Pound-Swiss Franc Rate Likely to Extend Sideways Amidst Mixed Technical Signals

Image © Adobe Stock

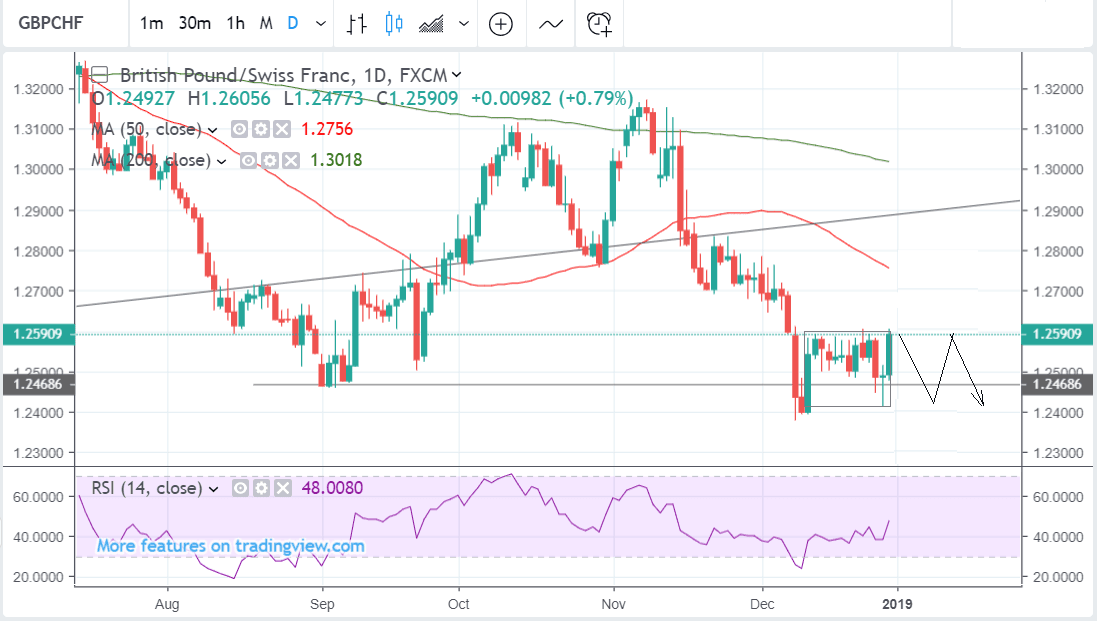

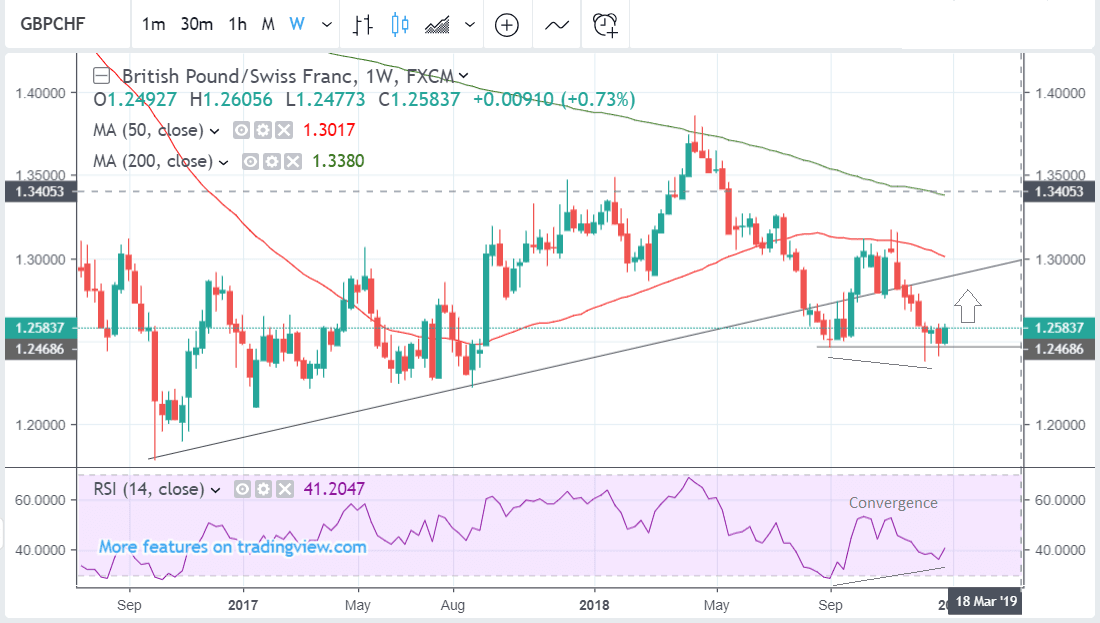

- GBP/CHF charts giving off mixed signals

- Suggests range-bound behaviour to continue

- Pound to take cue from PMI data; Franc from risk trends

GBP/CHF is trading at 1.2598 at the time of writing after rising by almost 0.80% on the first day of the trading week, and New Years’ Eve. The pair has been driven higher by Pound strength from a combination of factors, including month end flows, Dollar weakness and easing hard-Brexit fears.

The technical picture is complex and overall we are neutral in our outlook, expecting the sideways trend to continue.

Whilst the current tenor of markets may be bullish there is no guarantee it will last, and longer-term, the trend is still bearish. Without stronger confirmation of further upside the downtrend remains dominant and biased to continue.

Yet at the same time, there is a strong indication that the pair could bounce due to the convergence of RSI momentum with price at the recent December 10 low. Whilst price made a new yearly low the RSI did not, and this non-confirmation is a strongly bullish indicator.

The mixed signals from the charts suggest a sideways bias, if anything, since the indicators largely cancel each other out.

Be aware, while the interbank rate on GBP/CHF is quoted at 1.2540 the retail rate offered on bank accounts of the major banks is likely to fit into the 1.21-1.2190 bracket while the rate on offer with independent specialists is likely to sit in the 1.2420-1.2470 bracket.

The Swiss Franc: What to Watch

Then main data release for the Swiss Franc is Manufacturing PMI data for December, which is out on Thursday, December 3, at 8.30 GMT. It was still relatively strong in November when it came out at 57.7, but forecasters expect it to pullback marginally to 57.2 in December.

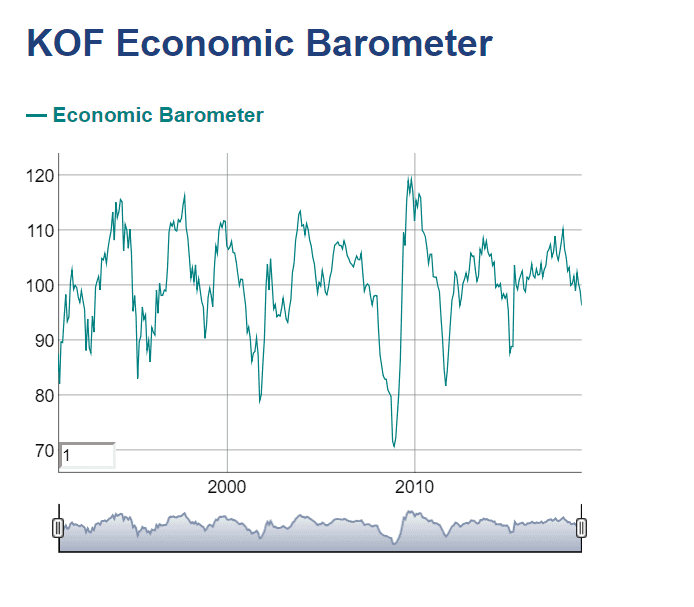

Yet overall economic data in Switzerland has been declining recently; the Swiss economic institute barometer or ‘KOF’ dropped to 96.3 min December, down from 98.9 previously. It missed expectations of 98.8.

“The main drivers of this development stem from indicators belonging to the producing sector (manufacturing and construction). In addition, a weakly negative signal is sent by the financial sector and private consumption. Favorable export prospects, on the other hand, cushion this downward tendency.” Says the Institute.

The Swiss Franc has shown broad based strength recently as risk aversion has increased on the back of the decline in the US stock market. Whilst stocks have seen a bounce at the start of the new trading week it’s not clear how long this can be sustained. If the downtrend resumes, it could lead to increased inflows into the Franc and a stronger Swissie.

More recently the Franc may possibly also have been supported by easing geopolitics, “related to US withdrawal from Syria. But we can’t find the exact linkage yet.” Says the Actionforex.com newsroom.