GBP/CAD Rate Week Ahead Forecast: Rude Awakening for the Bulls

- Written by: Gary Howes

Image © Adobe Stock

The scale of the Pound's fall against the Canadian Dollar last Friday was significant and we wonder if it has dented what was one of global FX's best-defined uptrends.

GBP/CAD hit its highest levels since 2021 last week at 1.76, as a strong rally extended to fresh multi-month highs, but the exchange rate looked overbought as it did so.

A Relative Strength Index (RSI) reading above 70 confirmed these overbought conditions, which typically signals a pullback/consolidation is needed.

The market has duly delivered this, and the RSI has neutralised by falling to 50, and we would look for the immediate selling pressure to ease.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

To be sure, this is not a wholesale breakdown of GBP/CAD and there is a chance that the gains gain build again from here.

Shaun Osborne, Scotiabank's Chief FX Strategist, wrote ahead of GBP/CAD's Friday tumble that the daily, weekly, and monthly DMI studies remain bullishly aligned for the GBP.

A monthly break above long-term trend resistance (now support at 1.7320) keeps his attention "on gains developing towards 1.80 (at least) in the next few weeks or couple of months".

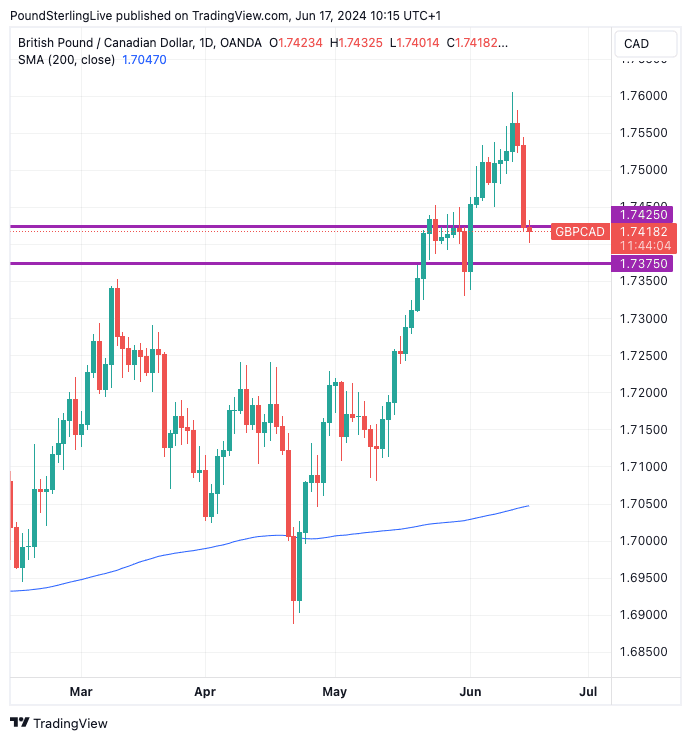

"Minor dips (to the 1.7375/1.7425 zone) should be well-supported from here," he adds.

Above: GBP/CAD at daily intervals. Track GBP/CAD with your own alerts, find out more here.

As the above shows, GBP/CAD has fallen to that support zone he mentioned. We would look to see if this area holds in the coming days. If the exchange rate remains above here, the prospect of the uptrend reasserting is likely.

The key calendar event to watch comes on Wednesday when the services inflation print is released. Services inflation beat expectations last month and confirmed underlying inflation trends are running well ahead of levels consistent with a durable fall in UK headline inflation to 2.0%.

"My prediction for next week’s CPI inflation figures. Headline 2.3% (unchanged). Services inflation 6% (+0.1). Goods inflation -1% (-0.2). Core inflation 3.8% (-0.1%). Not enough change to prompt a rate cut from MPC," says Andrew Sentance, an economist and former member of the Bank of England's MPC.

In May, Sentance correctly predicted that April's inflation reading would overshoot expectations, and if he is again correct, these upside surprises will likely boost the pound.

The Bank of England and other economists expect a steady pickup in inflation over the remainder of the year owing to elevated services inflation levels. Another above-consensus reading would raise questions about just how fast the Bank of England can cut interest rates, which can underpin the Pound on a relative interest rate basis.

This would keep GBP/CAD above 1.7375.

The Bank of England is in focus on Thursday, and guidance regarding the prospect of an August interest rate cut will determine where the Pound ends the week. The market currently sees less than a 50% chance of an August rate cut, meaning there is scope for repricing in a GBP-negative direction.

Dave Ramsden and Swati Dhingra are likely to again vote for an immediate cut. What will be interesting is whether more members of the MPC join them in voting for a cut. If yes, the odds of an August rate cut will rise, weighing on the Pound.

GBP/CAD likely falls below 1.7375 if this occurs.

"The pound may lose some of its recent momentum if UK services inflation comes in cooler than expected next Wednesday, as it would raise the probability of a BoE cut in August and bring rates differentials back to the fore," says George Vessey, Lead FX Strategist at Convera.

That said, last month's above-consensus inflation print will be a sober reminder to the MPC that UK inflation is likely to prove sticky in the coming months. This should encourage a degree of caution that can, on balance, mean any weaknesses in the Pound are short-lived.

"Monetary policy will remain a more important driver for the pound sterling, which should remain robust thanks to a late-moving Bank of England and a nascent economic recovery," says David Alexander Meier, an analyst at Julius Baer.