Canadian Dollar Rally Fades Quickly after Economy Claws Back Lost Jobs

- Written by: James Skinner

"Questions will be raised whether Macklem's pivot was too early," - TD Securities

Image © Pound Sterling Live

The Canadian Dollar rallied against a retreating U.S. Dollar and an underperforming Pound after Statistics Canada data suggested the local economy clawed back in October all of the jobs lost during the summer months and then some, although the decline in GBP/CAD was quickly reversed.

Statistics Canada said on Friday that its economy created 108k jobs last month, adding to the 21k new employments from September and far exceeding the 11k seen as likely by measures of consensus among economists.

This was owing to job gains in manufacturing, construction and the sectors dealing in accommodation and food services, which were partly offset by job losses in wholesale and retail trades as well as natural resources industries.

"The monthly employment count is notoriously volatile, and unusually large swings in employment during the pandemic have probably made standard 'seasonal adjustment' of the numbers more difficult," says Nathan Janzen, assistant chief economist at RBC Capital Markets.

"But there is little evidence of weakness in the October data. Early signs of softening in the labour market were part of the reason the Bank of Canada opted for a smaller (but still large) 50 basis point hike to the overnight interest rate in October," Janzen adds.

Above: Pound to Canadian Dollar rate shown at 15-minute intervals alongside USD/CAD. Click image for closer inspection.

Above: Pound to Canadian Dollar rate shown at 15-minute intervals alongside USD/CAD. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

October's was the first increase in overall private sector employment since March and more than reversed losses of some 113k between the June and August months, although it afforded only limited benefit to the Canadian Dollar.

Meanwhile, wages rose by 5.6%, close to October's 6.9% inflation rate and the fifth month in which pay has grown at an annualised 5% or more.

"We think it is a positive story for CAD, at least in the short-term. Questions will be raised whether Macklem's pivot was too early. We won't know for sure until we see more data coming in that shows a sharper hit to interest rate sensitive sectors this quarter," says Mazen Issa, a senior FX strategist at TD Securities.

"We question the fundamentals of the Canadian dollar generally; the housing/debt servicing issue looks very problematic in Canada in this quarter and early next year. Meanwhile, its non-energy trade balance worsened to a new record," Issa said on Friday,

Issa and the TD Securities team warned on Friday that the Loonie's outperformance of other currencies this year may limit its ability to rise further and could leave it more vulnerable to any bad news emerging from the local economy in the months ahead.

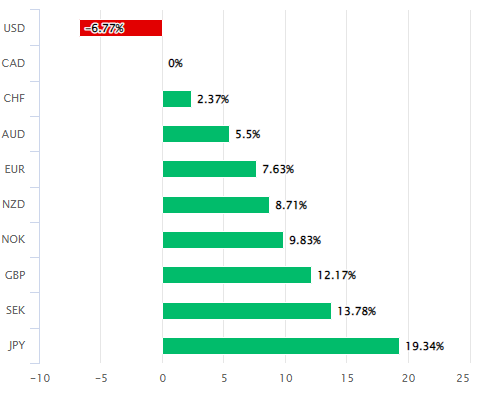

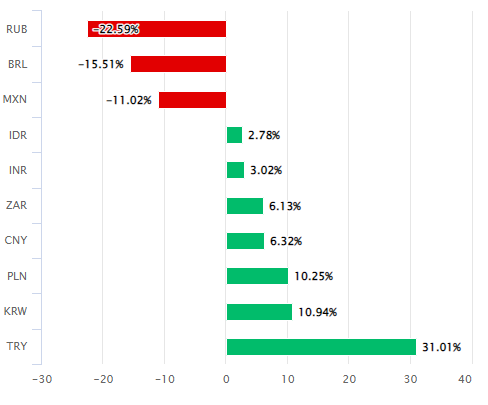

The Canadian Dollar remained the second best performing currency in the G10 basket for 2022 on Friday after falling more than six percent against the U.S. Dollar while rising against all others including with double-digit percentage increases over Sterling, the Swedish Krona and Japanese Yen.

Above: Canadian Dollar relative to G10 and G20 currencies in 2022. Source: Pound Sterling Live.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"Although there is one more employment report to come before the Bank of Canada's next meeting, today's data support out call for a further 50bp interest rate hike," says Andrew Grantham, an economist at CIBC Capital Markets.

"The most concerning aspect of today's data for the Bank of Canada may be the unexpected re-acceleration in wage growth to 5.5% (versus 5.2% in the prior month and against consensus expectations for a slight deceleration) although this series is notoriously volatile on a month-to-month basis," Grantham adds.

One other possible reason for why the Canadian Dollar's gains were quick to fade on Friday is the way in which economists see the Bank of Canada (BoC) responding in December when many expect the cash rate to be raised by either a quarter of a percentage point or by half a percentage point.

The BoC raised its bechmark interest rate to 4% in October but warned that any further increases are likely to be smaller than those seen so far while also suggesting that the end of its interest rate cycle is likely approaching.

Since then the job market is not the only part of the economy to outperform forecasts as other data released last week also suggested that Canadian GDP was more resilient in August than many had anticipated with growth coming in at 0.1% for a second month running.