Swiss Franc "Seen as the Ultimate Safe Haven" Amidst Coronavirus Scare, but is Becoming Increasingly Pricey

- Franc to benefit on further Coronavirus anxiety

- But, becoming increasingly expensive

- Potential for sharp reversal seen to be growing

Image © Adobe Images

The overarching theme for global financial markets this week is the outbreak of Coronavirus in China, with fears that the world's second largest economy could suffer a slowdown in growth triggering a sell-off in global stock markets.

Risk is therefore the main driver of stocks, commodities and currencies; and in times of stress it is the Japanese Yen, Swiss Franc and U.S. Dollar that tend to appreciate as money flows out of equities and into 'safe harbours'.

However, the Swiss Franc is being touted as being the ultimate safe haven in the current virus-driven market sell-off which suggests further upside is likely if anxieties continue.

"In times of risk aversion money normally floods into the Japanese yen and the Swiss franc. Due to the proximity of Japan to China the risk of the virus penetrating Japan is high, with one confirmed case so far. Therefore, the Swiss franc is currently seen as the ultimate safe haven and has strengthened by over 3% against the Euro from its pre-Christmas level of 1.10 CHF to the Euro in the 1.06’s, the strongest level since April 2017," says Chris Towner, Director at JCRA.

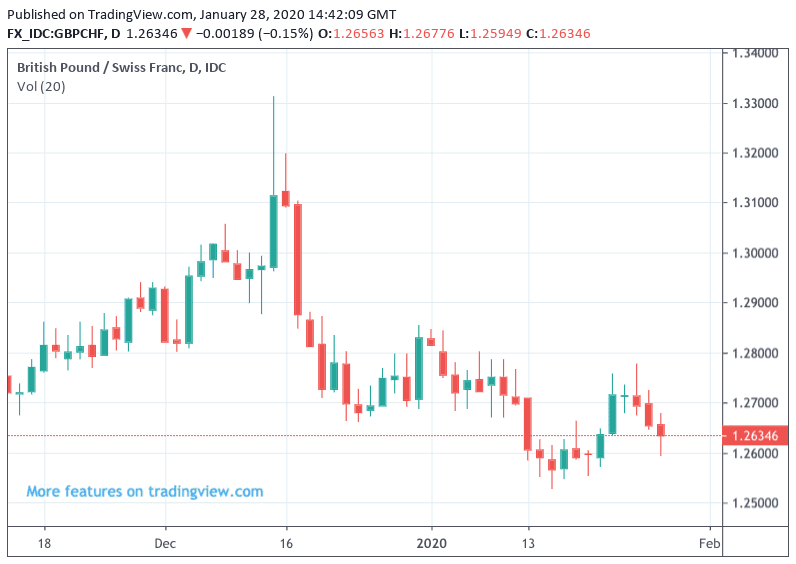

The Pound-to-Franc exchange rate is quoted at 1.2636, as the trend lower that has been in place since mid-December extends unchallenged.

The Euro-to-Franc exchange rate is quoted at 1.0698, but had been at 1.066 earlier in the day which marks a fresh 33-month low. The Dollar-to-Franc exchange rate is at 0.9725.

"The spreading of the coronavirus is affecting exchange rates instantly by dampening risk appetites and increasing safe-haven demand on the margin," says David Kohl, currency strategist at Julius Baer. "Risk-appetite measures have peaked since financial markets took notice of the new strain of the coronavirus. This is shifting the focus to safe-haven currencies like the CHF and JPY."

The National Health and Health Commission in China has reported they have received 4515 reports of cumulative confirmed cases of Neo Coronavirus in 30 provinces (autonomous regions and municipalities), 976 cases of severe cases, 106 cases of cumulative deaths, and 60 cases of cumulative cured discharge. There are 6,973 suspected cases.

But Beware the CHF Reversal

Because risk sentiment is in the driving seat on global financial markets should worries over the spread of the virus subside, the Franc could be the laggard as markets retrace.

"Markets will now be focusing on the pace of the spread of the virus and whether there are signs of acceleration or deceleration," says Towner.

China’s Xinhua news agency meanwhile reports noted respiratory scientist Zhong Nanshan as saying the virus outbreak may reach its peak in one week or about 10 days.

This will give markets reason to pause, and if this view gains traction stock markets could well start recovering and the Franc could find itself coming under pressure.

Also working against the Franc could be its sheer dominance of late, a situation that leaves it looking expensive and prone to a pullback.

"Since December 2019, the CHF has already enjoyed speculative support, which has attracted the attention of the Swiss National Bank and has brought a new wave of currency interventions to prevent further appreciation. Exposure to the CHF seems rather crowded, and the negative interestrate carry reduces the attractiveness of buying the CHF," says Kohl.