Canadian Dollar: 2021's High-flyer Loses Altitude Following Disappointing Jobs Report

- Written by: Gary Howes

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7392

- Bank transfer rates (indicative guide): 1.6783-1.6905

- Money transfer specialist rates (indicative): 1.7235-1.7270

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar is just about holding onto its status as the best performing major currency of 2021 with some slippage following a below-consensus employment report.

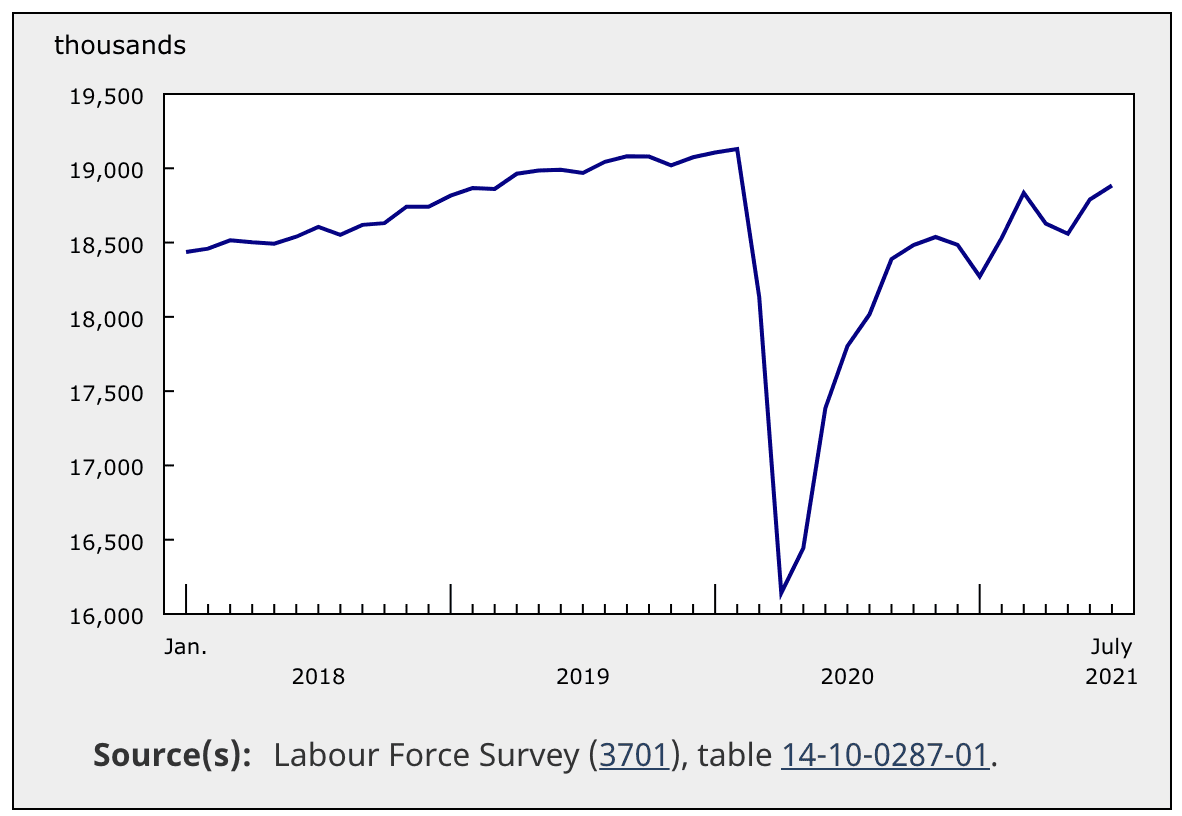

StatCan's Labour Force Survey for July revealed a solid 94K jobs were created, however for currency markets this represented a sizeable disappointment against expectations for a reading of 177.5K.

Unemployment fell less than expected to 7.5% from 7.8%.

"Canada’s dollar fell Friday and was on track for a losing week after local jobs data underwhelmed," says Joe Manimbo, Senior Market Analyst at Western Union Business Solutions.

The Pound-to-Canadian Dollar exchange rate traded at 1.7414 in the wake of the report while the U.S. Dollar-Canadian Dollar exchange rate was seen a more assertive 0.35% higher at 1.2545.

To be fair to holders of the currency, Canada is creating jobs and the economic recovery remains firmly on track, bolstered by one of the world's fastest and most comprehensive vaccine rollouts.

But all this good news does appear to be baked into the Canadian Dollar's existing levels and therefore the bar to further advances in the currency remains elevated.

"Low numbers of new Covid cases and a further relaxation of restrictions had the desired effect on employment in July," says Royce Mendes, an economist at CIBC Capital Markets. "All of the employment gains were in the services sector, with accommodation and food services leading the way by adding 35K jobs."

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

A particularly positive element of the report picked up by economists is that the surprisingly strong increase in full-time roles.

"We expect the easing of virus containment measures over the summer will further support the recovery in those hardest-hit sectors. The lion’s share of the jobs were full time positions and hours worked moved substantially higher after being sluggish over the last few months," says Rannella Billy-Ochieng, Economist at RBC Economics.

The Canadian Dollar has found support in 2021 from the Bank of Canada which has steered markets towards a 2022 interest rate hike, courtesy of the strong economic recovery.

In fact market pricing suggests two interest rates in 2022 are likely, a development contingent on inflation remaining elevated and the economy continuing to churn out jobs.

"The robust recovery in employment during the past two months more than makes up for the losses incurred during the third wave," says Mendes.

"That said, employment is still 1.3% below the level in February 2020, and gains are likely to slow from here, with many employers reporting labour shortages due to generous government support, concerns about contracting Covid in high-contact work settings, and childcare duties," he adds.