Pound-Franc Rate Forecast to see Further Downside to Midpoint of Previous Uptrend, Risk Trends and Polish CHF Mortgage Ruling Eyed

Image © Albert Czyzewski, Adobe Images

- GBP/CHF to decline to 50% of prior rally

- Support shelf there could propel pair higher again

- Main driver of Swiss Franc risk trends

- Ruling on Polish CHF mortgages eyed

The Pound-to-Franc exchange rate (GBP/CHF) is trading at around 1.2199 at the time of writing, after a deep 1.47% contraction last week. Studies of the charts suggest the pair will probably trade with a bearish bias at first but that a substantial break higher or lower would be needed after that to provide confirmation of the next move.

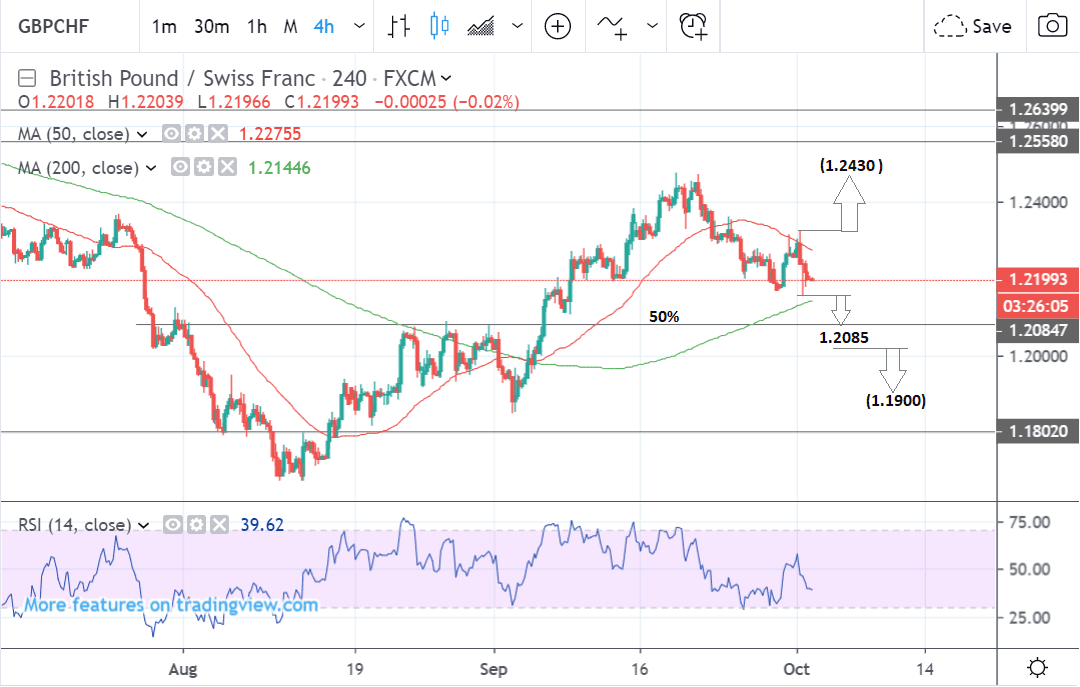

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days -

has been falling since the September 18 highs and we see this recent bearish trend continuing at least a little way lower.

The next probable target for the decline is the 50% retracement level of the previous rally (from the September 12 lows) at 1.2085. This has special supportive qualities which are likely to prevent deeper declines. A break below 1.2150 would provide confirmation.

After that the pair could move in either direction.

One possibility is that it could resume its uptrend higher to a target at 1.2430 and the September 20 highs. Such a move would gain confirmation from a break above 1.2326.

Another possibility is that it continues declining, with a move below 1.2050 providing confirmation for a potential breakdown to 1.1900.

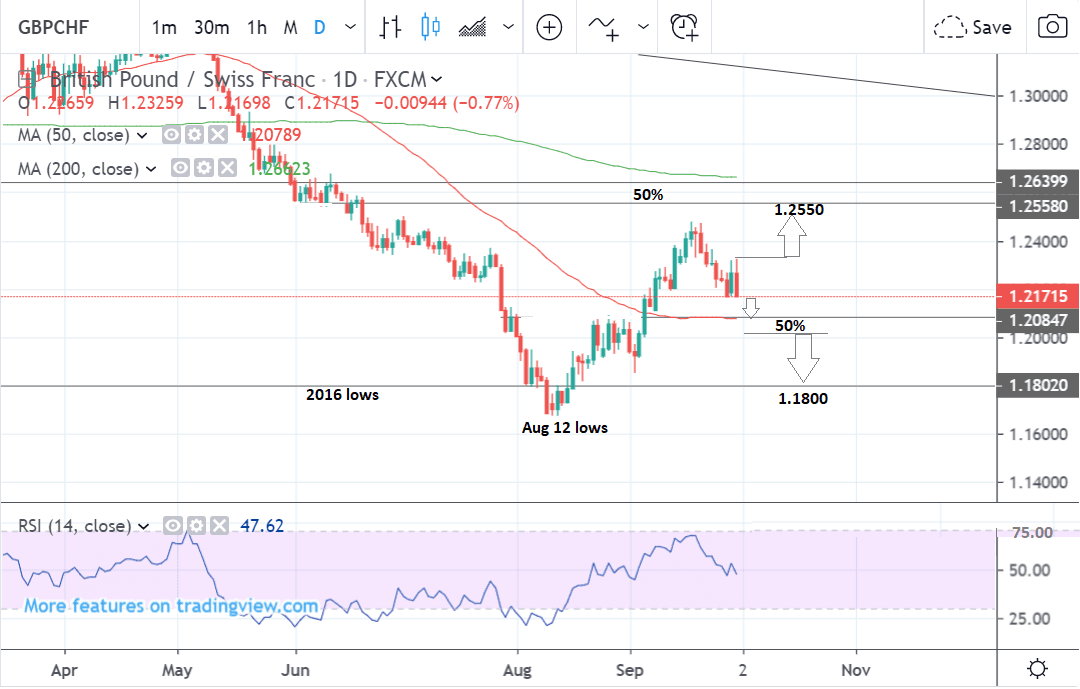

The daily chart shows the move up from the August 12 lows followed by the correction back down which is currently unfolding.

A continuation down to the 50% retracement of the previous rally and the 50-day moving average (MA) which is at the same level is a likely scenario.

Large MAs such as the 50-day often act as a barrier to prices whatever the direction of the trend and this is likely to reinforce the support provided here.

After that, there are various possible scenarios that might unfold.

A break above the 1.2326 highs would probably see the pair rise up to the 1.2550 level - which is itself the midpoint of an even larger previous rally.

Alternatively, a break below 1.2035 would see the pair probably decline to a target at 1.1800 and the 2016 lows.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

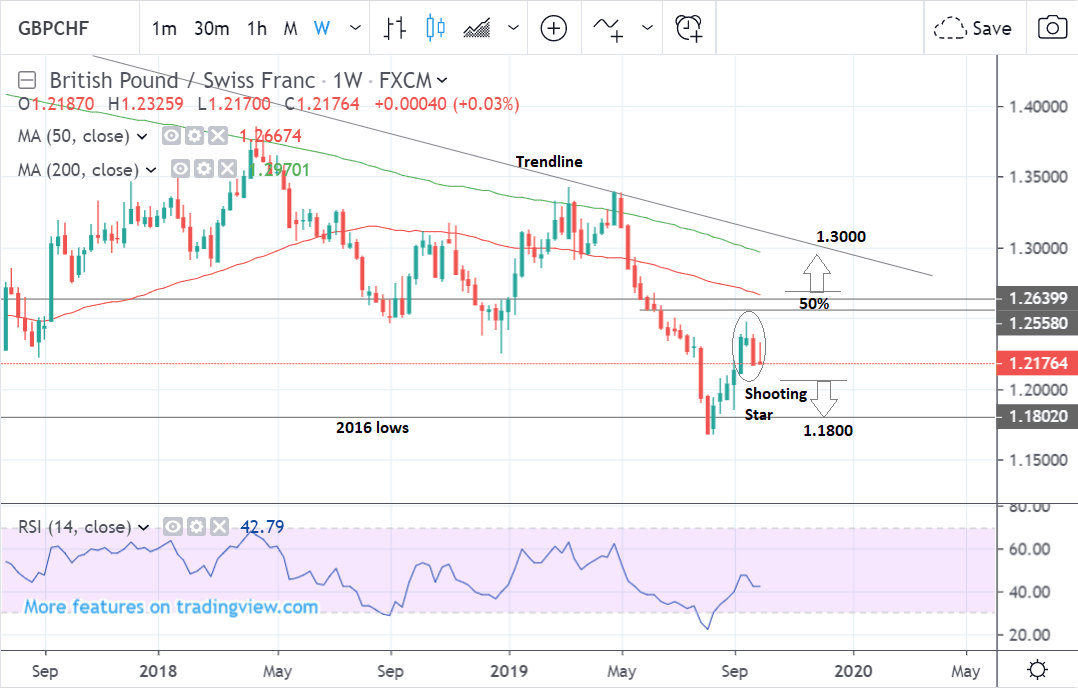

The weekly chart is showing the completion of a bearish ‘shooting star’ candlestick pattern at the recent highs, which suggests a downside bias to the outlook.

The fact the pattern was followed by a long, red, bearish, down, week provides further confirmation.

This suggests a continuation lower on the horizon, perhaps all the way down to the 2016 lows at 1.1800, at which point the pair may bounce.

Alternatively, a break above the resistance zone lying above price and then 1.2700 would probably green-light a rise to 1.3000.

The weekly chart is used to give us an indication of the outlook for the long-term defined as the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Swiss Franc: Two Key Drivers to Watch

The main driver of the Swiss Franc will be global risk appetite since the currency is a safe-haven which means it benefits from greater inflows in times of crisis and sees outflows during periods of calm.

"The Swiss franc is now in a position to benefit from any revival in risk aversion, as its correlation with the VIX (the volatility index) has increased to a multi-year high," says Olivier Korber, a strategist with Société Générale. "Imminent CHF volatility could be in sight."

As far as risk sentiment goes, equity markets have picked up overnight with risk sentiment improving and the S&P 500, a common barometer of risk appetite, up 5 points already in futures markets.

This is conversely putting downward pressure on the safe-haven Swiss Franc.

Looking ahead, the release of U.S. Non-Farm Payrolls (NFP) data on Friday, which is probably the most important release for the U.S. economy, could impact the Swissie if it differs wildly from expectations.

If the data shows payrolls rose more-than-expected in September the Franc could weaken as risk appetite returns and vice versa if the figures are lower.

Current market expectations are for the data to show 145k new jobs added in September.

A further issue which may affect the currency is a European Court of Justice ruling about whether it was lawful for Polish banks to sell low interest-rate Swiss Franc denominated mortgages to home-buyers in Poland.

Many of the mortgages were sold before 2015 when the Swiss Franc stormed higher after the Swiss National Bank (SNB) removed a cap that sought to limit the currency's strength. As a result, many mortgage holders have been left with huge debts.

A ruling against the banks could lead to a disruption in Polish and other European financial markets and potentially impact the Swiss Franc.

"The threat of an unfavourable ECJ ruling on the validity of indexation clauses in non-zloty mortgages looms large. In a worst-case scenario, lenders could be forced to convert FX mortgage exposure into domestic currency, while leaving the interest rate in CHF. This could be particularly difficult for banks with higher FX-mortgage exposure," says Marek Drimal, an Emerging Market Strategist with Société Générale.

If the practice is ruled illegal in Poland the same will likely be true in most of the EU suggesting a fall in demand for Swiss credit which might result in a decline in the Swiss Franc over time.

The Franc is however a sizeable global asset, and we would expect any impact to be limited.

Soc Gen's Korber does however suggest, that at the very least, the ruling could inject volatility in the Franc.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement