recommend that investors go short EUR/CHF with a target of 1.02," says Pandl.