Canadian Dollar Drops on Inflation Slowdown

- Written by: Sam Coventry

Image © Adobe Images

The Canadian Dollar fell against the majority of G10 currencies following the release of data that showed inflation in Canada was slowing faster than economists expected.

Canadian CPI inflation rose 3.8% year-on-year in September, said Statistics Canada, which makes for a sharp decrease from 4.0% in August and was below expectations for a reading of 4.0%. The month-on-month change stood at -0.1%, which was below expectations for 0.1% and 0.4% recorded in August.

Meanwhile, Core CPI was down 0.1% m/m in August (2.8% y/y), while the trimmed CPI measure was at 3.7% y/y, below the 3.8% expected by markets and 3.9% previously.

"With activity in the economy stalling in Q2 and Q3, excess demand appears to be diminishing, suggesting that inflation should continue to decelerate in the quarters ahead without the need for further interest rate hikes," says Andrew Grantham, an economist at Canadian Imperial Bank of Commerce (CIBC).

The fall in CAD reflects the market's downward rerating on the odds of further hikes at the central bank: The Pound to Canadian Dollar exchange rate was under pressure heading into the Canadian inflation release courtesy of some softer-than-expected UK wage numbers, but it has recovered to trade flat on the day at 1.6617.

The U.S. Dollar to Canadian dollar conversion was up half a per cent at 1.3838.

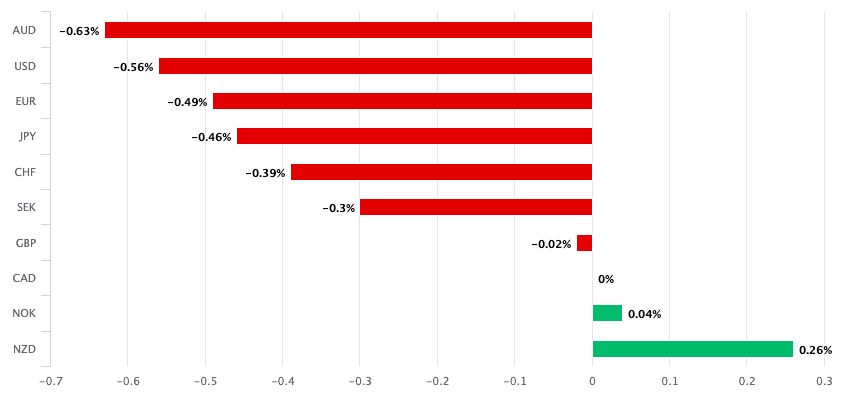

Above: CAD performance on Oct. 17 following the Canadian inflation release.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"Markets have significantly reduced their pricing of the probability of an interest rate hike at next week's meeting," says Marc Ercolao, an Economist at TD Securities.

The report's headlines show that food price inflation continues to slow, falling back to 5.8% y/y, ensuring shelter inflation (6.0% y/y) has overtaken it as the fastest-rising component of the basket.

An increase in rented accommodation (up to 7.1% from 6.4%), was offset by deceleration in owned accommodation (falling to 6.3% from 6.4%).

Gasoline prices contributed -1.3% on a monthly basis, reversing the large 4.7% gain last month, suggesting the impact of rising oil prices has largely fed through to consumers.

"Today's inflation print is another small step towards tackling the last leg of the inflation battle. Core inflation measures, in particular, taking a step back are a welcome development after heating up for consecutive months," says Marc Ercolao, an Economist at TD Securities. "With today's inflation print, the BoC is now equipped with all relevant data before making their policy decision next week. Alongside other measures that have shown momentum in cooling in Canada's economy, we see enough evidence for the BoC to stand on the sidelines next week, holding the policy rate at 5.00%."

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes