Pound-Franc Rate Poised to Break Above Trendline and Extend Uptrend

Image © Adobe Images

- Strong uptrend is hitting resistance ceiling

- More gains likely but clearance required

- Pound to be driven by Brexit news; Franc by risk sentiment

From a technical perspective, GBP/CHF is forecast to continue rising but global risk sentiment and growing nerves over a looming Brexit vote could shake this exchange rate over coming days. GBP/CHF is trading at 1.3131 at the time of writing, a quarter of a percent down on where it started the day but still some 0.75% higher than where it was one week previously.

Last week’s gains came mainly from Pound strength after chances of a 'no deal' Brexit declined. The pull-back over the last 48hrs, however, has mainly been due to a strengthening Yen on the back of rising safe-haven flows, amidst heightened concerns over the outlook for the U.S. economy.

From a technical perspective, GBP/CHF is forecast to continue rising. At the moment it is pulling back after touching tough resistance but the short-term uptrend remains intact and likely to resume.

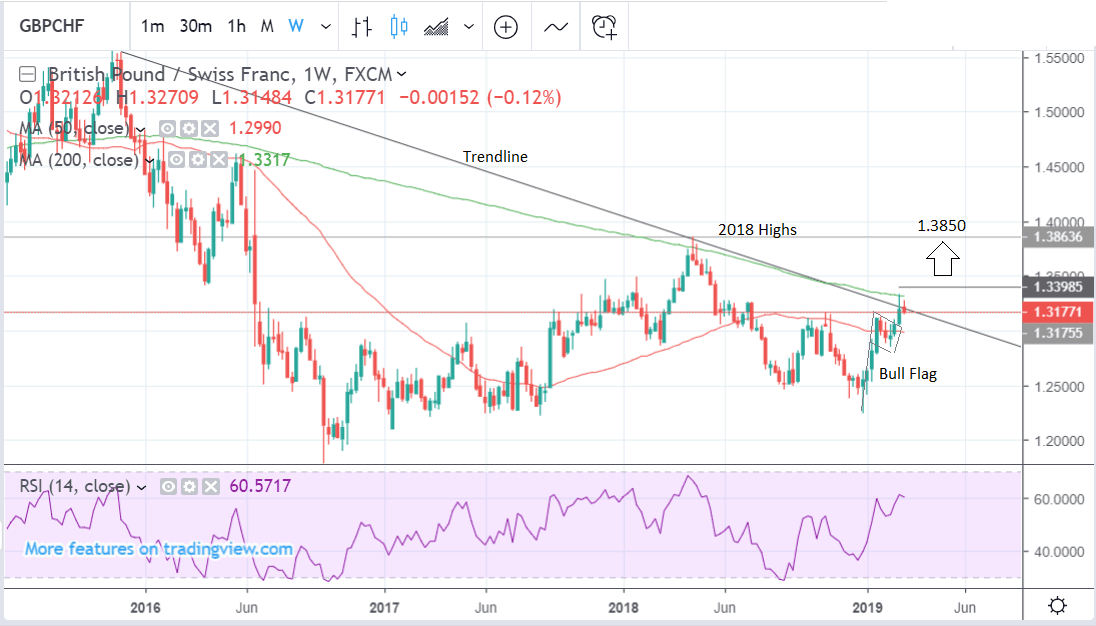

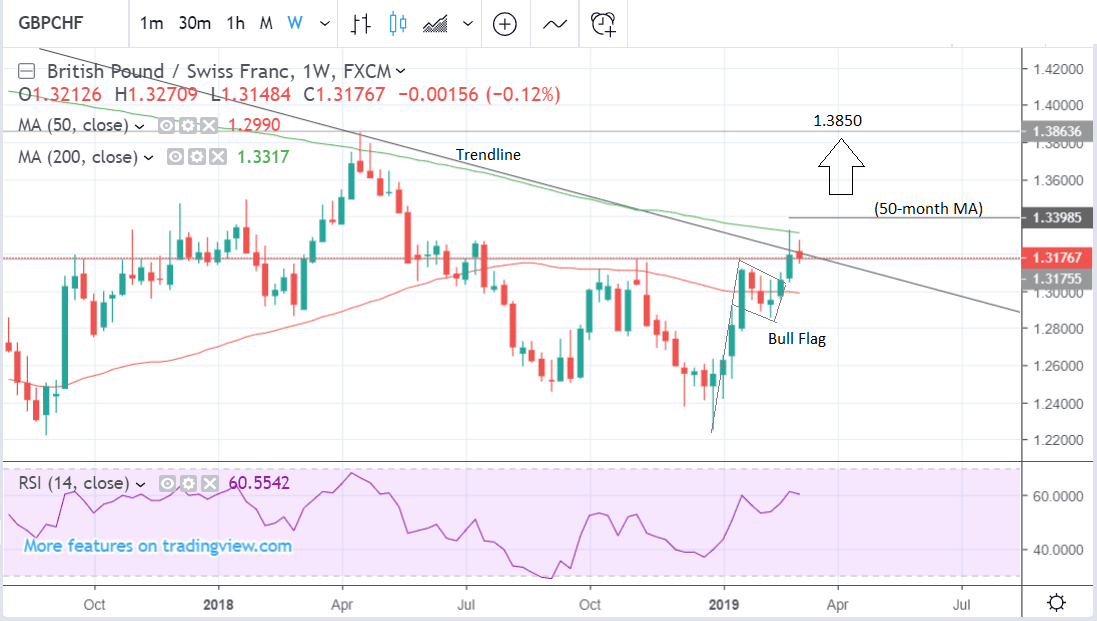

The pair has risen up and touched several key resistance levels, including a major trendline in the 1.31s and the 200-week MA at 1.3317. These have rejected the exchange rate which has fallen back down below the trendline. A break clearly above them - and the 50-month MA at 1.3407 - would see the opening up of a clear run up to targets in the 1.37s and 1.38s. Such a break would gain confirmation from a move above 1.35.

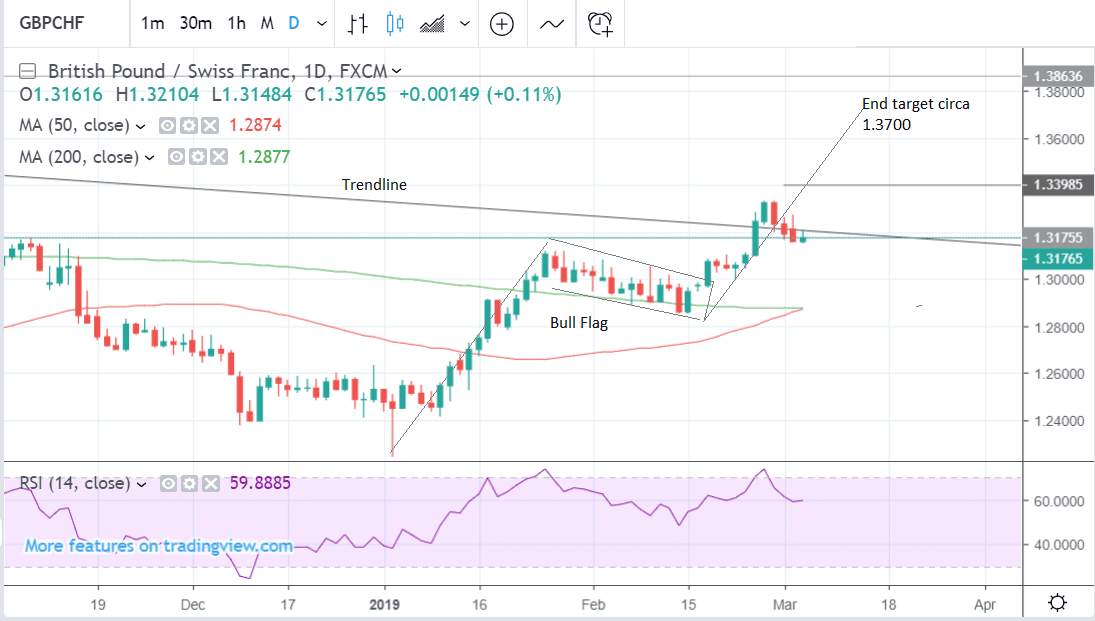

After forming the late December lows, the exchange rate rallied higher and unfolded a bull flag during January. It then broke higher in February and is now in the process of rising towards a target in the 1.37s, based on an extrapolation of the ‘pole’ higher.

The 50-day MA is very close to crossing above the 200-day MA and produce a ‘golden cross’ signal. This is likely to occur over the next few days and is a very bullish sign for the pair.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Negative Risk Sentiment Supports Franc, Markets Gear up for Brexit 'D Day'

The decline in GBP/CHF over the last few days has mainly been due to greater safe-haven flows into the Swiss Franc due to a combination of renewed fears about U.S. growth and political uncertainty.

“Risk sentiment turned sour,” says Marios Hadjikyriacos, investment analyst at broker XM.com. “The trigger for this retreat seems to have been the US construction spending print for December, which fell unexpectedly, igniting speculation for a downward revision in the Q4 GDP. Some headlines that House Democrats are opening an investigation into whether the Trump administration engaged in obstruction of justice may have contributed too, via amplifying political uncertainty.”

Yet at the same time, running alongside this, was a more positive-for-sentiment narrative about the U.S. and China getting closer to agreeing on a trade deal.

“China and the U.S. are approaching the finish line on trade negotiations that could end later this month, according to three sources,” reported Kayla Tausche and Fred Imbert or CNCB news on Monday. “Negotiations are in the “final stages” as the two sides plan a summit for the end of March at Mar-a-Lago, President Donald Trump’s Florida resort, sources told CNBC.”

A deal between the two superpowers would effectively roll back tariffs which Trump threatened to impose at the start of the year, which would have led to increases from the current 10% to 25% on $200m of Chinese imports. Such a deal would also be a relief for markets but a negative for the Franc.

Most analysts are optimistic a deal will emerge since neither the U.S. nor China will want the economic fallout from a trade war, or for sentiment to sour any further. In the long run this is likely to be negative for the Franc.

On the 'hard' data front, the next major release is the Swiss unemployment rate which is forecast to show a fall to 2.7% from 2.8% when released on Thursday at 18.45 GMT.

Inflation data was released on Tuesday morning and showed a 0.4% rise compared to the previous month, as forecast. On a yearly basis, it showed a 0.6% rise, also as estimated.

Neither of the data are likely to influence the Franc but any big surprises could spark some near-term volatility.

The Pound, meanwhile, could gain support over the same period on a Brexit deal being approved by the UK parliament which should aid an extension of GBP/CHF’s uptrend, in line with the technical forecast above.

The next 'meaningful' vote on the government’s final version of the Brexit deal will take place before March 12. Currently, it does not look as though the government will win since they have not managed to extract any meaningful concessions from the EU on the Irish backstop.

Jacob Rees Mogg, the head of the European Research Group (ERG), has said that he will only vote for the deal if it passes 3 ‘tests’. These are – (1) that the mechanism must be legally binding, so effectively treaty-level change; (2) the language must be clear “as to where we are going”; and (3) the codicil must contain a clear exit route.

Analysts at Citibank see the most likely course of Brexit as either successful voting through of the government’s withdrawal bill on March 12 or failing that a delay. Neither of these would be negative for the Pound and more likely positive.

“The Citi base case is for a deal before 29 March; failing that, an A50 extension is more likely than a No Deal. Citi’s metrics for positioning and what’s priced in all continue to support the view that No Deal risks are overpriced and a Brexit breakthrough is underpriced, leaving room for further GBP gains,” says Citibank.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement