Swiss Franc's Run Higher Against the Pound Dented by GDP Shocker

Image © Adobe Images

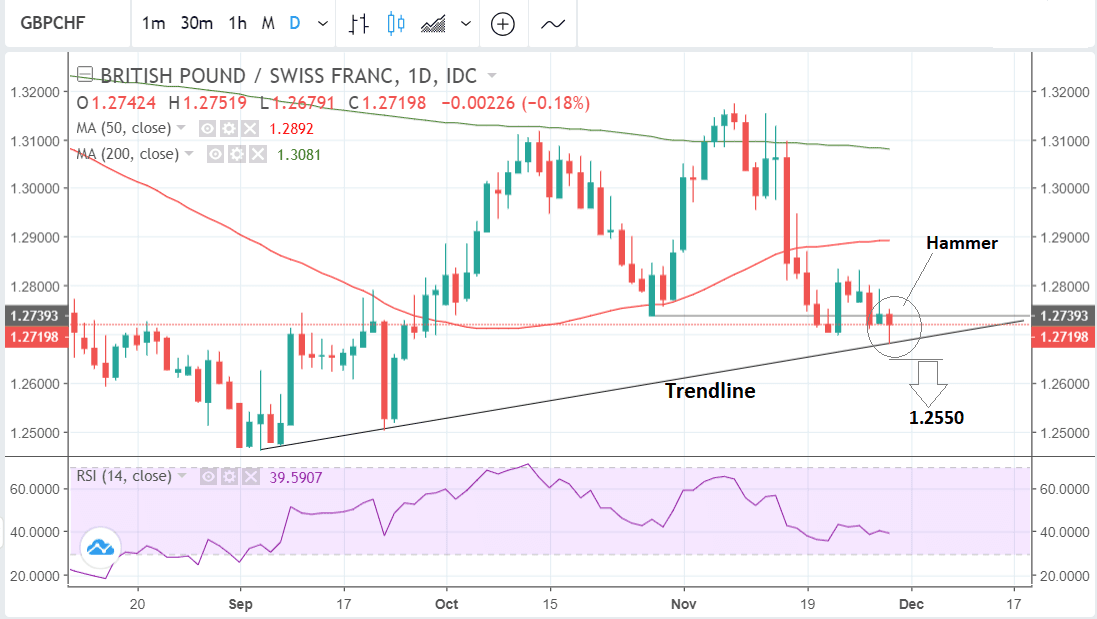

- GBP/CHF recovers from trendline after GDP miss

- Established short-term downtrend still intact

- Sterling driven by Brexit headlines; Franc by risk trends

The Pound-to-Franc exchange rate is trading at 1.2730 at the time of writing after recovering over half a cent from the day’s low.

The rebound has come on the back of a cheaper Swiss Franc which follows news Swiss GDP unexpectedly fell by -0.2% in the third quarter.

Overall we remain bearish, though much cautiously so than previously.

The pair has so far formed a bullish hammer candlestick which is often a trend reversal sign.

Assuming it endures, much will depend on tomorrow’s activity as to whether the signal is confirmed. Bullish activity on Friday will enhance the reversal signal supplied by the hammer, and we could see the birth of a new short-term uptrend.

As things stand, however, this is not yet the case and the pair remains locked in a downtrend.

Given the old trading advice that “the trend is your friend until the bend at the end,” this downtrend is considered more likely to continue than not, thus our market view remains bearish, on balance, despite the poor Swiss data.

Nevertheless, because of the negative GDP data we would now want to see additional confirmation before forecasting more downside, with a break below the 1.2650 lows supplying it.

Such a move would be expected to result in a continuation down to a target at the 1.2550 level, initially, followed by the key 1.2460 lows.

The pair is currently sitting on a trendline drawn from the September lows. This is a further impediment to more downside and another reason for requiring a clear break below the 1.2550 level.

GBP/CHF is trading below all the main moving averages including the 50 and 200 day, and week MAs, and this is an overall bearish sign for the exchange rate.

Exports Lead Swiss GDP Lower

Switzerland GDP data fell by -0.2% in Q3 when it was expected to grow by 0.4%. This was a far cry from the 0.7% rise in Q2.

The main reason given for the slump was a -4.2% drop in exports, suggesting the strong Franc might be to blame, and raising the possibility the Swiss National Bank (SNB) might decide to intervene to try to weaken the currency.

According to the data, exports of goods fell 4.2% in the third quarter (vs -0.3% in Q2) and imports declined at a softer 2.4% (vs -1.1% in Q2).

Compared to a year ago, GDP rose 2.4% vs the 2.9% expected, which compared to a prior 3.4% reading; revised up to 3.5%.

Another factor cited for the downturn in growth was weakening demand from trade neighbours in the Eurozone, especially Germany.

“The Swiss economy unexpectedly contracted in the third quarter, hit by weak domestic consumption and an economic downturn in Germany, its biggest trading partner, the State Secretariat for Economic Affairs (SECO) said on Thursday,” reports Silke Koltrowitz a correspondent for Reuters News.

Koltrowitz also cites a highly valued Swiss Franc as a part of the problem.

“The Swiss government and the Swiss National Bank see the franc currency as highly valued, the cabinet said after its annual meeting with SNB Chairman Thomas Jordan this month,” says the correspondent.

The SNB has a history of intervening whenever it thinks the Swiss Franc is ‘overvalued’. This has been the case on several occasions since the financial crisis in 2009 when the Franc rose due to large safe-haven flows.

The surprise GDP slump on Thursday suggests a possibility this may happen again, and is a risk factor for the Franc, looking ahead.