Pound-Franc Forecast: Pennant Pattern Heralds Risk of Higher Exchange Rate

Image © Adobe Images

- GBP/CHF forms bullish pennant with upside potential

= Break above 1.3000 to solidifying bullish view

- Swiss Franc moved by global investor risk appetite

The Pound-to-Franc exchange rate is trading at around 1.2785 at the time of writing, little changed from the week before and up 0.30% so far this week. Studies of the charts suggest the pair is pausing in an uptrend and forming a bullish pattern with the promise of higher exchange rates once it is finished.

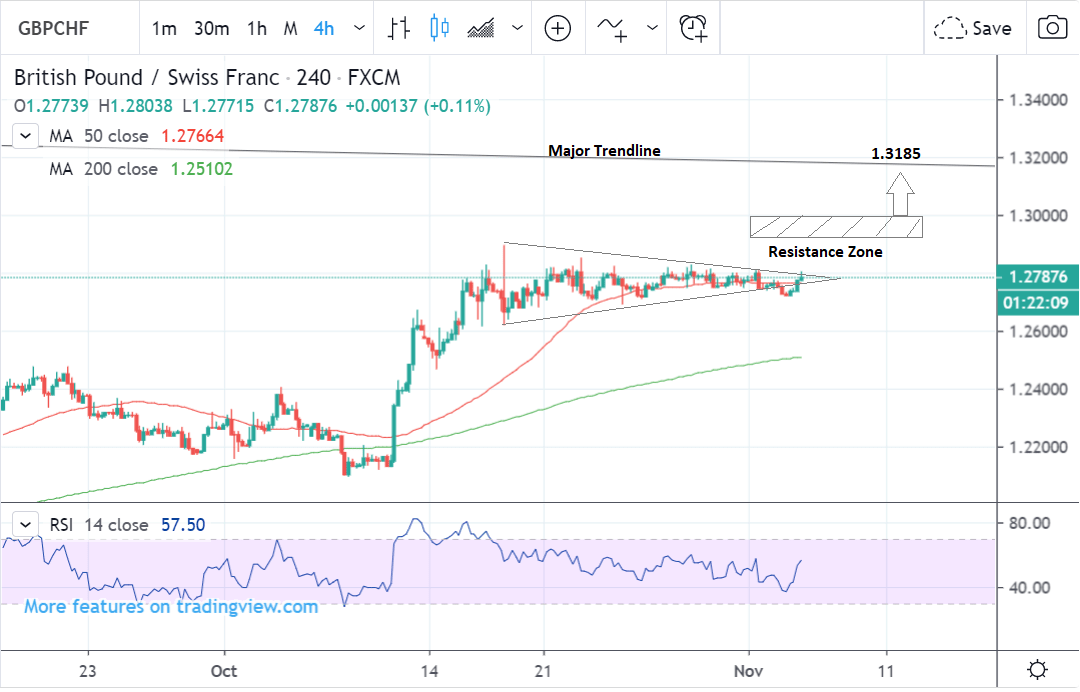

The 4 hour chart - used to determine the short-term outlook, which includes the coming week - shows the pair trading in a traingular range in the 1.27s after recently peaking at the October 17 highs, following a sharp rally.

The fact the pair is in an established uptrend favours a continuation higher to a target at the level of a major trendline, which is itself likely to present an obstacle to further gains.

A break above the October 17 highs at 1.2893 would provide confirmation of a continuation up to a target at 1.3185.

Tough resistance just above the price pattern, however, risks capping the exchange rate and preventing further gains, and for confirmation we would ideally like to see a clear break above this zone.

A move above 1.3000 would provide the required confirmation and green-light a continuation higher.

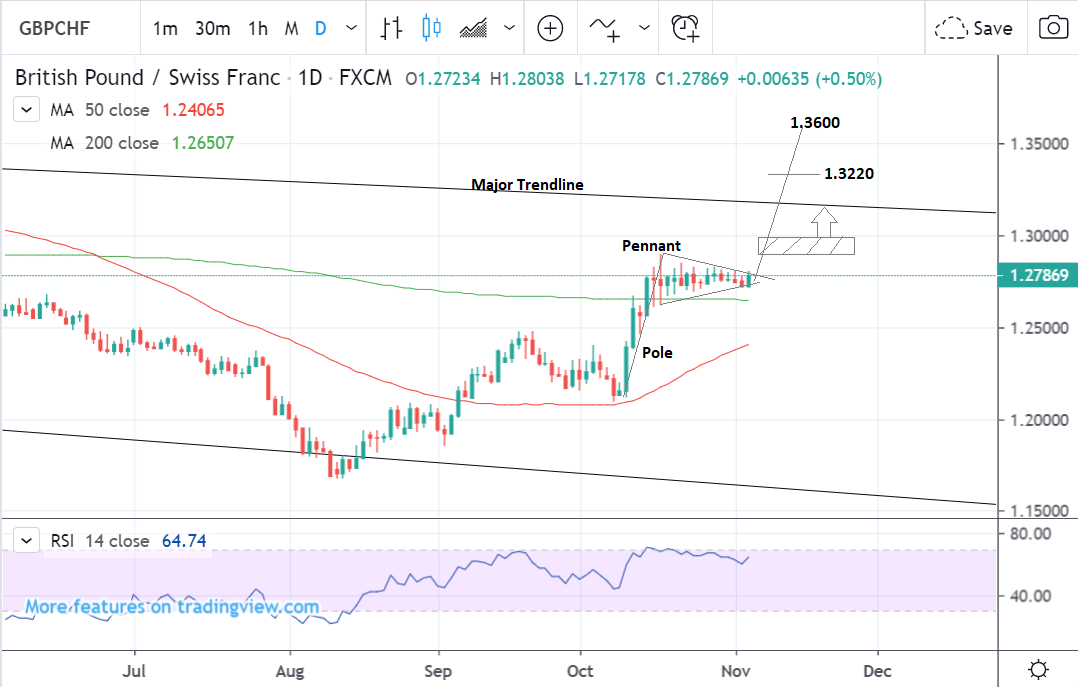

The daily chart is showing the formation of a bullish pattern called a ‘bull pennant’, which gets its name from the triangular flags which flew from medieval castles.

It is a strong indicator of more upside on the horizon.

The pattern is composed of two sections: a steep rally called a ‘pole’ followed by a sideways tapering, triangular consolidation.

Confirmation normally comes from a break above the pattern highs at 1.2893, although in this specific case, the resistance zone just above, could prevent further upside.

For more assurance, therefore, a clear break above the resistance, confirmed by a move above 1.3000 would be required.

Pennant patterns usually rise to a target that is equal to the height of the pole extrapolated higher by either 61.8%, which results in a 1.3220 conservative target, or 100% which leads to an eventual target at 1.3600.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

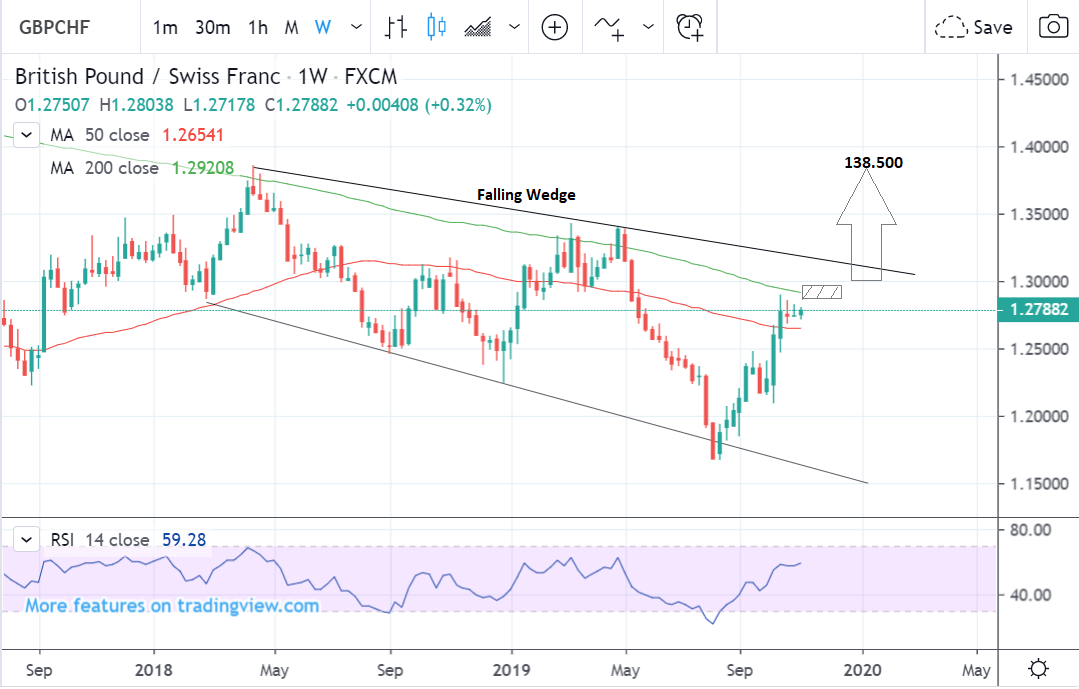

The weekly chart shows the pair rising up within an expanding wedge pattern.

Assuming a bullish breakout higher, as indicated on the daily chart, the pair is likely to rise strongly.

Gains are likely to be elevated by the fact the pair has formed a wedge pattern since breakouts from wedges tend to be steep and volatile.

An initial long-term target would be at the 1.3600 level, followed by 1.3850 at the key April highs.

The weekly chart is used to give us an indication of the outlook for the long-term, defined as the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Swiss Franc: Improving Investor Sentiment is Key Risk

The main driver of the Swiss Franc (Swissie) in the near-term is likely to be investor risk appetite since the currency is a favoured safe-haven which means it rises during times of economic or political strife when investors become fearful for the global outlook.

The opposite, however, appears to the be case at the moment. A key barometer of risk appetite is the U.S. stock market which rises when investors are feeling optimistic, and it is making new all-time highs.

The S&P 500 is up 13 points to 3079 on the day and the Dow Jones is up by 108 points to 27,462, showing investor risk appetite, if anything, is stronger than ever and putting downward pressure on the Swissie.

The rise in risk appetite has come about because of a more favourable outlook for trade talks between the U.S. and China, who are in the process of signing the ‘Phase 1’ deal.

According to commentary from Commerce Secretary Wilbur Ross, talks are “very far along” and he was “quite optimistic” that Phase 1 would be signed off.

Ross’s optimism has even led to speculation that the U.S. might suspend the tariffs scheduled for December and possibly even put off auto tariffs on European imports, removing a further risk factor from the global outlook.

The general tone out of Washington regarding trade is “signalling a more generalised dialling down of trade hostilities by the US administration,” says Nick Smyth, an analyst at BNZ Bank.

The improved risk appetite also comes despite news that the People’s Bank of China (PBoC) has cut interest rates for the first time in over 3 years, something which might ordinarily cause widespread concern.

The PBoC lowered its 1-year medium lending facility (MLF) by -5 bps to 3.25%.

The move underlines the rapid deterioration of domestic growth and paves the way for a cut in the loan prime rate (LRP), the current main policy rate, in coming weeks.

Yet whilst it is concerning the PBoC cut their lending rate it also sends out the message the Chinese authorities are ready and willing to react swiftly to deteriorating data, which could be construed as positive.

A further risk factor on the horizon that might impact investor sentiment and the Swissie is the release of the ISM non-manufacturing PMI, which along with its cousin the ISM manufacturing PMI, is one of the most important economic indicators of the health of the U.S. economy, and, to a certain degree by extension, the global economy.

A recent concern amongst investors has been that the slowdown in manufacturing witnessed in the U.S. could be migrating over to the hither-to resilient services sector of the economy, and if this happens, that it could precipitate a recession.

Fear of such contagion has heightened the focus on the non-manufacturing sections of the economy including the ISM non-manufacturing PMI out at 15.00 GMT on Tuesday (today).

“The market’s focus is the non-manufacturing ISM survey, released tonight, for an updated read on the US services sector. The survey has slowed this year and last month hit a three year-low of 52.6, but it remains significantly more positive than the manufacturing equivalent,” says Smyth.

The consensus estimate amongst economists and analysts is for the gauge to come out at 53.5 in October from 52.6 previously.

A higher than expected reading should be taken as positive or bullish for the USD but negative for the Swiss Franc, while a lower than expected reading should be taken as negative/bearish for the USD but positive for the Swiss Franc.

The employment sub-component of the ISM is also likely to attract attention as it has been falling quite steeply over recent months, suggesting underlying weakness from a slowdown in hiring.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement